¿Con qué se come el Inflation Tax?

Economists have this maddening habit of talking about the "inflation tax" without caring that nobody has any idea what they're talking about. Here, we'll make it simple.

Last week, as she discussed what it feels like to see your standard of living decimated by high inflation, Toña Marturet got at something Venezuelans are getting only too familiar with: that maddening sense that there’s just no proportion between super-fast price rises and stagnant salaries.

We all know that. What we don’t all realize is that making prices rise faster than incomes is not a mistake, it’s a policy.

This goes back to one of the most maddeningly elusive bits of jargon in the economist’s lexicon: the idea of the “inflation tax”. The very idea that inflation is a tax is weirdly counterintuitive for people. I’m here to try to explain it with as little pain as possible.

The Inflation Tax in Eight Easy Slides

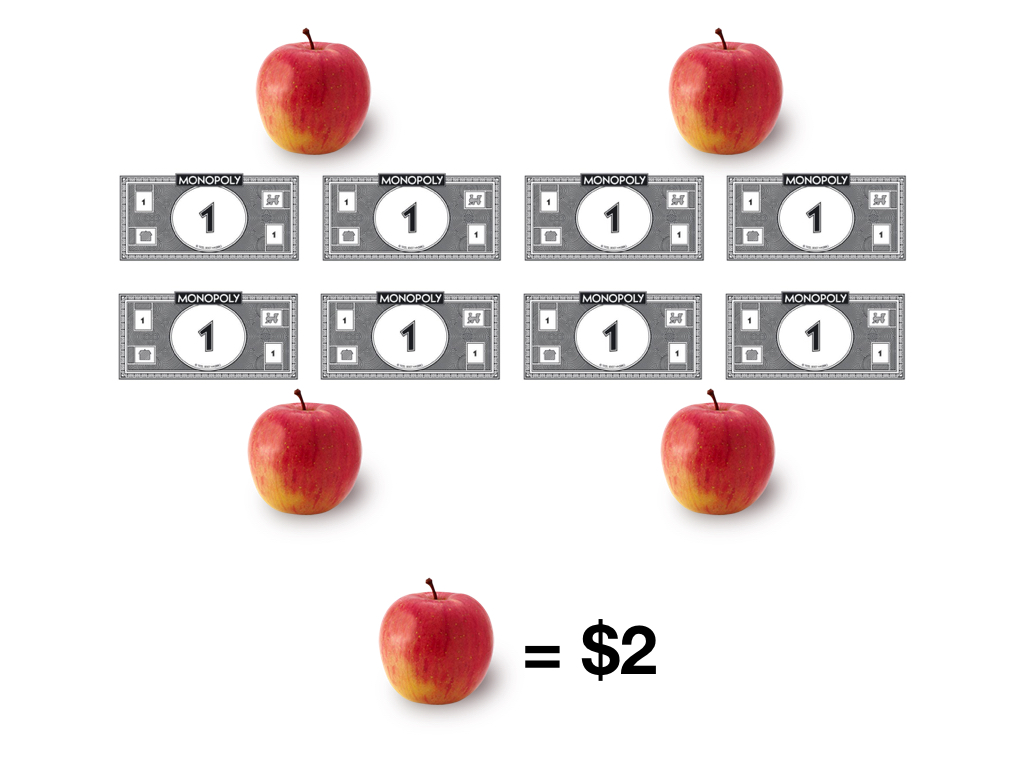

Say you have a very simple economy: the only money is $1 monopoly bills, and the only good is apples.

1. There’s a total of just eight dollars in circulation.

2…and all the economy produces (and consumes) is four apples.

3. It’s straightforward to see that the price of an apple is going to be two bucks.

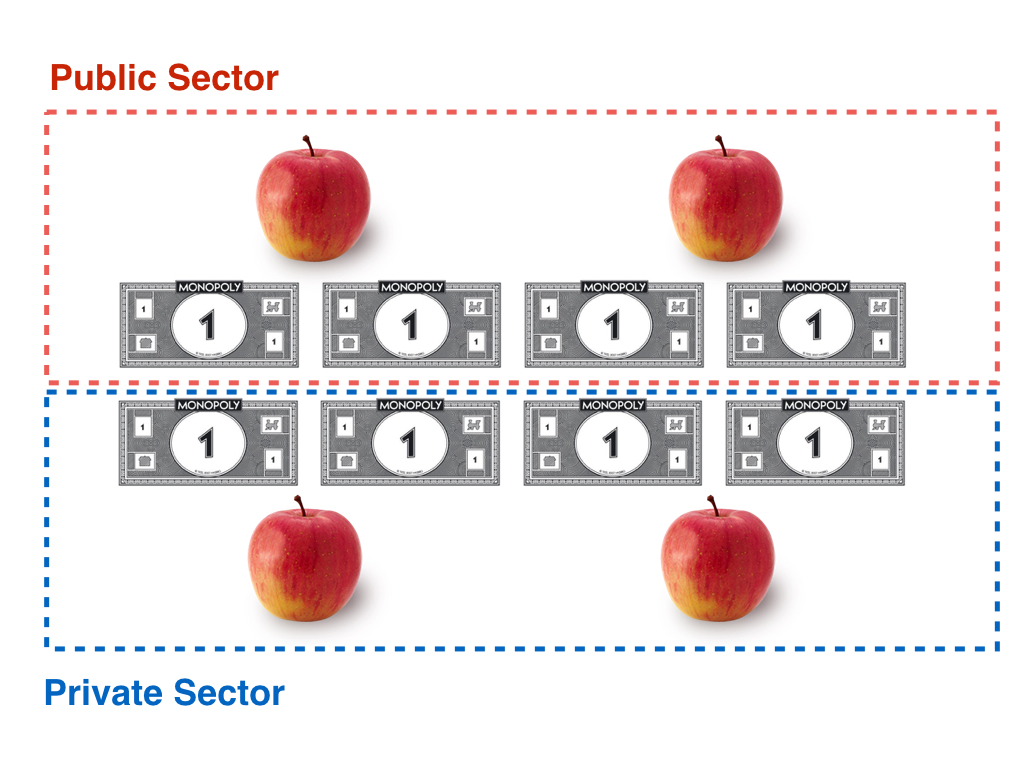

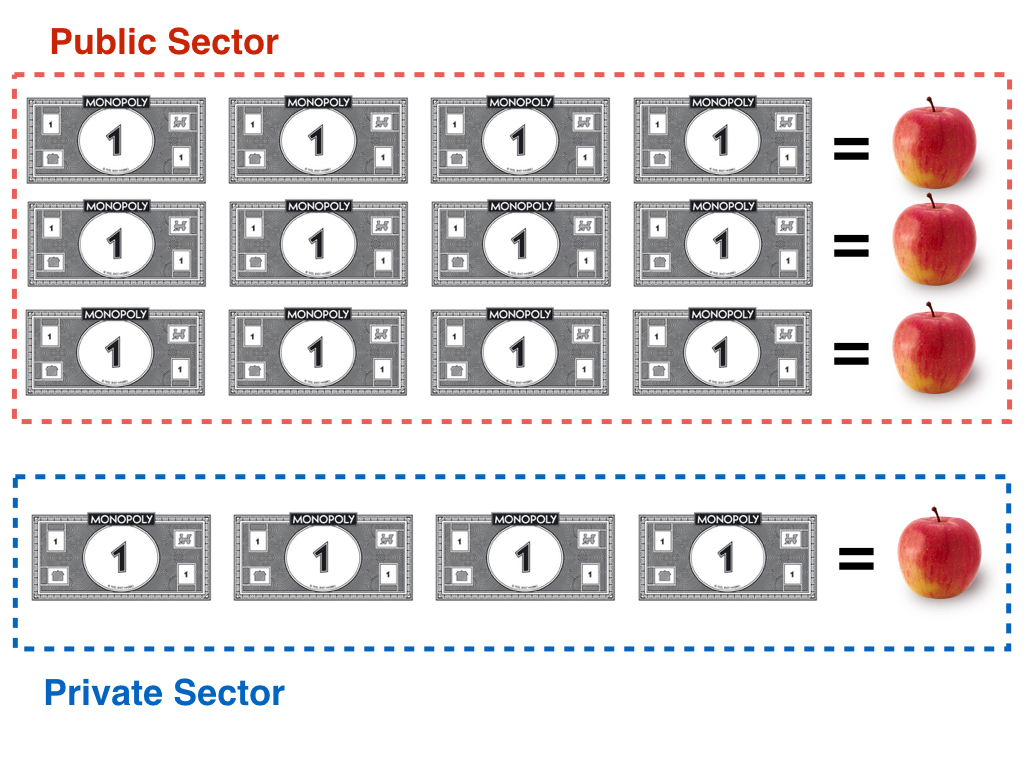

4. Now, let’s say in this economy the public sector takes up half of GDP (a.k.a., $4,) so the government can buy two apples.

The households and firms, meanwhile, control the other $4 (which of course = 2 apples.)

Now say in the government is in financial trouble. Maybe it owes international creditors an apple and the payment is just about to come due. Where’s it going to get a third apple?

Of course, it could just send some soldiers to go and confiscate one of the private sector’s apples, but that can get pretty messy and bloody. Luckily, there’s more than one way to skin that cat, because they can also just…

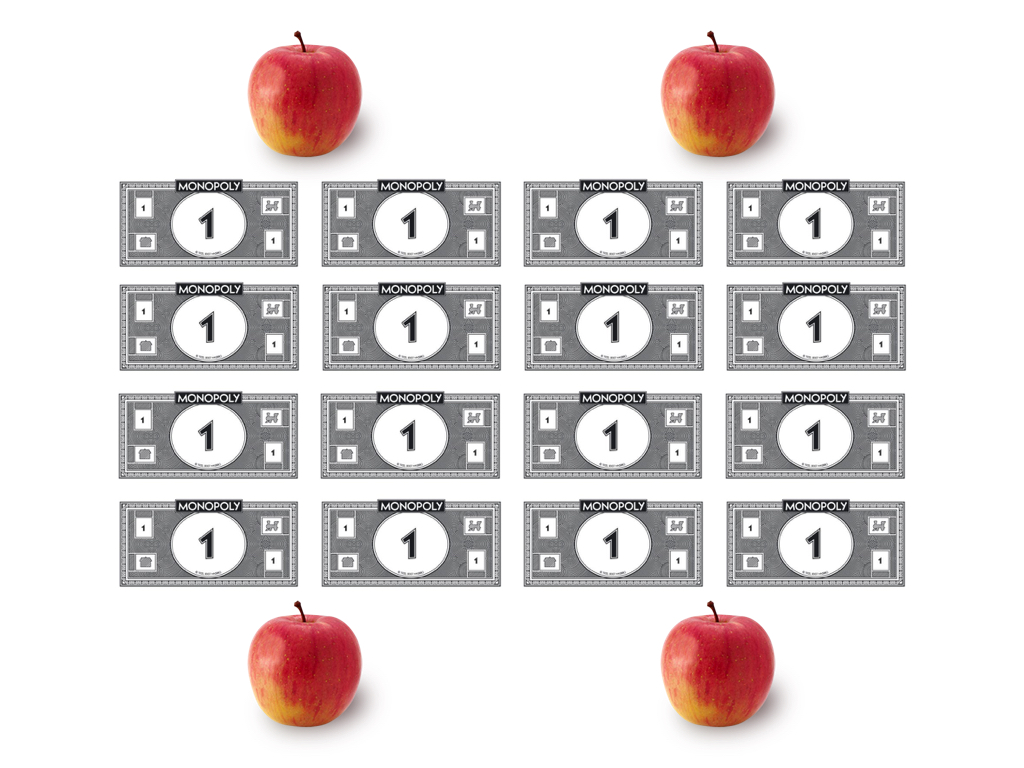

5. Pick up a phone, call up the central banker, and order him to print up another eight bucks.

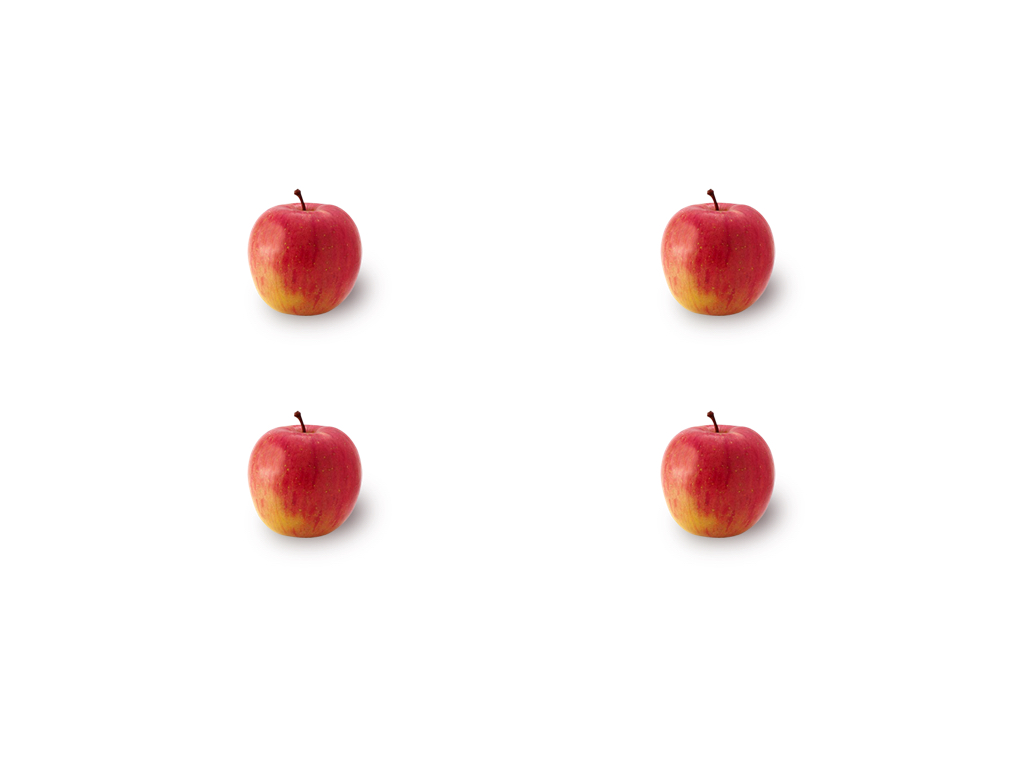

6. Now, there’s twice as much money in circulation. But that doesn’t magically somehow create more apples. Those 16 bucks are still chasing the same four apples we started with.

7. What do you guess is going to happen to the price of apples if you do that?

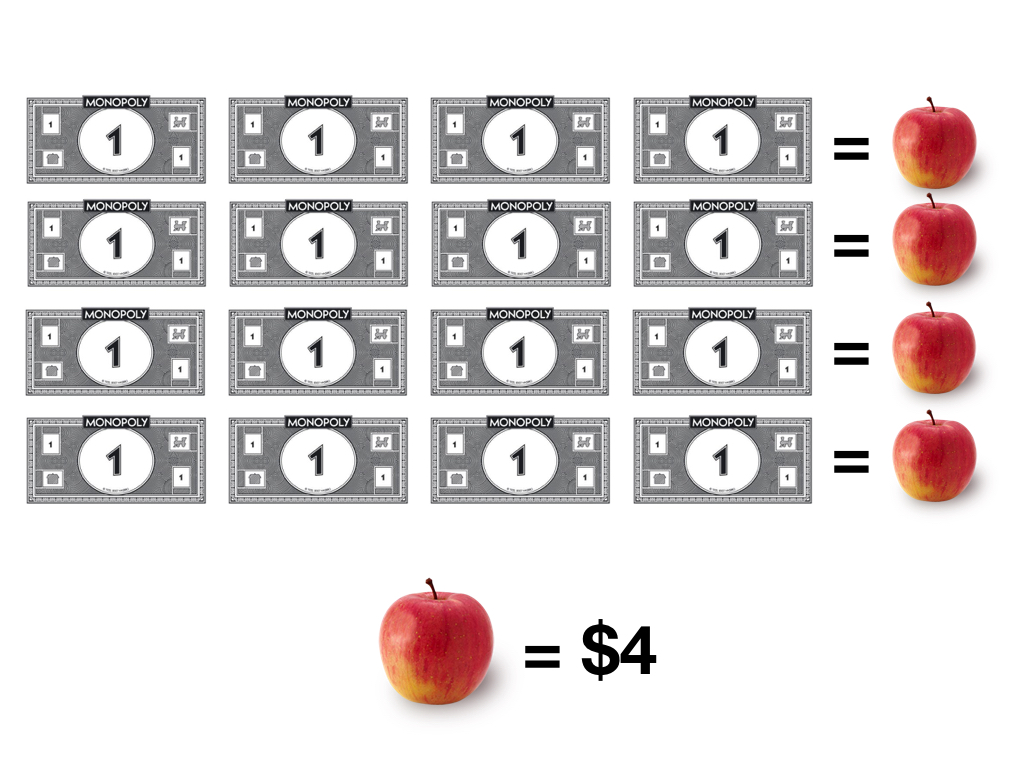

You guessed it:

An apple now costs double.

Now, here’s the tricky bit: Merentes isn’t gonna be all buena nota about it and split the new money with the private sector. Not the guy’s style at all. He’s just gonna call the new cash a “loan to PDVSA” (or some other such accounting sleight-of-hand) and hand it all to the government.

8. But guess what that means…

Yup, the mutherfucker just stole one of your apples. And he didn’t even need any soldiers or anything.

That’s the inflation tax right there. This is what’s going on when you go to the store and see prices going up in an elevator while your salary boes up via the stairs.

Is this a grossly oversimplified explanation that leaves out a million and one wrinkles? You betcha! Does it get at the basic mechanism involved? Yes it does.

The point is, inflation isn’t a policy mistake, it’s a policy. In fact, it’s a tax: a way for a broke-ass public sector to shift purchasing power out of your pocket and into its pocket.

Venezuelans who can no longer afford skyrocketing food prices aren’t going hungry by mistake, they’re going hungry by design.

Caracas Chronicles is 100% reader-supported.

We’ve been able to hang on for 22 years in one of the craziest media landscapes in the world. We’ve seen different media outlets in Venezuela (and abroad) closing shop, something we’re looking to avoid at all costs. Your collaboration goes a long way in helping us weather the storm.

Donate