Spot the Revolution

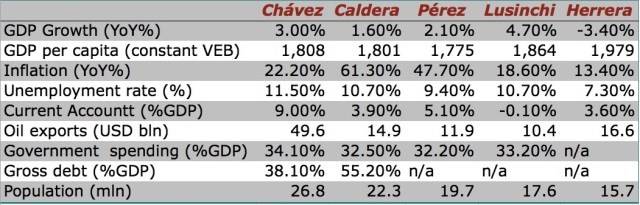

A neat Bloomberg chart puts things in context. (Numbers are averages for each president’s entire term in office.)

And note, here the yardstick is the crappy second half of the puntofijo era, not the relatively functional first half.

And note, here the yardstick is the crappy second half of the puntofijo era, not the relatively functional first half.

But the charts that best tell the story, though, are the two bullshit-bulldozers The Economist ran:

Despite an enormous oil boom

Poverty dropped only marginally faster than in the rest of the region.

Caracas Chronicles is 100% reader-supported.

We’ve been able to hang on for 22 years in one of the craziest media landscapes in the world. We’ve seen different media outlets in Venezuela (and abroad) closing shop, something we’re looking to avoid at all costs. Your collaboration goes a long way in helping us weather the storm.

Donate