The Diosdado Trade

As Diosdado Cabello meets Wall Street investors, Venny bond prices rally. What’s going on? No one is sure, but word on the Street is that the PDVSA re-profiling is basically a done deal.

Last Friday afternoon, El Mundo reported that Diosdado Cabello, the infamous President of the National Assembly and right hand man of the late Hugo Chávez, met with foreign investors on a Venezuela roadtrip sponsored by BofA’s Francisco Rodríguez, and including representatives from Ashmore Group, Marathon Asset Management and Emso. The pictures of Cabello looking all Wolf-of-Wall-St. were quite a sight.

But then, things went funny. We had a sudden, sharp rally in VENZ paper – and not on the short-end stuff that’s been the market darling all this year. Benchmark VENZ 22s led the buying spree, even as the fundamentals suggested investors should’ve been running for the exits, with oil prices tumbling even farther as the Central Bank published a horror-film Balance Sheet. Why on earth were investors running into a sinking ship? Why were they buying up paper that matures well into what weeks ago we were assured would be the default years? What exactly did Diosdi say to FRod and friends?

Given the principals, it’s no surprise that there was little of substance made public about the outcome of this “strongly positive” exchange. Nevertheless, reading between the lines and catching cues from the Venny money flow, our guess is that that PDVSA debt reprofiling that Eulogio del Pino started talking about a few days ago is now – how to put this? – God given.

When you think about it, it’s quite remarkable that these high powered investors didn’t meet with high-ranking Finance Ministry officials, or even PDVSA people for that matter. Instead, they made a beeline to meet a político who, in theory, has little else going on besides chairing the National Assembly – a gig he is projected to lose next December 6th by a wide margin. We all know who the clowns are and who the circus ringmaster is, but normally some sense of decorum prevents these things from being done quite so openly.

From the get-go, there was no doubt this investor trip to Caracas was more…political. What the media did not post – since no picture came out of it – is that investors also met opposition leaders (or so market gossip says). Clearly, December 06 elections are a tipping point in the Venezuelan bond market, and big Wall Street fishes want to be one step ahead of whatever political outcome flows out of an opposition victory – yes, most of them expect the oppo to win but fear tense political confrontation derived from such scenario. Remember the como sea?

It’s also a bit suspicious how well-timed this El Mundo PR perlita turned out for Diosdado: as he hosts a feel-good group shot making the rounds around the world, President Maduro was killing everyone’s buzz on Live TV announcing hard currency income has shrunk by two-thirds and that the Venezuelan oil price collapsed to a new 6-year low of 34,25 $/bbl.

More puzzling (or perhaps more telling?) the bond markets welcomed the headlines with a furious rally: VENZ and PDVSA paper rose 10% in average during the week – as some market actors already knew bajo cuerda about these meetings since last Friday -, with the long end (i.e. the kinds of bonds that had been shunned by Wall Street all year long) outperforming the short-end, which barely rose.

What this means in criollo newspeak: The first-in-line bachaqueros suddenly realized that there might be enough goods to get the party going a little longer, so they sold their very expensive spots to buy some farther away at a much lower price. Common sense and financial theory dictates that this only made sense to them if there’s something they do know (that the common folk doesn’t) that’s boosting the shop’s ability to keep giving away goods and that is not yet reflected in the price of the spots in line.

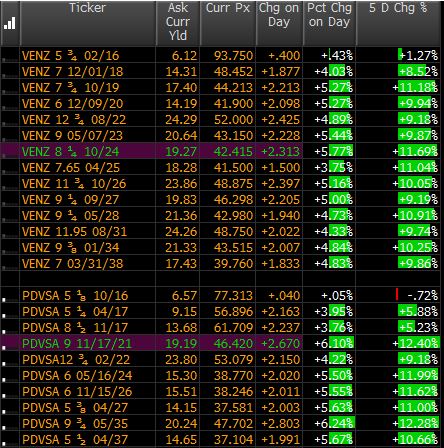

Prices are indicative mid-point levels as of Nov 20th; Source: Bloomberg. Note how VENZ ’16 and PDVSA ’16 (the ‘first in line’ bonds) missed this rally.

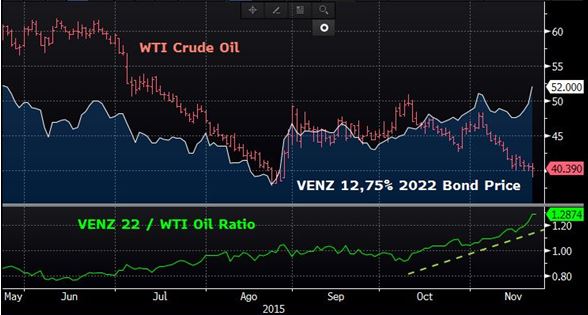

The strangest part of this move was its total disconnect from fundamentals. Foreign Reserves are at a precarious $ 14,61 Bn., their lowest since early 2003. What’s more, the Central Bank’s own Financial Statements show an uglier picture under the hood, with a lot of creative accounting and mark-to-market gymnastics behind the Reserves number. And strangest of all, the apparent breakdown of the connection between oil and Venny bond prices:

Prices are indicative closing levels over the last 6 months; Source: Bloomberg. The V22/WTI ratio, a measure of relative movement between the two assets, shows extreme strength in VENZ bonds unmatched with the weakness of crude oil since early October.

Considering all this, it seems like El niño Jesús (or rather Wall Street) will give Eulogio Del Pino the Christmas present he asked for: the Re-profiling of PDVSA short-term bonds.

There’s no other way to explain why the market went suddenly crazy for the longest-dated portion of CCC-rated junk, right at the moment where all the key variables suggest these bonds should be worth pennies on the dollar. There is somebody who’s obviously very happy with the headlines, though: lil’ Diosdi was pilas enough to grab the political reward in a time where he could really use some to avoid losing his job.

Caracas Chronicles is 100% reader-supported.

We’ve been able to hang on for 22 years in one of the craziest media landscapes in the world. We’ve seen different media outlets in Venezuela (and abroad) closing shop, something we’re looking to avoid at all costs. Your collaboration goes a long way in helping us weather the storm.

Donate