Morality of Venny Bonds: the Foreign View

If you're invested in Vennys that mature soon, you're invested in misery. I called some contacts on the Street to find out how they think about this. Mostly, they don't.

The evidence has been clear for nearly a year. Venezuela isn’t just experiencing isolated food shortages. The whole country is starving. Media reports from last year showed that there were malnourished infants showing up in hospitals, and 90% of people said they didn’t have enough to eat. ENCOVI, a study carried out by an independent consortium of Universities, showed 3 in 4 Venezuelans are losing weight, and not a little bit. Earlier this month, the government health ministry released data showing a huge increase in infant and maternal deaths, leading Maduro to sack the health minister. The humanitarian consequences of the regime’s actions cannot be ignored by anyone who is paying attention.

Is there any moral justification for handling debt from a country facing this much hardship?

Is there any moral justification for handling debt from a country facing this much hardship?

Actually, it depends. It depends on how you get involved. When a bond is first issued, the entity buying it is putting money directly in the government’s pocket. But most bond trading isn’t like that: mostly, the bond market consists of people buying and selling existing debt. That’s the so-called secondary market: debt shifting hands between third parties. When that happens, no new money is being extended to Maduro & Co.; it’s just a transfer of risk among private market players. Think of it as a game of hot potato on which millions of dollars worth of bonds change hands day-in, day-out, but the government doesn’t see a dime from any of those transactions.

Does all of this mean that you, as an investor, are morally exposed only on primary market transactions? I think so (and so do most investors), save for an important exception. Remember what Daniel Urdaneta cheekily calls the Bachaquero of Wall Street trade: buying up bonds close to maturity (the ‘short end’), effectively putting yourself first-in-line to collect debts from the government. Your “investment” consists on buying today in the secondary market (at a discount) a claim to receive money from PDVSA tomorrow. If this is the game you’re playing, you’re directly betting on the government’s policy of willingness to pay at all costs. You’re gambling that the government will privilege your payment over the next shipment of antibiotics. How comfortable are you with that?

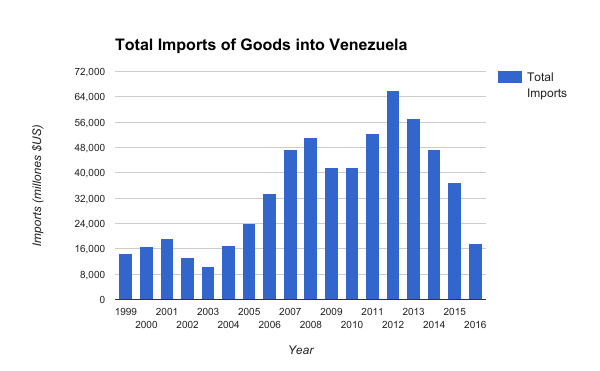

As the regime has strangled imports and found innovative ways to find enough dollars to kick the can down the road, short-end bondholders have benefited greatly, despite the country’s wretched condition. Over the past year, Venezuela and PDVSA debt has returned 52%, and short-end bonds have returned 70% or even more. Over that time, Venny debt has been responsible for about 15% of the total performance of the most important benchmark Emerging Markets (EM) debt index, which has returned about 9%. This return was made possible in large part by the government’s resilient willingness to pay regardless of the human consequences.

No EM mutual fund manager can afford to simply ignore Venezuela (or any other authoritarian government out there, for that matter); its huge size, astronomical yields, and high volatility make it a key component of the performance by which managers are evaluated. Had a manager decided to step aside from Venny debt last summer when the acute food shortages became chronic, they would have missed a big portion of those gains, leading to a career-threatening underperformance relative to the benchmark.

Just to stay level with the benchmark, you’re forced to cash in on some of Maduro’s most damaging decisions. Venezuela’s rulers have conspired to hoard as much hard currency as possible by pawning assets, constricting imports, liquidating reserves and then using the dollars to pay the tab on the country’s $150 billion debt pile, with the fringe benefit of enriching themselves along the way. Billions of dollars needed for food imports have been redirected to debt service, including roughly $17 billion in 2016 alone. It is Marxist rent-seeking on an unprecedented scale with grave and well documented humanitarian consequences.

It is a way for the government to keep the generals happy. They are recycling dollars to the generals via these bonds.

So how do foreign investors in Venezuela and PdVSA sleep at night? Does the government’s clear intention to sustain the regime by putting debt service ahead of food and medicine imports impact their investment decisions? I asked a group of emerging market bond strategists, traders and portfolio managers if and how Maduro’s path has changed their approach to Venezuela. All are anonymous to allow them to speak more freely.

When asked how the food crisis would impact his decisions, a manager at a large hedge fund said, “It is a very dangerous game… Inside information is the key to playing the regime’s longevity. The decisions are made with a political framework we are not familiar with… So we are not involved… We might buy bonds opportunistically and hold them over the weekend, but never in ‘size’ and neither for the long haul.” This is the consensus opinion among investors that aren’t required to have a view due to their mandate to follow a benchmark.

Probably the most succinct statement on trading the country’s debt came from a trader at a Latam bank. “The thing about this regime is that you don’t know. You don’t know how long it will last, you don’t know who is in charge, you don’t know if the bonds will be worth 40, 20 or zero in a restructuring. You don’t even know how much money is still in the country or how much gold is in the vaults. What we do know is that the military is getting rich. Very rich.”

A US-based trader agreed that the drivers of prices are not foreign investors, but buyers from within the regime. “There aren’t any real money investors looking for a good yield. Locals trade quite actively… It is a way for the government to keep the generals happy. They are recycling dollars to the generals via these bonds… it is a good way for them to buy at 80 cents on the dollar get paid at 100, and bring the dollars back from offshore through the parallel market. It is one of the biggest money laundering schemes out there.”

A manager at a Latin family office offered a more measured outlook. For him, the moral question doesn’t apply because he thinks holding short-end Venny bonds in the current context is a bad investment to begin with. If the government keeps on stubbornly paying its debts until —inevitably— running out of cash, he believes that the humanitarian situation would get worse in the midst of a hard default, one on which there is no pre-negotiated restructuring of sovereign and PdVSA debt.

This return was made possible in large part by the government’s resilient willingness to pay regardless of the human consequences.

“If Venezuela defaults, people will starve in the streets,” he tells me. “The ‘starvation index’ will go up because what remains of the financial system will seize up, oil could be embargoed, and production could fall further. Things are going to get worse before they get better.” Not that these concerns are driving his decision-making: he just doesn’t think it’s a good investment, period.

The most stark comment on the morality of debt prioritization came from a trader at a US fund. He made clear that mutual fund managers can’t afford moral considerations: “They would be breaching their fiduciary duty to consider the moral issues […] and money walks —assets have been walking out of active funds and into index funds, and these bonds are represented in the index. They can’t afford not to own them.”

Another US-based trader agreed with the power of the benchmark. “Everyone who owns bonds there is an index follower. The moral/ethical argument against holding the bonds doesn’t exist because there are no discretionary investors left that are seeking a good yield. People own it only because they have to own it, and if they don’t it is a huge problem.”

This view was echoed by a Wall Street strategist. “From a cashflow perspective they have the capacity to continue to pay through the end of the year, and I suspect that (holders of the debt) are going to start bailing when it is too late. Anyone that has anything to do with an index gets burned by being underweight, so they inevitably come back. To completely step out of the position, you would have to compensate somehow. And there isn’t enough risk-adjusted yield to compensate elsewhere.”

Billions of dollars needed for food imports have been redirected to debt service, including roughly $17 billion in 2016 alone.

This strategist also laid out the “worst-case scenario”. “It’s tricky from a social perspective…because of the way they have painted themselves into a corner, it could be a Cuba or Zimbabwe-style default, where they stop paying and nothing happens for years.” Indeed, it is complicated to make the moral decision to avoid the debt because of the regime’s human rights abuses when it is far from clear what will happen in the short-term, say nothing of what happens after the country inevitably runs out of money.

You can call it Wall Street cynicism or moral ambivalence. Maybe you want to play the Gordon Gekko card and say it is an amoral lust for a bigger bonus. But at the end of the day foreign investors see enough ambiguity about the social and economic reaction function of default (as well as to the extent that their actions really help the government to stay in power) to allow them to sleep at night, and most importantly, many are simply shadowing an index that mandates they own the bonds.

What’s the solution? Perhaps there are clients that wouldn’t want to be involved in owning Venezuela for political or philosophical reasons, especially public pension funds. But despite increased media attention over the past couple months, the US government has failed to use its economic influence with banks, public pension funds and asset managers to put more pressure on Maduro. The markets have callously gone ‘business-as-usual’ on Venezuela despite the precipitous collapse of the democratic institutions and, even though it may not be in the best interest of market efficiency (and it would certainly be a huuuge argument for the government to cling onto their conspiranoid claims of the American Empire’s ‘financial blockade’ against Venezuela), the question on whether the regulating bodies should step in and put some order in the ruckus is more pertinent than ever.

One way US government could turn up the heat in this area is sanctions, and this might be changing. Last week the US Treasury Department imposed sanctions on eight members of the Supreme Court as punishment for the annulment of the National Assembly. The sanctions on these individuals freeze US assets, prevent them from travelling to the US, and prevent US citizens from doing business with them. There is precedent for wider sanctions similar to what the US imposed after Russia invaded Crimea. Those sanctions caused a serious upheaval in Russian financial markets as asset managers sought to assure they were in compliance with the law (or to put it more delicately, they ran scared-shitless towards the exits like a stampede). The Russians had the resources to ride that out, but the Chavistas may not be so lucky.

Without a catalyst from the banks, index providers or US government, most EM investors are going to keep owning Venezuelan debt until the end, because their jobs depend on it. And it’s hard to get a fund manager to sell a bond when his paycheck depends on not selling it.

Caracas Chronicles is 100% reader-supported.

We’ve been able to hang on for 21 years in one of the craziest media landscapes in the world. We’ve seen different media outlets in Venezuela (and abroad) closing shop, something we’re looking to avoid at all costs. Your collaboration goes a long way in helping us weather the storm.

Donate