Bullish on chaos

There's a storm brewing in our country, but in VennyLand…everything is Awesome!

Why on earth would Venny bonds being going up now? As Caracas Chronicles readers, you of all people don’t need reminding that the country is a mess.

And not just in general, but especially right now: the launch of the recall referendum drive on President Maduro; a Guri Dam that’s days away from collapse; riots ending with military deployments in cities like Maracaibo, San Francisco, Maracay and even Caracas. Minister Jesús Farías caught on primetime TV saying the government ran out of dollars; the economy grinding to a halt with five-day public sector weekends. Our crude oil basket selling at a 25% discount to WTI crude oil futures, as the “Big Four” oil service companies’ won’t keep extending credit to a visibly broke customer; and an overwhelming sense of chaos looming over the country…

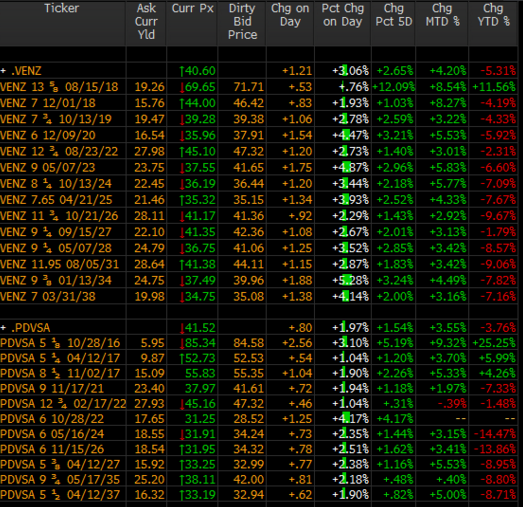

And yet, Venny bonds are just loving it! VENZ and PDVSA debt is posting total returns of +4,5% on average month-to-date, three times the average for Emerging Market bonds for the same period. Some of the usual trends are showing again: Short-end bonds are topping the charts in yearly performance, and bond salesmen are dusting off their pitch about the Bachaqueros of Wall Street.

Some folks are pointing at rising oil prices, coupled with a benign context in global markets, to justify recent gains. But as we said, the icky stuff we’re producing nowadays is way below international benchmarks, and financial markets have a nasty tendency to get wild way too often, like today in Japan.

It seems that, to be profitable in the Venny market of today, you need to be either under sensory deprivation, blissfully ignorant of the endless pile of negative headlines; or just plain dead inside. In this market, you have to throw away all economic and moral considerations regarding the nation’s debt crisis, and buy into the same-old rumours of alleged government buybacks in the PDVSA short end for a quick, somewhat predictable buck.

Just goes to show: total devastation is no bar to your neighbourhood friendly bond hawk!

Caracas Chronicles is 100% reader-supported.

We’ve been able to hang on for 22 years in one of the craziest media landscapes in the world. We’ve seen different media outlets in Venezuela (and abroad) closing shop, something we’re looking to avoid at all costs. Your collaboration goes a long way in helping us weather the storm.

Donate