García Mora vs. F-Rod

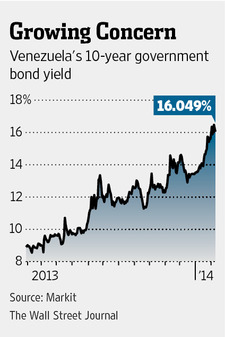

Quico has been talking about how Bank of America’s chief Venezuela economist (and friend of the blog) Francisco Rodríguez sees the economy. In a nutshell, F-Rod believes an adjustment is well under way, one that will allow the government to survive financially in the medium term. If the market has yet to internalize this, then this is an opportunity for early-bird investors.

Quico has been talking about how Bank of America’s chief Venezuela economist (and friend of the blog) Francisco Rodríguez sees the economy. In a nutshell, F-Rod believes an adjustment is well under way, one that will allow the government to survive financially in the medium term. If the market has yet to internalize this, then this is an opportunity for early-bird investors.

Political analyst Luis García Mora sees things as quite the opposite. He sees Ramírez as not really empowered. In his latest column, he claims Rodríguez meets with Ramírez but fails to get the other side of the story, and he sees little hunger for pragmatism inside the government.

Instead, he paints a picture of a government very much at war with itself, where economic decisions are not made, where gridlock is the name of the game.

Hearsay? No idea, but I think it’s worth pondering what each side in this debate is saying before making up our own minds.

To be fair, it’s surprising that Jorge Giordani’s exit from key positions inside the government has not been accompanied by any significant shifts in policy. If there was ever a time for Ramírez to assert his “moderate” views on policy, it is now. But this has not really happened.

The money quote (sorry it’s so long, but García Mora is … not the best writer, imho):

“There are a few Venezuelans in international banking whom, for a tasty bond, will write and cash in on the Republic as they send out award-winning reports thanks to their connections in the high government: when people in the Finance Ministry call, they listen.

A month and a half ago, one of them brought (I am told) important institutional investors – bond purchasers from the US – into a meeting with Ramírez. In this meeting, the investors would get a feel for the real state of the economy, to know if they should buy Venezuelan bonds. What did cold, serious, intense Ramírez say to them? First off, “we made a mistake. The model has failed. State-owned enterprises have not worked out. The State has grown exponentially, at a huge cost. We are now paying for the consequences of these mistaken policies. We are going to begin giving back seized assets to people that have shown to be efficient in handling them. For example, the oil sector, and the seized farmers of the south of Lake Maracaibo. We will slowly begin compensating them for damages, and transferring the ownership of these companies to their rightful owners. And we are going to do this in agriculture, we will return seized lands to people that made them productive with their work.

Second: “We are going to a single, free and flexible exchange rate. This anomaly of having four exchange rates has brought huge amounts of corruption and an impressive growth in smuggling.”

Third: “On the topic of gasoline; part of it goes across the border at a huge cost for the country. The topic of gas prices for us means a $20 billion subsidy.

Other things were mentioned. Opening up the oil sector. Agreements with multinationals. An oil savings fund for Venezuelans, in order to lower the inflationary effect of oil booms.

The fellows heard all this and said “Done! The economic problems are going to be solved.” And they conclude this thanks to Bank of America, responsible for writing bullish reports on the Venezuelan economy.

In a matter of hours, though, Elías Jaua reacted: “Here? Return lands? To whom? These lands belong to the Republic!”

…

That is how decisions are made in the high command…

Ramírez’s announcements get weaker every day. This heightens the drama for the man responsible for setting up the meetings, the one they call “El Kid,” just like the closing pitcher.”

For what it’s worth, Fausto Masó (another heavyweight Sunday paper political analyst) seems to concur.

Caracas Chronicles is 100% reader-supported.

We’ve been able to hang on for 22 years in one of the craziest media landscapes in the world. We’ve seen different media outlets in Venezuela (and abroad) closing shop, something we’re looking to avoid at all costs. Your collaboration goes a long way in helping us weather the storm.

Donate