Why the black market dollar's gone haywire

The recent spike in the black market dollar has taken some by surprise. It shouldn't have: the minute we heard Maduro talking about messing with the banks' reserve requirement to fund "urban agriculture", we reached for our wallets.

As the parallel dollar jumped the last few weeks after months of unaccustomed stability, people keep asking us what on earth is going on. The surge, however, estaba cantada, ever since Nicolás Maduro decided, last September 22nd, to lower banks’ legal Reserve Requirement Ratio (RRR)— the encaje legal — in the name of urban agriculture.

Messing with the RRR is one of those decisions that seems recondite and technical to muggles, but that we economists are trained to recognize as a big deal. And, indeed, it signalled a tectonic shift in Venezuela’s monetary policy.

Whereas former Economy VP Miguel Perez Abad had worked to limit money printing and constrain liquidity growth, this absurd move unleashed a trillion new bolivars into an economy already running at triple-digit inflation. At the time, our take on the risks from messing with the RRR was adamant:

Accelerating inflation, depreciation in the parallel rate, worsening fiscal deficits (as inflation this high is effectively cutting real tax revenue).. Basically another push in the key drivers behind the macro shitstorm the country is currently in.

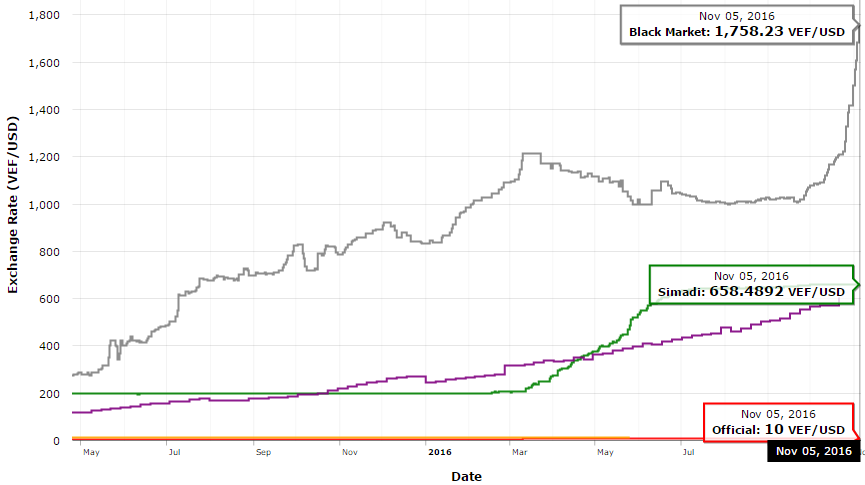

Depressingly, our forecast is right on track. Again. The price of greenbacks in the unofficial market has shot up by over 70% in a month or so, almost in lockstep with with the announcement of the ‘unconventional’ monetary policy program that we like to think of as “#TropicalMierda Quantitative Easing”.

Quantitative Easing, #TropicalMierda Style

“Recent stability in the black market rate was underpinned by a brutal contraction in domestic liquidity. An unsustainable situation”… Luis Vicente León was definitely onto something back in September. While Pérez Abad’s policy worked for a while to curb the depreciation of the bolivar, it did nothing to fix the reason underlying the collapse in its value: a government that spends more than it can borrow, and has borrowed more than it could probably pay back. With the holidays (and the end-of-year bonuses associated with it) drawing near, the government was hard-pressed for a quick cash boost. And dropping the RRR does just that.

The government force-fed the new bonds to domestic banks, essentially forcing them to spend all the funds freed up by dropping the RRR on lending to…you guessed it, the government.

With the help of a couple of colleagues, I ran a hasty post-mortem on the nitty-gritty of the monetary bazooka. In mid-October, the branch of the Finance Ministry in charge of public debt issuance seems to have been instructed to coordinate a mammoth deal with two very large para-fiscal institutions. BANDES and the Simón Bolívar Fund issued bonds amounting to around 500 billion Bolivars and a low-single-digit coupon rate.

With unofficial estimates of inflation easily above the 500 mark, this sounds like a killer deal, right?

Wrong.

The government force-fed the new bonds to domestic banks, essentially forcing them to spend all the funds freed up by dropping the RRR on lending to…you guessed it, the government.

(There’s a term for this: it’s called financial repression. Not surprisingly, academic studies of our case show financial repression is a key driver of our economic chaos.)

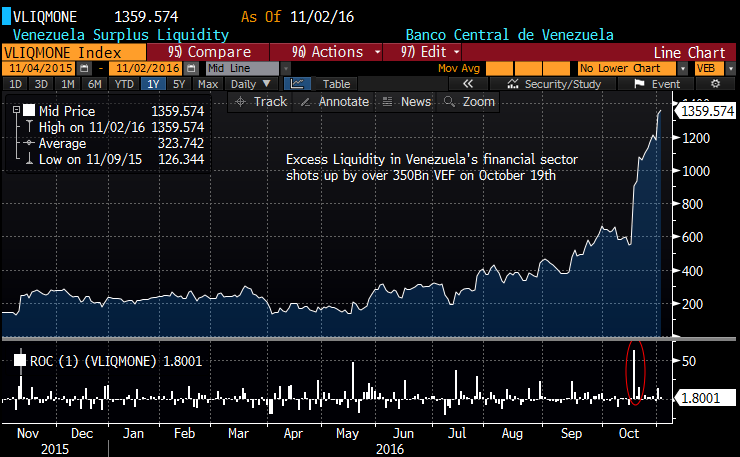

But back to our story. Once state entities got the money from the deal in their checking accounts, the spending binge began. Let’s follow the money—in this case, Surplus Liquidity in Venezuela’s financial sector as reported by BCV. It’s easy to see that the money bazooka started in earnest on October 19th, a day on which the system overflowed with 350 billion Bolivars.

Just to put this into perspective, they might have spent a whole lot more cash that day for all we know; that figure only represents the number of bolivars that couldn’t be digested by the banks right away. And it meant that surplus liquidity in relative terms (as % of deposits) more than tripled overnight.

Hermoso, ¿no?

Behold what happens when you inject absurd amounts of liquidity, #TropicalMierda style, to finance public spending, into an economy that stopped producing real goods years ago and just can’t handle it:

(H/T Girish Gupta; http://www.venezuelaecon.com/)

The spike in the parallel rate has been so aggressive and ‘unexpected’, mind you, that Ángel García Banchs publicly had to recognize he had been wrong in his prediction of a downward trend in parallel rate (which he’d doubled down on literally the day before #TropicalMierdaQE!) and an imminent unification in the domestic FX market.

The problem isn’t just what’s driving the exchange rate, but figuring out the rate itself

To add insult to injury, the meltdown in the dollar black market has coincided with growing uncertainty about the actual free-market rate, if such a thing exists at all. Ever since DolarToday stabilized around the 1000 VEF/$ mark for most of 2016, several analysts claimed that the rate the site reported was increasingly out of sync with the rest of the market indicators, such as the Colombian Peso:VEF rate at the border, and reports of actual corporate FX transactions.

Some claim that the black market rate was deliberately suppressed for months by intervention from public entities (boosting supply of FX through selling at the SIMADI rate) or straight-up manipulated by DolarToday’s new data source and ‘methodology’, (based, believe it or not, on Instagram comments, but that’s a whole different rabbit hole.)

Oh, what the hell…we love rabbit holes!

For months the DolarToday website prominently featured this peculiar note on methods:

El tipo de cambio corresponde a las operaciones privadas realizadas en Venezuela (Caracas principalmente) […] Los datos correspondientes a operaciones privadas en la ciudad de Caracas los obtenemos promediando la información que los mismos usuarios publican en la sección de comentarios de Instagram.

That bit of #TropicalMierda methodology was sudenly omitted from the site some days ago, setting off a collective “hmmmmmmm”.

To put this updated policy into context: we know that the long-standing feud between government authorities and DolarToday sort of resolved itself earlier in August, when BCV dropped its lawsuit against the website in polite terms and zero disclosure about what happened there.

Zillions of rumors flew around about the website being bought off by government allies. It sort of made sense, hearing government officials boasting how they had won the war against the site, and the ‘market’ sort of agreed it. However, once the parallel rate began to fly again, and the Instagram dollar policy was taken down, the sweet talk was dried up and the trusty old #EconWars jibber jabber came right back.

All of this leaves a plateful of unanswered questions. Does this new surge in the parallel dollar means that the BCV-DolarToday honeymoon is over?.. Does it mean that the past months of stability were nothing more than a coordinated effort to keep greenbacks cheap, allowing a small and well-connected elite to hoard them and flip them now for astronomical profits? What’s happening behind the scenes that makes people so desperate to buy dollars at increasingly higher prices and with no end in sight?

More importantly, though…how much is a dollar really worth in the streets nowadays? I, for one, have no clue at this point. But they are becoming as scarce as the gallineros verticales this disastrous policy was supposed to bankroll in the first place.

Caracas Chronicles is 100% reader-supported.

We’ve been able to hang on for 22 years in one of the craziest media landscapes in the world. We’ve seen different media outlets in Venezuela (and abroad) closing shop, something we’re looking to avoid at all costs. Your collaboration goes a long way in helping us weather the storm.

Donate