The pain from the China loans

One of the more interesting angles of the China financing story is the way it is hampering Venezuela’s ability to weather the current slump in the oil prices.

Here is the lowdown on the renegotiation with China:

“The MOFCOM article goes on to explain that the declining oil price requires Venezuela to export more oil, but that Venezuela is unable to increase production in the short-term. The Venezuelan government therefore sought to extend the loan period.”

This was mirrored in a recent Wall Street Journal article, which said,

“… Venezuela ships oil to Cuba and other Caribbean countries through special agreements, and doesn’t earn cash on it. It also ships hundreds of thousands of barrels to China annually, to pay off tens of billions in loans made by Beijing, say former oil industry executives … Now, with the price of oil falling, Venezuela will have to pony up even more barrels to China to cover its debts. Meanwhile, up to 800,000 barrels a day are consumed domestically at pennies on the gallon.”

The China loan deals Venezuela has embarked on the last few years are making a bad situation considerably worse. Here is why.

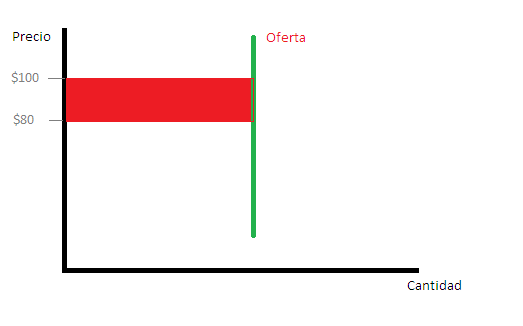

Imagine, if you will a country that always sells a fixed amount of oil, no matter the price. You could say that country has a vertical supply curve – irrespective of what the price is, the quantities sold do not change much. Many industries exhibit vertical supply curves – for example, chances are that your local movie theater will offer the same amount of seats regardless of the price of movie tickets.

Since income is given by price (P) times quantity (q), we can say that for countries with vertical supply curves, a drop in the price of oil means lost income equal to the difference in price times the amount you sell. In this graph, the lost income would be given by the size of the read, very red area – the area of the rectangle is the price differential times the quantity.

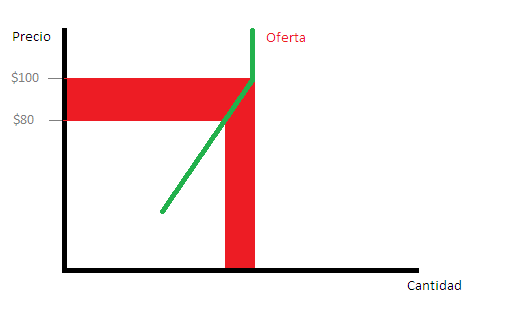

Venezuela, though, does not have a vertical supply curve. That is because the China loan agreements stipulate that when the price of oil falls, Venezuela must ship more oil to China to compensate, leaving fewer barrels available to sell to international markets. In other words, Venezuela has a positively sloped supply curve – a fall in prices is accompanied by a fall in the quantities available to markets.

In other words, the graph for Venezuela doesn’t look like the one above, but rather like the one below.

Notice how much larger the red, very red area is.

The situation is quite simple. Because of the loans we signed with China – them paying in advance for future shipments in oil – the drop in oil prices means Venezuela doesn’t just sell each barrel for less money, it also has fewer barrels available to sell to the market. Venezuela’s downturn is therefore made all the worse by the ridiculous conditions the geniuses at PDVSA signed on to.

In other words, a bad situation is made worse, and the hit in our fiscal income is all the larger.

And why was all of this done? Why were the agreements with China signed in the first place?

Cue Chávez’s economic guru, a certain Mr. Giordani:

“In this stage of the Bolivarian process, it was crucial to overcome the elections of October 7th, 2012, as well as the elections of December 16th of that year. Consolidating political power was an essential objective for the strength of the revolution y for the opening of a new stage in the process. Overcoming these obstacles required a great sacrifice met with an economic and financial effort that brought the use of resources to extreme levels, something that had to be reviewed in order to guarantee the sustainability of the economic and social transformation.”

Caracas Chronicles is 100% reader-supported.

We’ve been able to hang on for 22 years in one of the craziest media landscapes in the world. We’ve seen different media outlets in Venezuela (and abroad) closing shop, something we’re looking to avoid at all costs. Your collaboration goes a long way in helping us weather the storm.

Donate