When Maduro 'defeated hyperinflation…' and Killed the Banking Sector

In a typical bank agency office in Caracas, every day feels like Sunday. There are no lines of clients anxiously holding folders or in a rush to cash in a check. Bank clerks have barely any work to do.

In Venezuela, banks are bearing the cost of running more offices than needed with very few sources of income. It would make sense to them to shut down many, but Sudeban—the banks’ national regulation authority—stands in their way.

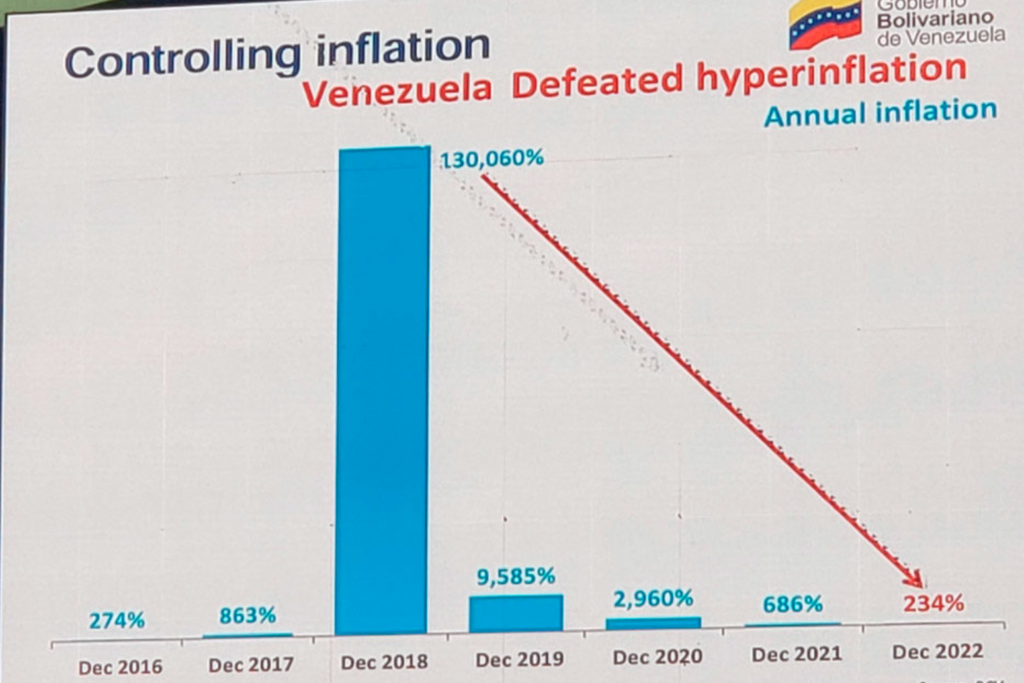

That’s the reality behind the chart that went viral after Delcy Rodriguez’s presentation to Turkish businessmen on the performance of the economy. Inflation went from 130,060 % to 234% (according to Delcy), with Maduro’s monetary policies pulling down financial institutions.

Since Maduro’s presidency started in 2013, the government has gradually raised the reserve ratio from 17% to 73%. That means that banks should hold onto almost all the money deposited by their customers—also known as liabilities— instead of lending out or investing it to grow their profits.

Unexpectedly, sanctions—since the government and government individuals & Co. couldn’t tuck away their earnings abroad—were part of a set of conditions that boosted business activity in the country, considering the previous context of an economic collapse of historical proportions (which is still looming around). But the new investments will not last without lenders stimulating production and consumption.

Reserve Ratio Suffocation

In late 2018, Calixto Ortega, then president of the Venezuelan Central Bank (BCV), announced the decision to tackle hyperinflation by raising the reserve ratio from 31% to 57% of the bank reserves in bolivares calculated (October 31st). When the funds deposited in the banks easily surpassed the bank reserves because of inflation, the BCV also raised the so-called “special reserve ratio” from 60% to 100%.

If in September 2018 a bank’s reserves were 100 billion bolivars, that bank would have had to freeze 57 billion bolivars. If in November the reserves were 300 billion bolivars, the bank would have to freeze the same 57 billion bolivars based on the previous nominal reserve plus the additional 200 billion, that is to say it would have to save 257 billion bolivars. If that was the case, the bank could only lend or invest the remaining 43 billion bolivars.

This means that banks did not issue financing for the opening of over 80 new restaurants during the last quarter of 2022 in Eastern Caracas nor for the new office buildings built—which according to the Construction Chamber are mostly empty. Private banks could not issue new credit at all.

Printing Money to Cover the Oil Industry Collapse

Maduro wanted to shrink the credit base to limit spending, therefore reducing liquidity. But the root of Venezuelan inflation lies in the fact that, for two decades, the Chavista regime has continuously issued base money whenever the oil market couldn´t make a profit. “The only way that the government can compensate for the income drop—and avoid the social implications of limiting public spending—is through the seigniorage, manufacturing money,” says Luis Zambrano Sequin, member of the National Academy of Economic Sciences.

According to the academy, the Venezuelan economy has been reduced by 70% during this government. In the meantime, inflation, hand in hand with the devaluation of the bolivar, led to informal dollarization. Middle and high-income Venezuelans had all their savings in US dollars, although buying and selling in dollars was illegal until 2018. That year, when the ruling assembly abolished the Law for illicit foreign exchange, Venezuela beat the record with a 130,060% hyperinflation rate.

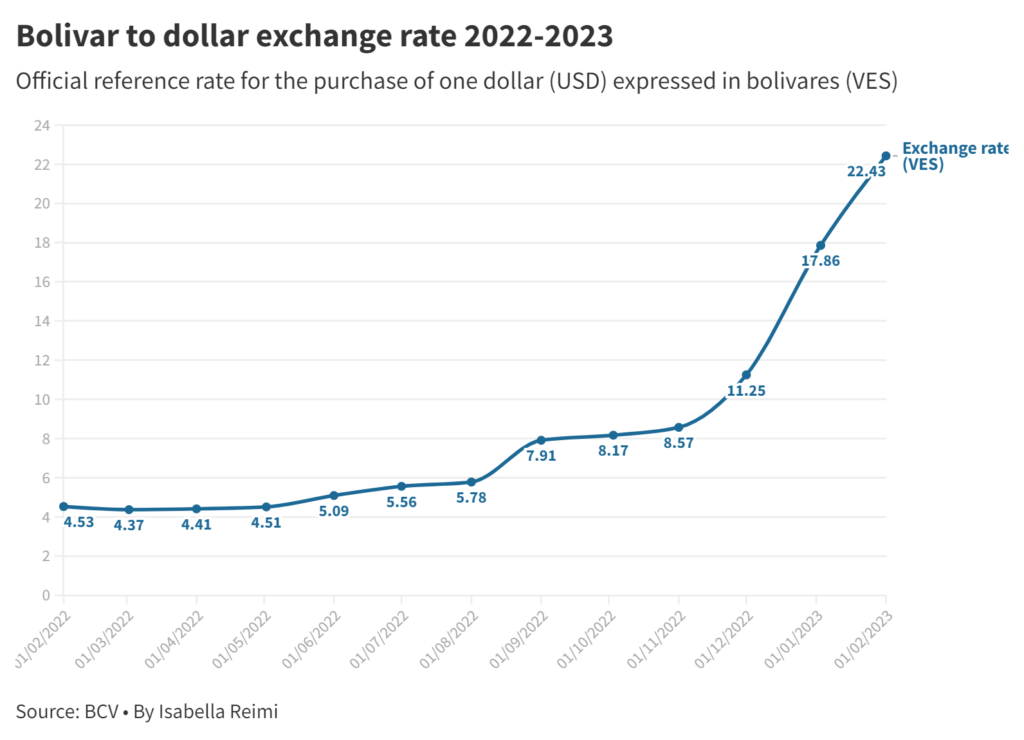

Clients massively requested loans from their banks for several purposes, including buying dollars from third parties to import manufacturing materials. They would still exchange bolivares and dollars in the black market, as the BCV imposed a low rate compared to the market value. Some customers even made a profit out of this scheme. “People asked the bank for a credit, then they bought and sold dollars [in the black market], paid the credit and kept the change,” says Diego Santana, an economist at the firm Econoanalitica.

All came to an end with the reserve ratio. With the BCVs decision, if the banks failed to comply with the ratio, they would have to pay a sanction equal to 138% of what they couldn’t hold. Banking sector insiders say that this was one of the private banks’ biggest expenditures since banks could not control that on many weekends more clients than expected reached the limit of their credit cards.

Intrabank lending was necessary to survive. The interbank short-term lending or “overnight” increased to 24% in December 2018, a hike of 15 percentage points compared to the previous June.

And Hyperinflation Came to an End, Didn’t It?

With the reserve ratio, BCV’s implementation of a more comprehensive bolivar-to-dollar rate and new loan interest rates indexed to that “BCV dollar” hyperinflation came to an end in February 2022. At the same time, the government decreased the special reserve ratio from 100% to 93% in 2020, then to 85% in 2021 and finally to 73% at the beginning of 2022.

Nonetheless, the experts cannot guarantee that a high reserve ratio worked as an effective monetary policy in the first place. The economy shrank for 27 consecutive quarters from Q4 2014 to Q3 2021, and then had accelerated economic growth in 2022 until the second quarter. Now the economy has slowed down, with monthly inflation for January above 300%, according to the Venezuelan Finance Observatory, while the BCV dollar rate increases.

Oscar Torrealba, an economist at think tank Cedice Libertad, says that financial experts forecasted 15% growth in the Venezuelan economy for 2022, but the year closed with 7%. “They took the money away from those who could drive production,” Torrealba explains about the lack of credit. He believes that raising the interest rate, besides being “highly recessive,” does not fix the institutional problem. “People need loans to be able to invest and in Venezuela people invest on their own. There is no evidence that inflation would be further reduced.” The solution, he says, relies on people’s trust in the bolivar.

What the Economy Truly Needs: Investment

Conindustria, the association of manufacturing institutions, found in a survey that 78% of the company owners say that bank financing would enable them to increase production.

The banks needs the government to lower the 30% reserve ratio in US currency, but according to Zambrano Sequin, it’s unlikely that the BCV would expose their dollar reserves to migrate.

Since January 18th, Sudeban allowed banks to issue a total amount of credits worth 30% of their USD reserves, but only in bolivares. They still cannot lend dollars.

Back to Delcy Rodríguez, the vice-president announced that the government would evaluate “an expanded flexibility over time” of the reserve ratio. Santana believes that both the bank and the private industry need credit. Nonetheless, in his experience “government decisions have never been very logical.”

Caracas Chronicles is 100% reader-supported.

We’ve been able to hang on for 21 years in one of the craziest media landscapes in the world. We’ve seen different media outlets in Venezuela (and abroad) closing shop, something we’re looking to avoid at all costs. Your collaboration goes a long way in helping us weather the storm.

Donate