I come not to bury IMF Conditionality, but to praise it!

Nicolás Maduro, still believing in cigüeñitas preñadas…

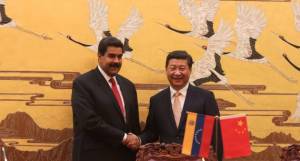

We may hate to admit it, but Nicolás Maduro’s Chinese junket has, as far as we can tell, been a success. He gets to leave with a headline figure of $20 bn. dollars worth of new deals with the Chinese.

Of course, only an unknowable-portion of that number will end up finding its way into Venezuela in dollar form, with the also-unknowable remainder basically staying in China either to finance oil-facilities there or as financing for Chinese products and services to be sent to Venezuela.

But some portion of that figure will find its way into Venezuela’s Central Bank, used to buy the bolivars it takes to pay for the activities of Chinese contractors in-country. And so the deals certainly buy the Venezuelan government some respite from a Balance of Payments crisis that, depending on whose back-of-the-envelope, not-based-on-official-data-because-official-data-isn’t-published calculation, is either imminent or merely “looming”.

One upshot of this is that it puts Maduro’s likely best-alternative-to-a-Chinese-deal option off the table – at least for now. We do know that initial feelers had been sent out from the Venezuelan government to the IMF in case the Chinese froze them out, though of course the government would obviously not go there unless they were totally out of options. (That, incidentally, is also how it’s supposed to work: Lord Keynes originally designed the IMF as the place you go when you’ve placed yourself beyond the pale of literally all other sources of finance.)

Of course, Maduro prefers China to the IMF because China won’t demand the IMF’s dreaded “conditions” for a bailout. Said differently, China won’t demand that he undo any of the crazy policies that have brought a major petro-economy to the doors of a BoP meltdown. China won’t press him to get rid of exchange controls that introduce distortion after distortion in the domestic market, wasting huge resources and pissing away our oil legacy. China won’t press him to rationalize a fiscal policy that spends an order of magnitude more money subsidizing gasoline than healing the sick in hospitals. China won’t put its foot down and say no, we won’t keep giving you $20 bills if you intend to sell them for 10 bucks each.

The Chinese won’t, in other words, use their leverage to push the Venezuelan government into a less self-destructive policy stance. And why should they? Every time the Venezuelan government gets into trouble, they go back to China to beg for more money on more and more concessionary terms, beseeching them to take more and more of our oil. Economic imperialism has never had it this easy!

Nope, China will not press Nicolás Maduro to run Venezuela minimally competently in Venezuela’s best interest; China will just let Nicolás Maduro to run Venezuela as incompetently as he wants, in China’s best interest.

Caracas Chronicles is 100% reader-supported.

We’ve been able to hang on for 22 years in one of the craziest media landscapes in the world. We’ve seen different media outlets in Venezuela (and abroad) closing shop, something we’re looking to avoid at all costs. Your collaboration goes a long way in helping us weather the storm.

Donate