El Feed

Maduro's Great Leap Forward? 🇨🇳

Nicolás Maduro is visiting Xi Jinping on September 14th, despite relations between China and the Bolivarian Revolution cooling down in the last few years. Is this the return of an old lifeline?

China to the rescue!

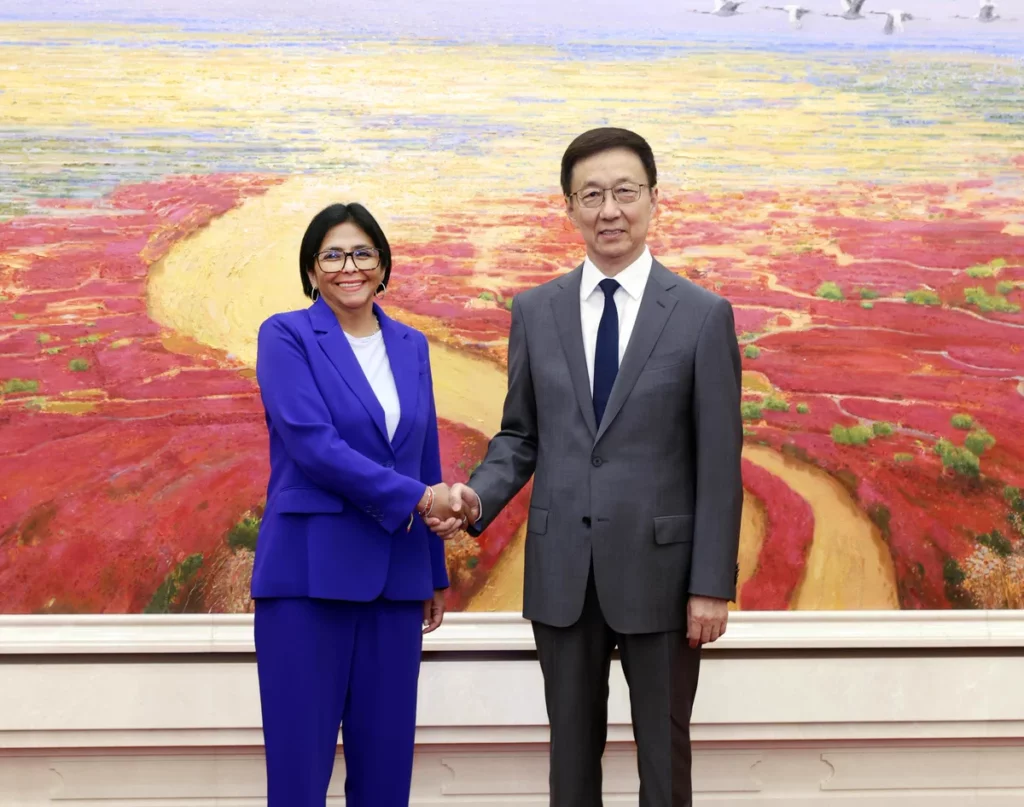

Energy trade, debt repayment (Venezuela owes over $10 billion to China) and new financing are likely the main focus of Maduro’s visit, according to Reuters. The government previously sent Vice President Delcy Rodríguez and Oil Minister Pedro Tellechea to China on Tuesday, seeking to discuss new joint ventures to revive Venezuela’s oil industry.

While China is still the main consumer of Venezuelan oil, PDVSA is no longer shipping crude directly to its Chinese partners due to American sanctions: instead, it’s using intermediaries like Malaysia and Oman.

From the PRR

Nicolás Maduro is currently working on several fronts of the international arena. While he has been able to make certain progress rebuilding business relationships with Western countries, this “progress” hasn’t been enough to produce the quick influx of cash he requires to fund his 2024 campaign. In consequence, he’s been forced to turn, once again, toward China.

This is how our Political Risk Report kicks off this week. Some times sanctions relief is not quite enough. Maduro & Co. are working a multilegged strategy to tilt the financial scale back to their side. It’s as if the world is ready to lift sanctions and welcome Venezuela back to the international financial system, and all it needs is Maduro to give it an excuse. But still, better conditions to develop the oil business doesn’t mean immediate cash in their pockets. For immediate cash, Maduro needs to pay a visit to the world’s biggest pawn broker: China.

More gossip you can find in the PRR:

Sources also report the US is exploring options to stop the auction of CITGO shares, likely by modifying or pausing the effects of the Delaware court decision that found that CITGO and its parent companies were an alter ego of the Venezuelan State. Under that scenario, CITGO would only be liable for its own debts, and not for the vast debts of the State, such as the CIADI arbitration awards.

Venezuela on the web

This piece from El País made the rounds today. The headline is a bit midleading:

“$3 billion in Venezuelan frozen assets may be released in the coming weeks.” Why is it misleading? Because the article refers to the UN managed trust that is likely to be approved and set up in the coming weeks, but it’s very unlikely that it will manage $3 billion any time soon. See, hunting down the accounts and going through the approval process to allocate those funds to the trust are titanic tasks in themselves.

What is true, however, is that the reason that the agreement was stuck was that there was no assurance by the US that the funds would be protected from creditors. Now the assurances are in place.