Abad Plan

Miguel Pérez Abad has a plan to finally bring DolarToday to heel by squeezing liquidity and letting SIMADI go nuts. It's just too bad it also involves people not eating.

Last week the Vice-President for Economic Affairs, Miguel Pérez Abad, made a bit of a splash saying the government is close to “freeing” the DICOM exchange rate market”. Our suspicion is that a bit of semantic game-playing is involved: in chavistaspeak, “free” doesn’t really mean free. Still, it’s a signal that changes may be coming to our nunca bien ponderado multiple exchange-rate system, which remains one of the fountainheads of macroeconomic chaos in Venezuela.

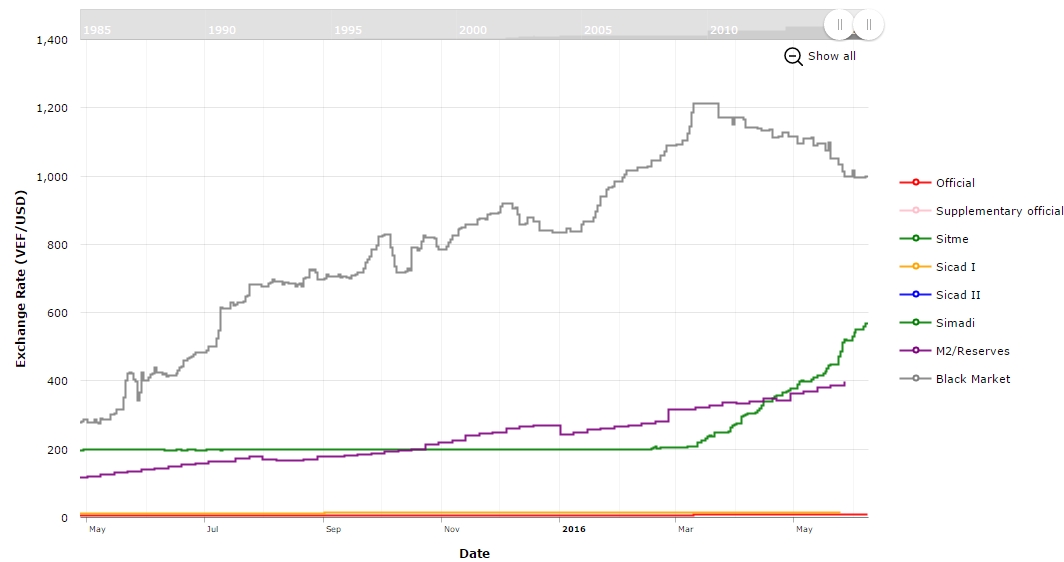

To prepare the ground for the potential grand opening of the DICOM market, the government has been working, with some success, on bringing down the black market rate. It has done so by devaluing the SIMADI rate ever closer to the black rate, while restricting liquidity. Less money -in real terms- means less money available to exchange in the high black market rate. The strategy has coincided with a downward trending DolarToday rate since mid-May.

Source: Girish Gupta’s Venezuela Live Economic Data

Source: Girish Gupta’s Venezuela Live Economic Data

Nobody seems to have given the rest of the cabinet the memo explaining why this demolishes the conspiracy theories about DolarToday as basically a number plucked out of thin air by conspirators -turns out the black market rate does respond to economic fundamentals.

But before truly meaningful changes in policy are implemented, we might have to wait until a victor emerges from the fight raging inside the loony bin also know as Maduro’s cabinet.

Recently on this blog, Daniel Urdaneta portrayed the fight for control over economic policy as a straight-up head-to-head between the moderates (a relative term) clustered around Pérez Abad and the Psychotics who listen to Alfredo Serrano, the Podemos-linked ultra-heterodox Spaniard.

According to a note to clients by Ecoanalítica, and a news report by El Nacional, there are really three sides facing off: Pérez Abad and the Minister of Finance and Public Banking, Rodolfo Medina, on one side; Nelson Merentes, president of the Central Bank, and Rodolfo Marco Torres, Minister of Food, on the other; and lastly, the madhouse Serrano leads.

I take these things seriously because both Ecoanalitica and El Nacional have a good track record of reporting on cabinet infighting about economic policy. They were, for instance, among the first to raise the alarm about Serrano last year.

Pérez Abad seems to be trying to push a plan that calls for allowing the DICOM rate to continue to devalue until it converges with the black market rate; putting downward pressure on the black market rate by tamping down on liquidity as mentioned above, and also by cutting government spending and having PDVSA sell around USD 800,000 – USD 1.5 million per day in the black market; streamlining price controls so they apply to just a few essential goods, while gradually eliminating controls on other prices; providing direct subsidies to low-income families; promoting a voluntary swap of the PDVSA debt due in October and November; and keeping the highly distorted DIPRO rate —the one currently at VEF.10 — but with quarterly adjustments.

Merentes and Marco Torres are said to agree with the devaluation of the SIMADI/DICOM rate, but they resist a key element of Pérez Abad’s proposal: letting that currency market clear, as was announced a few months ago.

Both reports say that even though Medina replaced Marco Torres five months ago, the latter stills controls allocations in that market and has no intention of giving up this enormously juicy source of patronage, just like he hasn’t truly given up control of the public banks and BANDES.

Divvying up the super-cheap dollars is the greatest manguangua in revolutionary Venezuela: it can’t surprise anyone that the guys who control it wouldn’t want to give it up.

For his part, Serrano is said to agree with the monetary contraction, but pushing against any relaxation of price and exchange controls, since they’ve been such a resounding success. It’s easy to laugh, but we shouldn’t: Maduro’s gut instinct is always to listen to the most radical people in his orbit, and for economic policy, that’s Serrano.

Some parts of Perez Abad’s plan are already being implemented. Besides the SIMADI devaluation, the government is trying to put the hyperinflation genie back in the bottle, severely restricting money liquidity. Yes, the amount of money going around keeps increasing, but the rate of increase is slackening. On current form, liquidity will rise 48% during 2016 (about half the increase of 2015). But inflation is surely running way higher than that.

So prices are increasing a lot faster than the amount of money. That means that while there are more bolívares, the number of goods and services that you can buy with those bolívares is much less that before.

So, imagine what most salaried workers are going through -with prices rising faster than the money in their pockets- but at a country level. While this policy can help slow down inflation, it does so by plunging the economy deeper into recession. And it hits credit, too, since banks are unwilling to loan much at the government-controlled interest rates.

As we have argued before, the government is implementing severely recessionary policies -halving imports, cutting expenditures massively- and the monetary contraction is just another one. Abad’s adjustment plan, in other words, runs directly through Venezuelan workers’ tummies.

They are pushing the brakes on the economy, hard. A red-bereted austerity package.

By far the weirdest part of Pérez Abad’s plan is his idea to have PDVSA sell dollars in the black market to bring down the rate, as that is -at least in theory- illegal. We wrote to Asdrubal Oliveros, Director at Ecoanalitíca, for confirmation. He told us that PDVSA already did this between 2010 and 2011, when the parallel market was already illegal, and they are poised to do so again by selling dollars (discretely) to locals at the black market rate.

So after having people prosecuted for it, making the black market a key part of the “economic war” narrative, and having the Central Bank file a lawsuit in the USA against Dolar Today, PDVSA might take part in the “subversive” market.

Peréz Abad’s plan does have some sensible policies, such as direct subsidies to low-income households, and eliminating some price controls. Opening the DICOM with a weaker rate could well entice private agents to sell dollars there, but it would be a drop in the bucket if the government keeps selling 92% of their dollars at the DIPRO rate. Of course, the plan is still firmly within chavismo’s incoherent and destructive policy framework. His plan is like the least decrepit mummy in an Egyptian museum.

This is not the first time a minister has tried to push economic policy in a more sensible direction -by chavismo’s standards. Rafael Ramírez spent several months in 2014 trying to sell his Ramírez Plan of “exchange rate unification”, only to be kicked to the curb by Maduro (albeit to a really nice, New York curb).

Maduro has shown himself to be unwilling or incapable to commit to a course of economic policy for more that a few weeks. I would not bet the Pérez Abad Plan will prove to be the exception. And yet, he’s managed to overcome the first hurdle in conquering his wishlist, which is already more than Ramírez ever achieved… the salutary effects of having no money to play with, I suppose.

Caracas Chronicles is 100% reader-supported.

We’ve been able to hang on for 22 years in one of the craziest media landscapes in the world. We’ve seen different media outlets in Venezuela (and abroad) closing shop, something we’re looking to avoid at all costs. Your collaboration goes a long way in helping us weather the storm.

Donate