Taking Over CITGO Is the Key for the Future

The three refineries and 5,500 retail stations that Venezuela owns in U.S. soil are one of the most important battlefields in the struggle of replacing the Maduro regime and funding our reconstruction. Here’s what has happened so far and what the interim government’s options are.

Photo: retrieved @carlosveccio

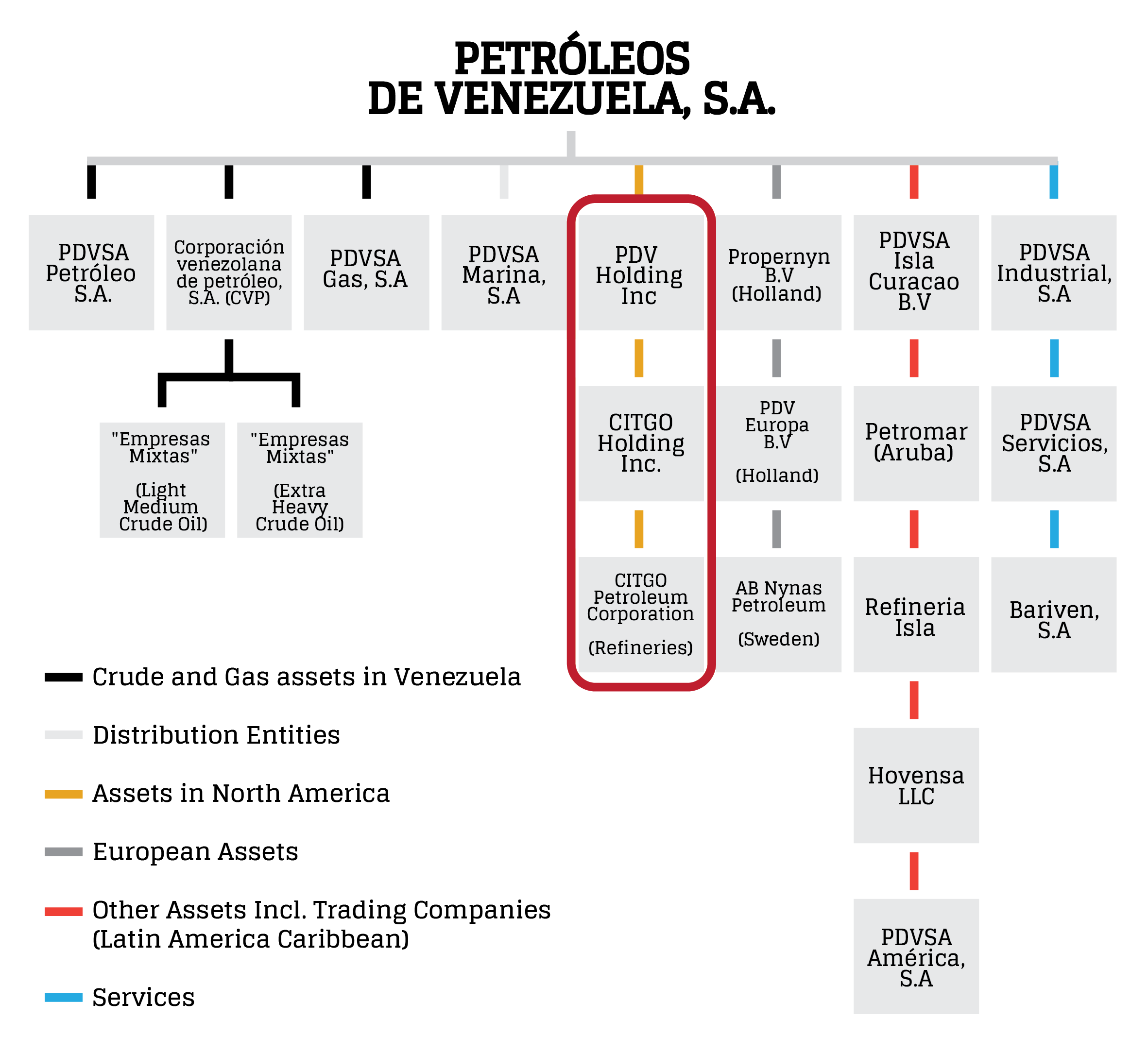

On February 13th, the National Assembly appointed a new board of directors for PDV Holding, CITGO Holding and CITGO Petroleum, as well as members for an administrative board for PDVSA, the National Oil Company of Venezuela. The announcement came two weeks after the Treasury Department’s Office of Foreign Assets Control (OFAC) and the Secretary of the Treasury, in accordance with Executive Order 13850, determined that PDVSA was subject to U.S. sanctions. Because of this, all PDVSA assets subject to U.S. jurisdiction are blocked, and U.S. persons are barred from engaging in transactions with the company.

How are these two announcements linked and why was it so important that the National Assembly quickly designated a new board of CITGO? In order to answer that, we need to provide some background.

The menaces of the recent past

As shown below, PDV Holding is the parent company of CITGO Holding and CITGO Petroleum Corporation, owners of several assets in North America including the following: three refineries with a combined processing capacity of 750,000 barrels per day (bd), 48 terminals, nine pipelines, over 5,500 independent retail stations in 29 U.S. states, as well as other transport and storage facilities. As of 2015, the company reported an estimated equity value for CITGO Holding (net of debt) of $8.5 billion, and more recent estimates put the value of the company between $4 billion and $8 billion, making this subsidiary PDVSA’s most valuable asset abroad.

Problem is that this asset is at risk of being taken out of Venezuela’s hands. First, as explained by Daniel Urdaneta here, 50.1% of CITGO Holding’s equity was pledged as collateral for PDVSA bonds expiring in 2020 (USD 2.5 billion), and the remainder was used as collateral for USD 1.5 billion loan to Rosneft. Daniel also explained that there are other bonds that could potentially provide a claim to those bondholders over CITGO assets.

Problem is that this asset is at risk of being taken out of Venezuela’s hands. First, as explained by Daniel Urdaneta here, 50.1% of CITGO Holding’s equity was pledged as collateral for PDVSA bonds expiring in 2020 (USD 2.5 billion), and the remainder was used as collateral for USD 1.5 billion loan to Rosneft. Daniel also explained that there are other bonds that could potentially provide a claim to those bondholders over CITGO assets.

The second group of interested parties is related to companies making claims against Venezuela for damages relating to expropriation. The mining firm Crystallex, as well as others such as ConocoPhillips and Owens Illinois are included in this group. Even though some of these claims were against the republic and not specifically targeted at PDVSA, there is now a precedent that opens the possibility for these companies to claim equity in CITGO. A federal judge in Delaware ruled in August 2018 that Venezuela’s discretionary control of PDVSA rendered the company the “alter ego” of the government.

In other words, the two entities are one and the same, and therefore, the assets of one could be used to pay the debts of the other. In a report from September 2017, legal experts estimated that Venezuela’s exposure to these claims was around $16 billion. This means that even if we don’t consider other possible claims coming from other bondholders and companies, the value of CITGO assets will not cover all claims. To put it simply in Caribbean Spanish: “no hay cama pa’ tanta gente”.

The conundrum of the present

Now, even if there’s a new administrative board in PDVSA, the fact is that with Nicolás Maduro having de facto power, the operations in Venezuela are still in the hands of the board chaired by General Manuel Quevedo. Recognizing this situation, OFAC issued general licenses to allow certain transactions and activities related to PDVSA and its subsidiaries, some within specified time frames or wind down periods. However, payments for these transactions benefiting PDVSA must be made into a blocked account in the United States. In practice, it means that if the Maduro regime sends oil to CITGO refineries, they won’t collect the money from that sale. If, in addition, control of CITGO is on the newly appointed board, then there’s not much incentive for PDVSA to keep sending oil to the U.S. or paying the 2020 bonds or any obligations with CITGO collateral. This means that most likely PDVSA will not honor the payment of interest on their 2020 bonds, triggering legal actions from bondholders.

This is why the first set of actions for the newly appointed board of directors of CITGO is aimed at protecting assets from all the above claims. In this sense, the idea would be to provide some breathing room and preventing CITGO from losing its value. News reports have mentioned the possibility of CITGO filing for court protection under Chapter 11 of the Bankruptcy Code, allowing for reorganization for the company, “sort out competing creditor claims and to deal with a looming governance crisis” and ultimately preserving Venezuela’s strategic interests in CITGO.

However, there might be other options on the table, that might include some standstill, or agreement, with bondholders and other creditors, to refrain from further legal actions on CITGO, to prevent the destruction of collateral value. This is why some analysts have considered the possibility of using CITGO dividends to honor bond payments, for instance. Moving forward on this front depends on the credibility about the new board’s ability to effectively control and improve the operation of the company.

This is why the second set of actions from the new board are aimed at improving the balance sheet and overall performance of the company, in order to build confidence in an eventual debt restructuring process, if that happens to be the case. With the current political situation, effective control of PDVSA by Guaidó’s team hasn’t happened, but it also means that with the recognition and support of the Trump administration to prevent CITGO from being auctioned among creditors, being in the U.S. provides better ground for the new board to exercise control over the company. As it’s pointed out here, “Maduro definitely does not have any ability to send men with guns to Citgo’s headquarters to keep his board there,” and that translates to the rest of CITGO’s operations.

There’s a valid concern about what happens to the operation of CITGO now that PDVSA stops sending oil to the U.S. On average, between 2009 and 2018, Venezuelan crude represented around 42% of CITGO oil imports. These purchases were made by the Lake Charles and Corpus Christi refineries, with more than 90% of them being heavy crude. All of the oil imports from Lemont were coming from Canada.

However, given the dramatic decline in oil production in Venezuela over time, companies like Phillips 66 and other major refiners have reduced their purchases of Venezuelan crude. CITGO had also replaced Venezuelan crude as their total input, even before the sanctions took place.

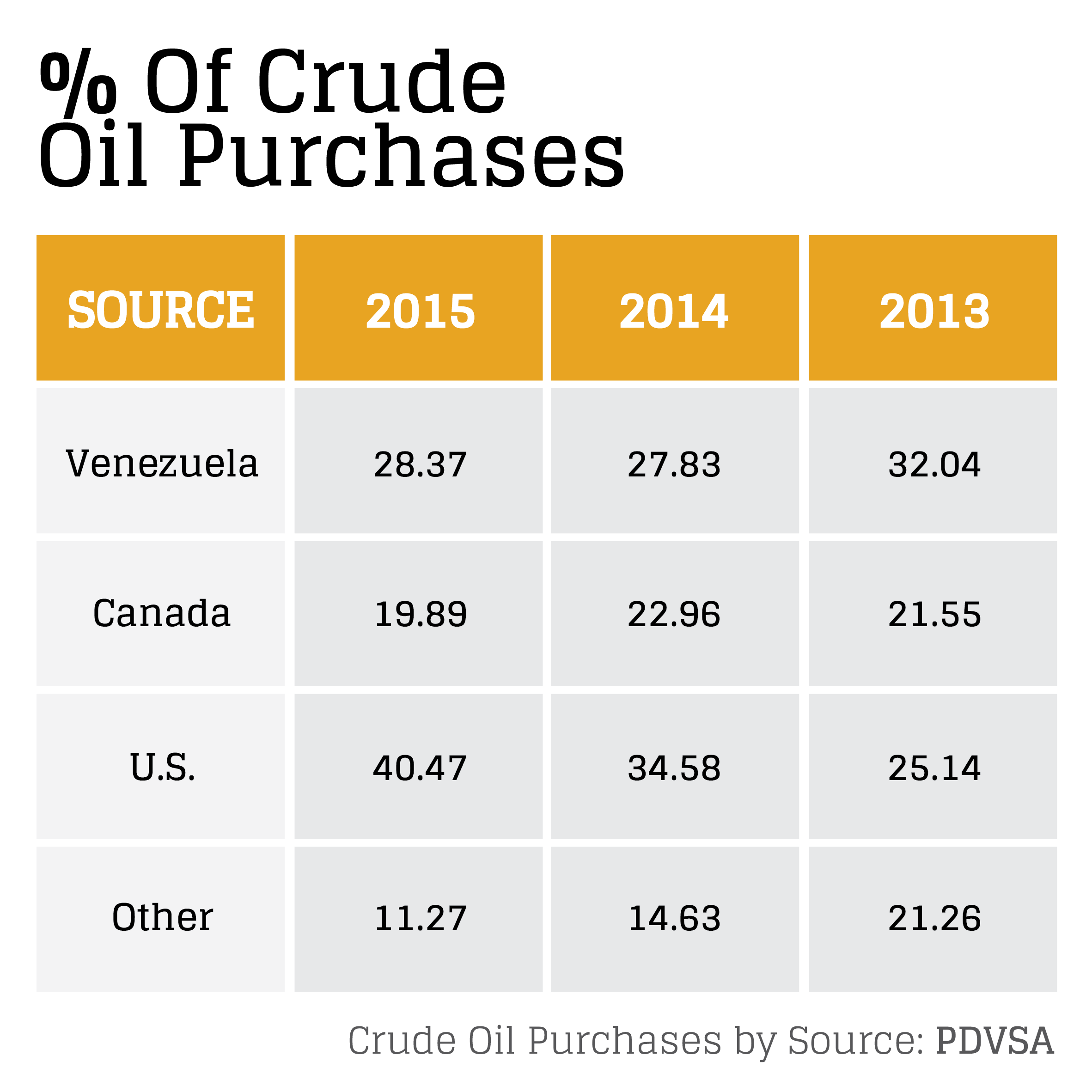

As you can see in the chart, by 2015, approximately 28% of CITGO crude oil purchases (imports and local purchases in the U.S.) were coming from PDVSA and PDVSA affiliated suppliers (CITGO Petroleum chairwoman Luisa Palacios also mentioned similar numbers on March 12th at CERAweek, one of the most important conferences in the energy sector worldwide). The increasing share of the U.S. is due in great part to the increase in supply coming from hydraulic fracturing in this country, reducing the need to import light crude.

This means that although there are disruptions associated with not having heavy crude from Venezuela to operate in the Gulf Coast refineries and the market may be in short supply of these grades, there might still be some margin for substitution from some other countries. In addition, cash margins (a measure of profitability of refiners), suggest that in recent years the Lake Charles and Corpus Christi refineries have performed at an average level among Gulf Coast refineries, while the Lemont refinery was one of the top performers in the Midwest. This also indicates the potential for a shift upward if the right governance and organization changes take place.

This means that although there are disruptions associated with not having heavy crude from Venezuela to operate in the Gulf Coast refineries and the market may be in short supply of these grades, there might still be some margin for substitution from some other countries. In addition, cash margins (a measure of profitability of refiners), suggest that in recent years the Lake Charles and Corpus Christi refineries have performed at an average level among Gulf Coast refineries, while the Lemont refinery was one of the top performers in the Midwest. This also indicates the potential for a shift upward if the right governance and organization changes take place.

For Venezuela, the ownership of CITGO may be key in the future of the oil industry as a whole. The International Maritime Organization (IMO) will enforce a new regulation, reducing the maximum content of Sulphur in fuels to 0.5, starting in January 2020. This will mean that heavy/sour crude will probably become cheaper compared to light crude (even with the current shortage of supply), which could increase refinery margins for CITGO. The complexity of CITGO refineries allows them for better use of heavy crudes, in compliance with IMO regulations, which further increases the profitability of the company.

In the coming years, Venezuela could have an even greater opportunity. The reason is that the fuels used for trucks, tankers and airplanes are coming from refineries such as the ones from CITGO (other opportunities may come from the petrochemical sector). These fuels can be produced with great profit using heavy crude oil, such as the one coming from the Orinoco Oil Belt. Unlike the light transport and the electricity industry, there are not many available substitutes for these oil products in the heavy transport and petrochemical sectors, and as the shipping, travel and manufacturing industries continue to grow rapidly in emerging countries, the value of the products coming from CITGO will probably be much higher in the future.

For Venezuela, being able to get a grip of that opportunity and that future depends on the actions that are taken today, and it definitely could be a signal of better things to come.

Caracas Chronicles is 100% reader-supported.

We’ve been able to hang on for 21 years in one of the craziest media landscapes in the world. We’ve seen different media outlets in Venezuela (and abroad) closing shop, something we’re looking to avoid at all costs. Your collaboration goes a long way in helping us weather the storm.

Donate