Venezuelan Exports Beyond the Devil's Excrement

Rum and cocoa, but also shrimp, food, and even auto parts. The figures are still very low, but the private industry is exporting much more than in 2019 and 2020

The trade flow from Venezuela to the United States hasn’t stopped, in spite of the sanctions. It even increased in 2021 and 2022, according to the Asociación Venezolana de Exportadores (Venezuelan Exporters’ Association; Avex) and the Cámara de Comercio Venezolana Americana (American-Venezuelan Chamber of Commerce; Venamcham).

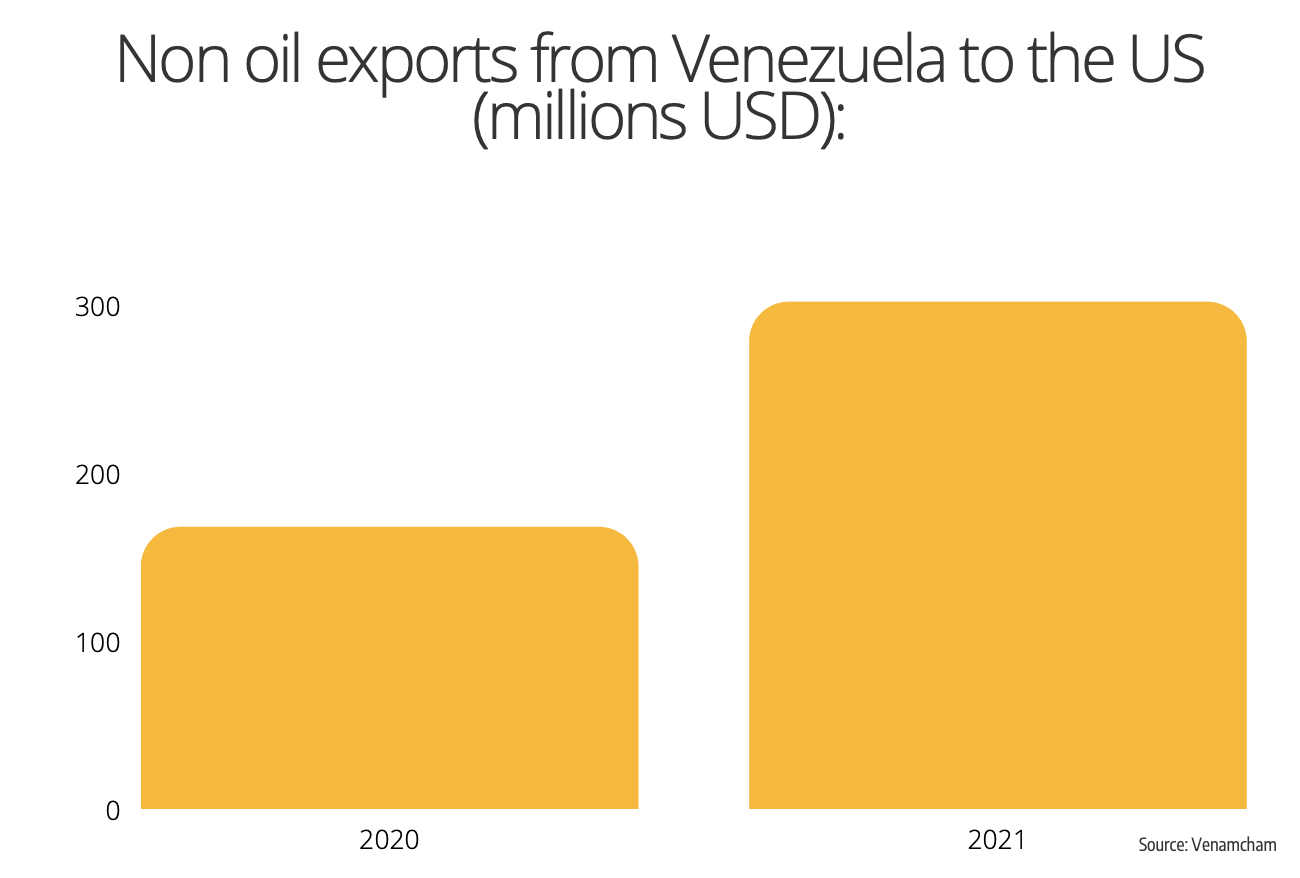

In 2021, Venezuela exported products valued at 302 million dollars to the United States, an 80% increase or 134 million dollars over the 168 million dollars registered in 2020, according to Venamcham.

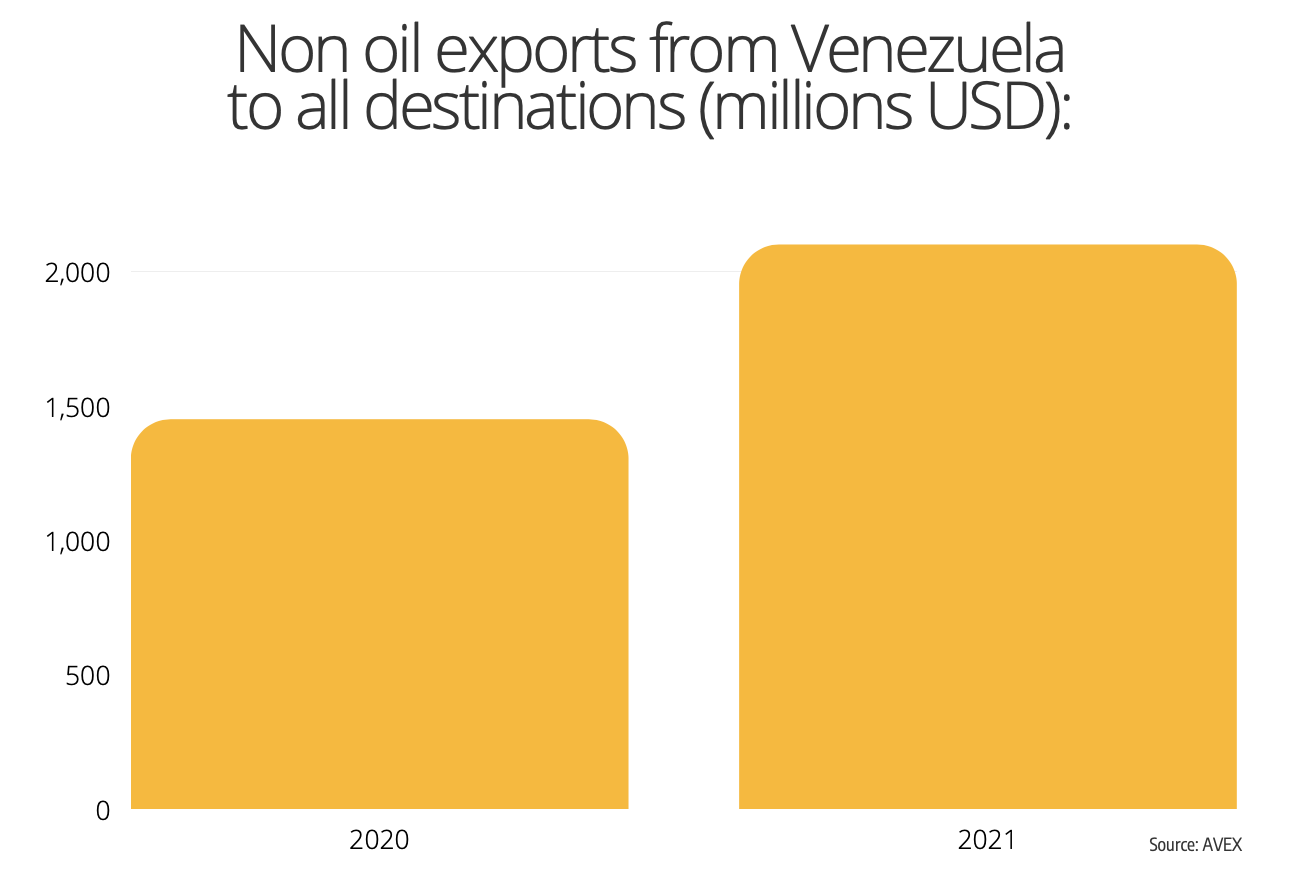

Total Venezuelan exports, including all destinations, not only the United States, reached 2,100 million dollars last year, much higher than the 1,450 million registered in 2020, when the pandemic hit hardest, said Ramón Goyo, president of Avex.

This year, exporters are hoping for an even better performance, given that in the first quarter of 2022 their shipments almost tripled, compared to 2021’s same period.

Avex’s numbers don’t include oil, gold, or junk metal exports. Those product lines are measured through other channels. Consulting firm Ecoanalítica, for example, estimates that oil exports will surpass 16,000 million dollars, almost three times of what came in during 2020 (5,714 million dollars).

You have to take into account that Avex and Venamcham are drawing their numbers from “mirror statistics”: in other words, those released by other countries based on imported products from Venezuela, because there isn’t official data available. Information by the Banco Central de Venezuela (BCV) on foreign trade has been missing since 2019.

However, in April, Vice President Delcy Rodríguez, assured that Venezuelan exports almost tripled during the first quarter of 2022, increasing 184% compared to the previous year. Her statement matches what Avex and Venamcham have claimed so far.

An Uneven Commercial Balance

Venezuela’s commercial balance continues to be dramatically uneven: the country imports almost ten times what it exports. But there’s good news in the midst of all the national economic chaos: after eight years of recession, which shrunk productivity by almost 80% between 2014 and 2021, exports no longer depend on oil by 95% like they did before.

The diversification of exports has deepened and the country has added value to many supply chains, and their non-traditional exports have been gaining ground. Venezuela is now shipping rum, gin, anise, wine, and cocuy; lobster, shrimp, tuna, prawn, crab, and fresh and frozen fish; seeds, oleaginous products, wafer cones, biscuits, artisanal and industrial chocolate; industrialized foodstuff for human and animal consumption; aluminum, steel, and plastic manufacturing; electric and automotive parts, among others.

“We’ve always exported those kinds of things, but in smaller quantities. You didn’t see many aluminum, chemical, and plastics exports, but the current market situation and functioning value chains made us able to take advantage of those opportunities and the private sector exports are now stronger,” Goyo claims.

Exports from Venezuela’s private sector mainly head to the United States, Latin America and Europe. But Asia is the main recipient of the exports from the public sector.

Made in Venezuela

The news in regards to rum exports? Reserve rums have multiplied and their prices go between 300 and 500 dollars.

“Shrimp production and exports are also expanding strongly. Production could easily grow 40% this year. There are large investments in Zulia, they’re going to increase from over 36 thousand tonnes to over 50 thousand tonnes,” Goyo says.

The Cámara de Fabricantes Venezolanos de Productos Automotores (Venezuelan Automotive Manufacturers Chamber; Favenpa), reported that last year, they doubled their shipping of car parts produced in the country compared to 2020, although it continues to be very low. Sales abroad in this industry were in the vicinity of 7 million dollars in 2021, “a very small amount when compared to 260 million from 14 years ago,” Omar Bautista, president of Favenpa, said to the Diario de Lara.

These manufacturers are exporting car batteries, aluminum radiators, aluminum pistons, brake pads, parts for wheel spindles and air, oil, and fuel filters. Their main buyers currently are Colombia, the U.S., Brazil, Argentina, Italy, and the Dominican Republic.

Among Venezuelan chocolate exporters, Chocolates El Rey and Franceschi brands stand out, but new chocolate producers have also added to these commercial flows, both industrialized and artisanal.

Jorge Redmond, president of Chocolates El Rey, suggests that the State should reduce bureaucracy in the export system to make it more efficient and fight the corruption that has taken over. “When Hugo Chávez came to power, you had to go through four stages in order to ship a container filled with chocolate. Today, you have to go through 90 stages and 19 different ministries which intervene in the process. It’s a mechanism which unnecessarily drags out the exporting protocol,” Redmond said to website VivaElCacao.com.

Exporta Fácil

When asked about the Exporta Fácil plan, recently announced by Nicolás Maduro as a new public policy in commercial matters, whose goal is to substantially increase exports in the short and mid-term, Goyo stated that things should be simplified, digitalizing processes, to reduce costs and time for procedures on foreign trade to improve the current situation in the field.

It can take approximately 12 days to process a shipment in Venezuela, and that level of bureaucracy decreases the country’s competitiveness. Neighbors in the region are able to do the same procedure in one day, for example.

“Enabling the consolidation of products through Ipostel could also work. If you join several exports to form a large shipment in one container, that also works. More air transport alternatives would also benefit us,” the businessman added.

The cost for using shipping docks in Venezuela is up to three times more expensive than other countries in the region, such as Panama, for instance. “If they really want to increase exports, these costs have to be reduced and also change the legal regulations that are affecting 70% of exports,” the Avex president said.

The guild proposes joining the technological and digitized platform with the National Guard controls (Anti-Drug Guard and Customs Guard) and all the ministries and state institutions that are involved in foreign trade.

Caracas Chronicles is 100% reader-supported.

We’ve been able to hang on for 22 years in one of the craziest media landscapes in the world. We’ve seen different media outlets in Venezuela (and abroad) closing shop, something we’re looking to avoid at all costs. Your collaboration goes a long way in helping us weather the storm.

Donate