The empty piggy-bank

The BCV vault

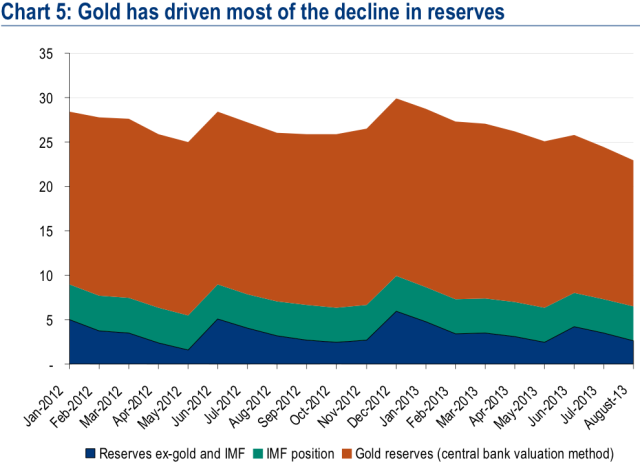

Business Insider cites a report by BofA economist (and amigo de la casa) Francisco Rodríguez, explaining how the dramatic drop in Venezuela’s foreign reserves is caused almost exclusively by the dip in gold prices.

The money quote:

Valued at market prices, gold reserves have fallen $4.2bn ytd and $5.5bn from their September 2012 peak. Not all of this decline has been incorporated into the reserves figure reported by the central bank due to the smoothing effect of the moving average formula. If gold remains at its current price, we can expect reserves to decline by an additional $1.1bn due to this effect.

Non-gold reserves now stand at $6.4bn. Of this, $3.9bn are SDRs and net credit positions before the IMF, leaving $2.6bn of FX holdings, 70% of which is in liquid instruments.

This alone won’t cause us to hit rock bottom. But it’s yet another troubling sign for the weak Venezuelan economy. Add that to the recent developments in Puerto La Cruz, which will surely force us to fork over hard cold cash to pay for imported petroleum products, and the outlook is not good.

Rest assured, though, that some people will continue to say everything is just peachy.

HT: Aquiles.

Key chart after the break…

Caracas Chronicles is 100% reader-supported.

We’ve been able to hang on for 22 years in one of the craziest media landscapes in the world. We’ve seen different media outlets in Venezuela (and abroad) closing shop, something we’re looking to avoid at all costs. Your collaboration goes a long way in helping us weather the storm.

Donate