Debt Sustainability from 30,000 Feet

Sooner or later, Venezuela will likely have to restructure its debt, and it's high time to begin planning for that scenario.

Venezuela’s debt has been in “eventually it stops” territory for years now. The economy is reeling thanks to a violent 50% import cut. PDVSA is billions of dollars behind on payments to foreign partners critical to its operations. And people’s stomachs are churning because there literally isn’t enough to eat. China, Wall Street and a few other creditors are the only ones still getting paid.

Venezuela’s debt is obviously not sustainable right now, but if things changed, could it be? It’s hard to say given the uncertainties. For one, the government’s spending is a black box. Over half of the public sector’s budget is cash transfers to unconsolidated entities. PDVSA is another black box. Nobody knows exactly how much oil it exports and how much cash it gets for those exports. Plus a lot could change in the coming years: policy, the executive, oil prices.

But it doesn’t end there: Assessing debt “sustainability” in the context of mass-hunger and a depression has staggering ethical implications. Venezuela’s GDP in dollars is also unknown and arguably unknowable in the context of byzantine exchange controls. Venezuela is complicated. These details matter. But if you abstract the nuance away and look at the problem from thirty thousand feet, a clear picture emerges.

What is debt sustainability? How do you model it?

To assess debt sustainability, you typically start by modelling a country’s debt-to-GDP ratio. For the debt to be sustainable, three conditions must hold behind the modeling woodwork:

- The government’s income must be reasonably in line with its expenditures (fiscal accounts ✓).

- Foreign currency inflows must be reasonably in line with outflows (external accounts ✓).

- The country’s debt strategy must be realistic given political, social and economic constraints. (Must have margin for error, allow for economic growth and rally stakeholder support ✓).

In any case, under my starting assumptions, Venezuela’s debt burden looks almost as bad as Greece’s. The base case assumes a:

- Sustained, long-run real GDP growth of 2.6% (± 0.3%)

- Marginal interest rate on new debt of 9.5% (∓ 0.5%)

- Sustained, long-run primary balance of 0.0% (± 0.5%)

- Starting GDP of $130 billion (± $10 billion)

- Public external debt stock of $140 billion

- Average interest rate on the current external debt stock of 6%

- The EIU’s 5 year U.S. inflation forecast (about 2% per year)

The most contentious assumption is the starting GDP figure of $130 billion. The IMF’s estimate for 2017 as of April last year is $149 billion.* Comparing the historical ratio of imports to GDP, which has stabilized between 4x and 5x in 2013-2015, with the most recent total import figure of $17.8 billion, yields a GDP of $71 to $89 billion. If you include another $6 billion for potentially omitted oil imports, the range rises to $95 to $119 billion. Adjusting Venezuela’s average 1998-2002 GDP in dollars for cumulative inflation, GDP growth, and exchange rate effects also produces figures in this ballpark.

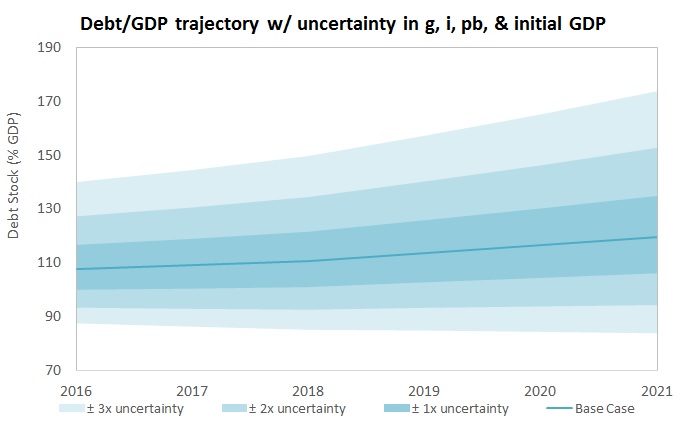

By assuming a base GDP of $130 and considering the ±10 uncertainty 3x over, I think I capture all reasonable estimates. When you crank the mathematical crank, this is what the assumptions yield in terms of debt to GDP:

In the base case (middle line), Venezuela’s debt/GDP ratio starts out at 108% of GDP and rises to 119% in 5 years. The initial debt load—already very high compared to Brazil’s 66% debt/GDP, Mexico’s 43% ratio, and Colombia’s 38% ratio—worsens with time. If on this path, bond markets will eventually demand Venezuela unpayable interest rates (like they have for the last two years) and the country will be unable to refinance debts as they come due. The base case is not sustainable. It goes without saying that trajectories above the base case line are also hopeless. When the parameter uncertainties work against Venezuela 1, 2 or 3 times over, the debt/GDP ratio really balloons.

In the areas below the base case line, where the uncertainties work in Venezuela’s favor 1x or 2x over, things still look bleak. Even though Venezuela grows faster from a higher starting point, has a larger fiscal surplus, and faces lower interest costs than in the base case, the debt/GDP trajectory still rises. Better, but not good enough.

The debt/GDP ratio only stabilizes below 83% of GDP when the uncertainties I listed come through 3x in favor of Venezuela. Does that mean the debt is sustainable then? Not necessarily.

Merely stabilizing the debt/GDP ratio at 83% poses serious risks. While shouldering that debt load, the economy is highly vulnerable to external shocks like the oil price shock that rocked Venezuela in 2014. Furthermore, the debt is highly vulnerable to policy shocks, like a sudden increase in expenditure to attend a crisis.

Debt sustainability is not just about being able to pay your debts in theory. It’s about having enough margin for error to pay them in practice. With basically no savings, Venezuela’s margin is significantly reduced. For that reason, I would hesitate to call Venezuela’s external debt sustainable even if it stabilizes at 83% of GDP.

What would it take to stabilize the debt?

As per the simulation, it would take a:

- Sustained, long-run real GDP growth rate of 3.5% (0.9% higher than base case)

- Long-run primary fiscal balance of 1.5% (1.5% higher than the base case)

- Marginal interest rate of 8% for new debt (1.5% lower than base case)

- Starting GDP of $160 billion ($30 billion higher than base-case)

Is that possible? Sure. Is it likely? I don’t see it. For starters, it looks like Maduro will stay in power until at least 2019. A lot of things will have deteriorated by then. Even if Maduro eludes defaulting on the bonds, Venezuela’s GDP and external assets will likely fall, it’s debt will likely rise, it’s long-run growth potential will fall (thanks to a smaller, weaker private sector), and PDVSA will produce less oil.

That aside, the model parameters required to stabilize the debt/GDP level just don’t seem feasible, no matter who’s in power.

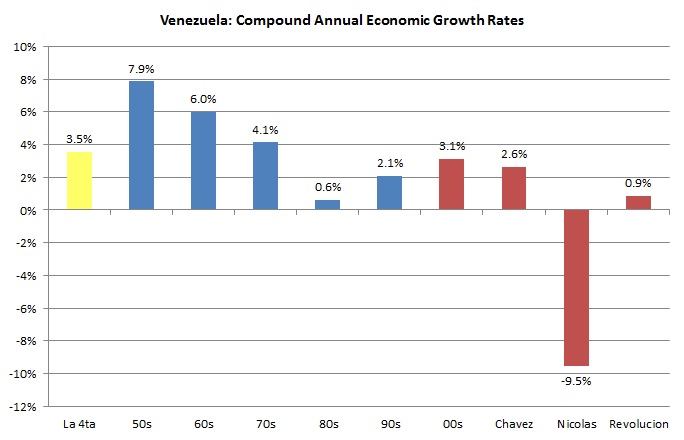

It’s hard for me to imagine that Venezuela will manage to sustain a growth rate of 3.5% over the long run. Without regime change, it’s obviously impossible. With regime change, it’s still hard.

If Venezuela only grew 1-2% in the 80s and 90s when it had imperfect but generally functional institutions, and Venezuela only grew 3.1% during the largest oil boom in its history (2000s), it’s difficult to imagine it will grow 3.5% per year in the long run. There could be a spike in “catch up” growth after good policy for a few years, sure, but then what? What are the drivers for long term growth in Venezuela’s undiversified economy? Oil? Newsflash: the number of barrels produced per capita has about halved in the last 50 years. Venezuela requires a deep existential change to achieve sustainable growth. Politicians don’t seem to have that in mind.

The surplus (ahem, deficit)

To stabilize the debt, a sustained, long-run primary fiscal surplus of 1.5% is required. I can’t imagine that happening either. If the regime doesn’t change, it obviously won’t happen. If it does, it also might not happen.

Any faction that gains power will be politically unstable and be strongly tempted to cut taxes and increase public spending to gain popularity and consolidate power. That’s why I don’t see fiscal surpluses being a stable equilibrium in the foreseeable future. In fact, I think political forces will push in the opposite direction, making a primary deficit more likely.

Incentives aside, the next regime will inherit a budget that’s a mess. On the income side, SENIAT is in tatters: tax collections increased 186% in 2016 when inflation was 500% or more. A lot of that decline in real revenues was the recession and other effects, but some of it must have been efficiency losses. PDVSA is also in tatters: light and medium crude production declined 24%/16% in the East/West regions while heavy crude production only grew 12% in 2010-2015. In addition, production from fields operated solely by PDVSA declined 27.5% while fields operated by joint ventures that charge juicy commissions increased 42.3% in 2010-2015. On the expenditure side, the state has a massive payroll, a massive pension system and massive indirect subsidies it cannot simply slash. Taming the current deficit will not be easy.**

Bankrolling Venezuela?

Stabilizing the debt at 83% of GDP also requires that bond markets lend to Venezuela at 8% for the forecast period. Somehow, I can’t help but laugh at that idea. Firstly, inflation is picking up and interest rates in dollars are poised to rise under Trump. That means issuing debt in dollars will be more expensive for all emerging market economies. Secondly, modern Venezuela is a semi-failed state run by largely inept politicians.

The last time markets were willing bankroll Venezuela for 8% a year was a decade ago, in 2007, when oil was booming and Chavez lived. Cuando éramos felices y no lo sabíamos. We’ll be lucky if markets lend us money at 10% in the next five years.

The road ahead

Folks on Wall Street often say that “Venezuela doesn’t need to default.” Strictly speaking, they are right. It is possible for Venezuela to get its act together, rationalize policy, attract massive investment, regain investor confidence, not default, etc, etc.

But to confuse possible scenarios with probable scenarios is dangerous and misleading. Let’s not delude ourselves. Sooner or later, Venezuela will likely have to restructure its debt. It’s high time to begin planning for that scenario, rather than crossing our fingers and looking the other way.

[*] The IMF’s more recent October 2016 data indicates a 2017 GDP of $314 billion. I’m assuming that is a mistake, because (a) it doesn’t make sense and (b) it’s inconsistent with the April 2016 data, the October 2015 $144 billion figure for 2017 GDP, and the April 2015 $183 billion figure.

[**] In normal countries, when a government spends more than it earns, it has to borrow or burn savings to cover the difference. In Venezuela, there’s a third option: to print the difference. In my model, I’m assuming that fiscal deficits actually lead to increases in debt, like they do in normal countries, because there’s no money printing. I see no point in considering a future where Venezuela continues to print money in the long run, devalue the currency and cause massive capital flight. That is clearly not sustainable, either.

[***] An earlier version of this post contained incorrect end-year debt/GDP ratios. The previous 120% figure for the base-case debt/GDP ratio for 2016 has since been corrected to 108%. After the change, the simulation converges to 83% of GDP instead of 90% of GDP in the +3x uncertainty case. The errors were corrected and the text is otherwise unchanged.

Caracas Chronicles is 100% reader-supported.

We’ve been able to hang on for 22 years in one of the craziest media landscapes in the world. We’ve seen different media outlets in Venezuela (and abroad) closing shop, something we’re looking to avoid at all costs. Your collaboration goes a long way in helping us weather the storm.

Donate