Why Being First in Line Matters

The smart money in the VENZ/PDVSA bond market flows to bonds maturing right away. Nobody believes Venezuelan promises with due dates later than 2017.

“Go for short end bonds!” the salesman from a major Street bank told us, “that’s where all the value on the curve is!” My colleague and I couldn’t see the reasoning – just a couple of weeks earlier the markets had been in free-fall, with short-end bonds – the securities that are closest to their maturity date – hit especially hard.

“Because bonds that are due in late 2015, early 2016… these are the first-in-line debts; they will maturing in the near future, and what few information we have about Venezuela’s public finances tells us they are likely to be able to pay their debts in the foreseeable time. Beyond there, we have no f***ing clue”.

It’s uncanny how this reasoning has proven itself right this year.

Just like the people waiting in line to buy subsidized groceries in Bicentenario hypermarts, Venny debt holders are literally making a bee-line to collect interest and principal payments on the promises to pay issued by the Republic and PDVSA. The only difference is investors don’t have to stand under the hot sun, or be marked with a sharpie on the forearm.

But just like bachaqueros, these guys are queuing up for a quick profit by buying bonds at the front of the line, ahead of potential big investors coming into the market. The bachaquero analogy, by the way, was coined by another salesman on a classic early-2015 trading day: short end bonds were up by 2 to 3 points with no supply to be found of at the end of the session.

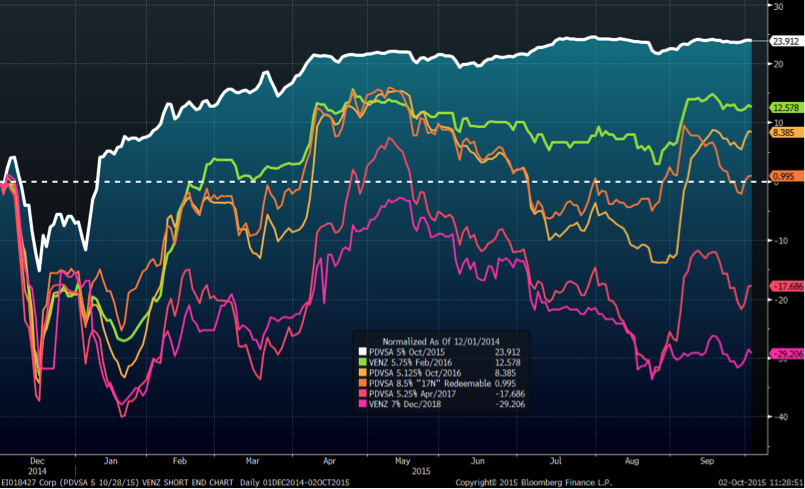

Here’s a chart showing the % change in the “short end” Venny bonds since the slump in bond prices of December ’14. Note how what drives returns here is the maturity date of the bonds: the closer to their due date, the more they have climbed in price throughout the year.

(Source: Bloomberg Professional Service, Bloomberg MSG1 Dealer-contributed mid prices. The plotted period is 12/01/2014-10/02/)

*The PDVSA 17N or 17 New is an exception to the rule because of its particularities. This bond redeems a third of its value each Nov 2nd, starting on 2015; hence, its weighted average maturity is somewhere between PDVSA 2016 and PDVSA 2017 ‘olds’).

Fast-forward to September 2015: Barclays hits the Street with a fresh report, arguing that this line of thought is still valid and short-end bonds are going to outperform again. They add another argument: since 2010 the PDVSA Pension Fund, along with other government-linked entities, has been in ‘buyback’ mode: literally buying its own bonds back just prior to maturity, and especially targeting the very first in line. This boosts the market price of these securities while it lightens the debt service: they end up buying back debt at values less than 100% of face value, hence partly paying themselves and cobrándose el vuelto when these bonds are due. It makes perfect financial sense from the point of view of the government, and anecdotal evidence from the bond markets partly confirm this.

It’s hard to find conclusive evidence, though: public reports are outdated and lack detail on securities holdings. But in the world of finance, sometimes all it takes is a newspaper story claiming rumors of government buybacks, or a series of well-timed tweets from a FinMin official’s account, to create a self-fulfilling prophecy that boosts prices on short-end bonds.

But one question lingers: How much is the government sacrificing or failing to do, in terms of their future capacity to pay and economic potential, to show short-term willingness to pay through bond buybacks and nothing else? As worrisome as this might be for any Venezuelan, this is not a question that keeps Wall Street up at night.

What about 2016? That’s a whole different ball game: Nearly all research houses are predicting some sort of credit event next year, especially if oil prices stay at current levels. The Credit Default Swap market is pricing in a cumulative default probability of 67% between Q42015 and Q42016. The increasing differential in risk perception in ’15 and ’16 maturities (PDVSA 15 yields about 6%, versus 50% in Venny bonds due 2016 and 58% in the case of the Pdvsa 17 News) is a reflection on this consensus view. Trade accordingly!

Caracas Chronicles is 100% reader-supported.

We’ve been able to hang on for 22 years in one of the craziest media landscapes in the world. We’ve seen different media outlets in Venezuela (and abroad) closing shop, something we’re looking to avoid at all costs. Your collaboration goes a long way in helping us weather the storm.

Donate