That Spending Binge Chart, Adjusted for Inflation This Time

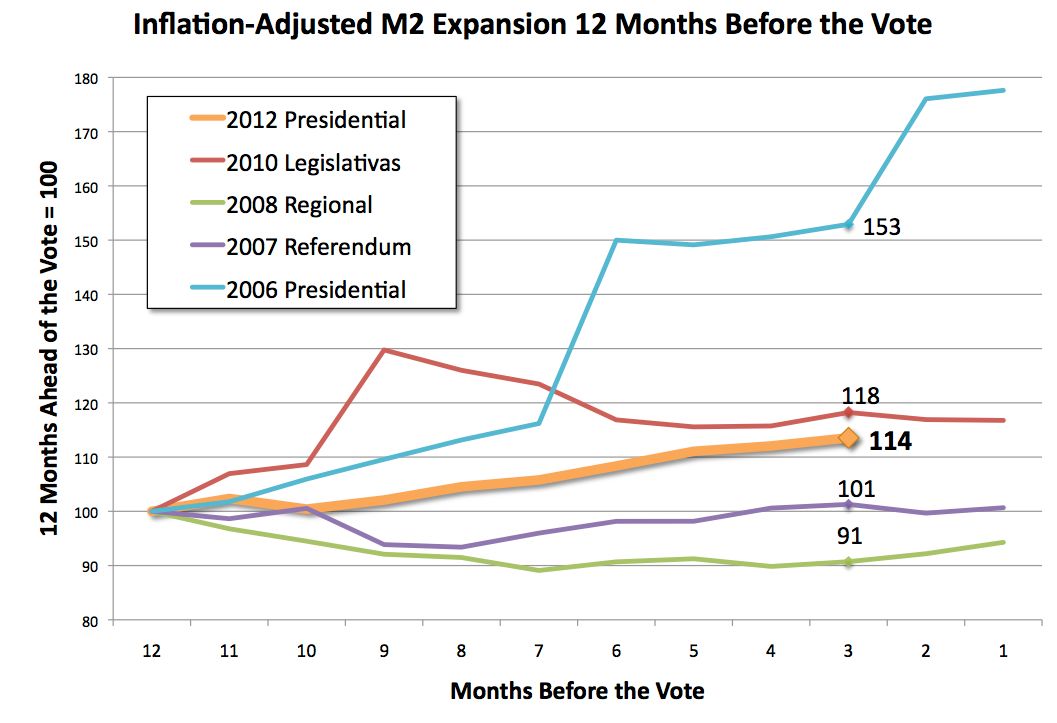

After a series of virtual (and well deserved) coscorrones for publishing what really was a misleading post this morning, I went back and re-did that M2 expansion chart including an inflation adjustment. (Since inflation numbers only come out once a month, this one is monthly rather than weekly.)

As you can see, the picture doesn’t look quite so bad when you take inflation into account. Sure, a 14% real expansion in the money supply is nothing to sneeze at, and there’s still time to ramp it up. But we’re certainly not in the same league as in the heyday of money-creation ahead of the 2006 election – a genuinely crazy monetary binge that did much to cause the higher levels of inflation we’ve had ever since.

As you can see, the picture doesn’t look quite so bad when you take inflation into account. Sure, a 14% real expansion in the money supply is nothing to sneeze at, and there’s still time to ramp it up. But we’re certainly not in the same league as in the heyday of money-creation ahead of the 2006 election – a genuinely crazy monetary binge that did much to cause the higher levels of inflation we’ve had ever since.

In fact, in real terms, monetary liquidity has expanded less quickly this year than it did ahead of the Legislative Elections in 2010 – and hell, we won that time!

Know hope…

Caracas Chronicles is 100% reader-supported.

We’ve been able to hang on for 22 years in one of the craziest media landscapes in the world. We’ve seen different media outlets in Venezuela (and abroad) closing shop, something we’re looking to avoid at all costs. Your collaboration goes a long way in helping us weather the storm.

Donate