Notes on a common misconception about the gasoline subsidy [Updated]

Whoops. The gas subsidy still sucks, but this post was wrong. Explanation below.

Whoops. The gas subsidy still sucks, but this post was wrong. Explanation below.

Venezuelans have a hard time understanding the crazed extremes of mindless waste generated by our legendary gasoline subsidies. It’s not surprising: the policy is so multidimensionally insane, it’s hard to really take in all the different layers of destructiveness in one go.

In our public sphere, virtually no one fully “gets” the gas subsidy. Take the typical oppo retort to chavismo’s sudden decision to “revise the subsidy”.

“But they’re just going to steal the money we pay,” people say, “that’s not going to help at all!”

It’s worth sitting and puzzling through why this popular response is actually wrong. And it’s worth stopping to admire the scale of insanity the policy has reached: the gasoline subsidy is so crazy that even letting chavista enchufados steal all of the money earned from raising gas prices would better policy than what we’re doing now!

The basic reason is Juan’s old hobbyhorse: deadweight loss.

Deadweight loss is a bit counterintuitive, which is why so many public figures – even ones who should know better – biff it. But the gasoline subsidy’s main effect is not, as people often think, to redistribute value from poor to rich (though surely it does do that.) Its main effect is to destroy value outright by allowing transactions that should never have taken place – and would never have taken place, if prices had reflected relative scarcity – to take place, wasting resources.

In Venezuela, the deadweight loss arising from the gas subsidy been estimated at $10 billion per year. That’s in the neighbourhood of the cost of the Brazil 2014 World Cup, for reference, or twice the yearly worldwide budget of the World Food Programme.

That’s value that, at present, isn’t being stolen by anyone. It’s being destroyed. Outright waste.

Fully grasp that and you start to grasp the scale of the gas subsidy’s insanity: in economic terms, even if 100% of the gas price rise is stolen, raising the price of gas would still be better policy than keeping it at current levels!

Because money that’s stolen tends to be spent, and that generates value. It generates a multiplier effect. The money the crooked general spends on that 18-year-old scotch ends up in the liquor store owner’s pocket. Part of it goes to his employees, who spend it on groceries. Stolen money may be a catastrophically inefficient way to generate economic activity, but it will generate some activity.

But it goes beyond that: even if it generated zero activity – if all it was just ferreted abroad – it would be preferable to the wholesale destruction of economic value involved in the subsidy.

And, of course, raising the price of gas would tamp-down on the overconsumption that fouls the air and clogs up the traffic.

But that stuff is frosting. The cake is in stopping the wanton waste involved in the subsidy.

None of this, of course, is to say that the government is motivated by a concern with the waste of deadweight loss. Not at all! Surely their basic impetus here is to just balance the books. (Which, again, is not to deny that bits of the PDVSA bureaucracy must be licking its lips at the graft opportunities the increased take will generate.)

The point is that the economic effect of ending the gas subsidy is logically independent of the political motivation for doing so. In economic terms, the case in favor of ending the gas subsidy doesn’t actually have anything to do with what the government ends up spending its increased revenues on. And if you think it does, chances are you’re either pretty lousy at economics or pretty good at populist politics.

—

Update: A real economist has a rejoinder in the comments section.

The deadweight loss analysis is illustrating but, in my opinion, not quite right because the domestic gas market doesn’t feature a typical upward-slopping supply curve given the particular nature of this market in Venezuela. And that might be the reason why people fails to understand it in the case of the gas subsidy.

I think that a more appropriate, but somewhat similar, analysis goes as follows:

First, for simplicity, assume that PDVSA purchases all the gas in the international market to meet domestic demand. Define total surplus as consumer surplus (CS) minus the fiscal loss of supplying gas to the domestic market (FS = total demand of gas * (international gas price – domestic price)).

Consumer surplus is the typical one. What we need to do now is to see whether this total surplus increases with the domestic gas price. That is, we need to calculate (CS_1 – FL_1) – (CS_0 – FL_0), where the first term denotes the total surplus after the increase in gas prices and the second term is the total surplus at current prices. It easy to proof that this the variation is positive. Let’s try to do it graphically.

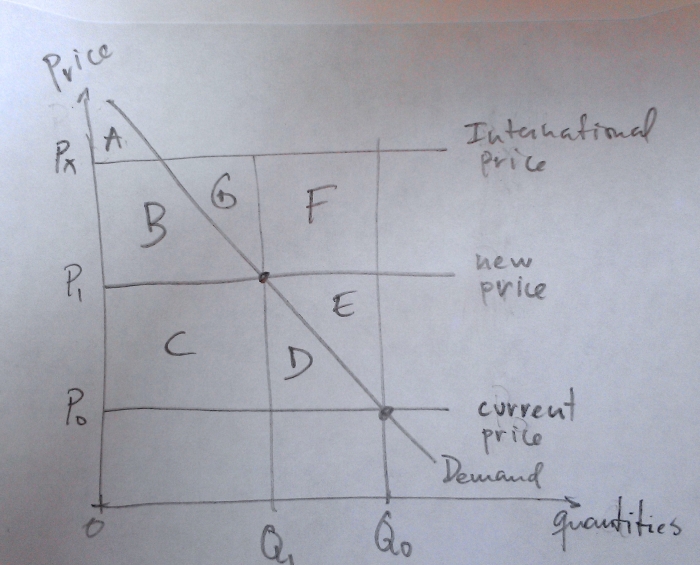

In the graph below, the vertical axis is the price level and the horizontal represents quantities.

The downward-slopping curve represented by asterisks is the domestic demand curve for gas.

The three horizontal lines represent price levels. The horizontal lines Q0 and Q1 denote the corresponding quantity demanded at each price P0 and P1.

We can now define areas delimited by the demand curve and the price and quantity lines. We denote each area with a letter (A to G).

Now we can define CS_0 = A+B+C+D, CS_1 = A+B, FL_0 = B+C+D+E+F+G, and FL_1 = B+G. Then, (CS_1 – FL_1) – (CS_0 – FL_0) = E+F.

This means that the drop in consumer surplus is more than offset by the fall in the fiscal loss. If the price were to increase all the way to international levels (Px), then the increase in total surplus would be E+F+G, which is the maximum attainable (assuming no negative externalities).

The intuition is very simple. With the ridiculously low gas prices, demand is quite high and we’re all paying for that in different ways: higher inflation as well as less and worse public goods. When the price increases, demand for gas drops and, as a result, the overall gas bill falls. Moreover, the associated negative externalities (traffic, polution, etc.) are reduced.

To conclude, what I think people ultimately fails to see is that they are paying for the gas subsidy in one way or another even if they don’t do it at the pump.

Manuel is too polite to say it, but this means the argument in my original post is wrong. Sorry!

Caracas Chronicles is 100% reader-supported.

We’ve been able to hang on for 21 years in one of the craziest media landscapes in the world. We’ve seen different media outlets in Venezuela (and abroad) closing shop, something we’re looking to avoid at all costs. Your collaboration goes a long way in helping us weather the storm.

Donate