Pa' Que Cuadre Chronicles: A Tour of PDVSA's 2015 Financial Statements

We dive into the fine print so you don't have to.

This week, PDVSA released its full, 128-page long Financial Statements for 2015. Excited? We were! So excited we devoted some quality time digging through the mud and the fine print, so you don’t have to.

Some of what we find is…the kind of thing you’d rather hear after taking a seat, with a glass of rum in hand. Wicked stuff. But let’s start with the vanilla bits:

Production levels

PDVSA reported a total production of 2,863,000 barrels per day (b/d) for 2015, down from 2,899,000 b/d in 2014. A mild 36,000 b/d drop over the span of one year. Doesn’t sound that bad, except, those 36,000 b/d represent $586.7 million at 2015’s average Venezuelan oil price.

Now, would you take an oil production figure from these people at face value? OPEC, for one, says our country was producing 2,357,000 b/d in 2015, and as of June of this year the figure dropped to 2,095,000 b/d – a staggering 262,000 b/d free fall in 6 months. This is the lowest output since the early 90s (if the 2002-2003 oil strike is not considered), and we would need another rum to go with the loss in US dollars.

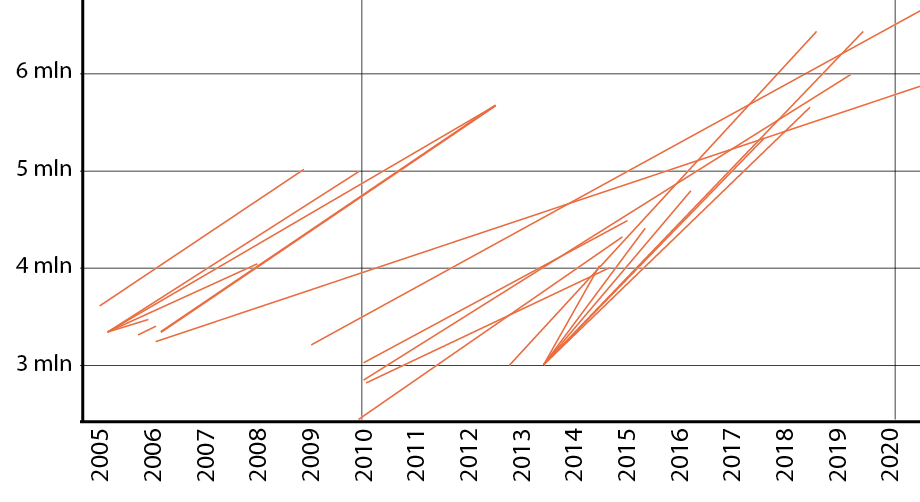

PDVSA’s longer term production performance is abysmal. Back in 2005, the company announced its “Plan Siembra Petrolera” (breathe, Amanda) to raise production to 6 million b/d by…2012. OK, that didn’t work out so well. In fact, the company’s targets have been missed and re-set so often, it’s all become a bit of a joke. A while back, Friend-of-Blog Setty made a fun chart of all the ambitious production targets PDVSA has announced…then missed.

Hope springs eternal…

It’s not funny, though: according PDVSA’s own data, we actually produced 350,000 b/d more back in 2005 than we did last year. Jeez.

Costs

And there’s something even funnier than that: PDVSA’s average cost per barrel. Back in 2013 it stood at $11.40 in 2013, then it jumped to $18.05 in 2014, then collapsed to $10.68 last year. Huh?

How convenient that PDVSA is able to reduce costs by 44% just as oil prices dropped by more than 50%. Is it a miracle? A herculean feat of cost-cutting? A work of the pachamama puking oil to help our people fight the oil price war? Of course not.

The Prime Directive is, ‘when something doesn’t seem to make sense, think exchange rate shenanigans’. Sure enough, the weighted exchange rate PDVSA uses to massage its balance sheet accounts for much of the weirdness. At a glance it makes sense to do it this way because PDVSA disburses expenses in both currencies, and exchanges dollars with the Central Bank at whatever official exchange rate depending on the origin of the greenbacks – exports or financial sources.

So, if something cost Bs1,000 in 2014, it got booked as $48 (Bs/USD 20.8 weighted rate), and $14.6 in 2015 (since the weighted rate had slid to Bs/USD 68.70). So those local currency expenses don’t mean that much.

Bachaquerismo contable, pues.

These rates are PDVSA’s weighted average rate in which the company exchanged dollars to the Central Bank. Sadly, there’s no detail in the report to allow us to double check it.

Making BCV Eat PDVSA’s Junk

The deeper you get into the weeds in the Estados Financieros, the crazier the critters that jump out. On page 39, we find this for-the-ages Accounts Receivable note:

In the second half of 2015, PDVSA transferred IOUs (pagarés) to the Central Bank (BCV), owed by Nicaragua and El Salvador on Petrocaribe oil exports. In total, PDVSA reported a financial income of $8.0 billion from these transfers to the BCV. At face value, this represents half of the total financial income of the company for 2015, valued at $16.83 billion. But what’s behind it can rather be one of PDVSA’s worst businesses in years:

We sat there and sort of scratched our collective heads over this one for a good long time.

As best as we can make out, what it means is that PDVSA had been sitting on a bunch of IOUs from Nicaragua and El Salvador without an easy way to turn them into cash. PDVSA could’ve tried to sell them on the market, as it did with the Dominican Republic IOUs, but it would’ve gotten pennies on the dollar. So somebody at PDVSA had a much better idea: why not shove this paper off on the BCV?

Here’s the detail, though: it looks like PDVSA didn’t get a dime from the BCV for the paper. What it got, instead, was lochas. Lots of them.

If BCV had handed over actual dollars, that would leave a paper trail. But dollar outflows of this size are nowhere to be found in BCV’s International Reserves records for the second half of 2015.

Our guess, in fact, is that BCV seems to have printed up fresh bolivars to purchase these IOUs from PDVSA.

To double check, we went to BCV’s monthly financial statements for 2015.

The month-on-month increases in the account named “Public Securities in Hard Currency” between August and October more or less matched with the numbers and time frame provided by PDVSA related to the IOUs transfer.

In criollo, for every Bs.100 banknote out there in October 2015, a fresh Bs.2 was printed to pay for PDVSA’s junk IOUs.

And there’s something I have not mentioned yet: the nominal value of the IOUs (the money that Nicaragua and El Salvador actually owe) reported by PDVSA is $4.3 billion. But the financial income from their transfer to the BCV was reported at…$8 billion!

Is it me, or did PDVSA inflated the price of the IOUs to get more bolivars?

This is all terrible, terrible accounting practice, but the victim here isn’t PDVSA, it’s the Central Bank. For the BCV’s balance sheet, these bond shenanigans mean two things: fire and ashes.

Artistic representation of BCV’s Balance Sheet

PDVSA is loading up their assets column with paper you probably can’t collect on, and it’s that assets column that backs the value of BCV’s liabilities…a.k.a., the money in your wallet.

We’d be more confident that Venezuela isn’t heading towards hyperinflation if the government would stop implementing the kinds of policies that consistently drive countries into hyperinflation.

PDVSA’s Metamorphosis from Oil Company to Off-Budget Spending Vehicle

But where did all that money go? It’s a bit puzzling, considering that PDVSA reported huge cuts in costs for both operations and administration. Well, it went to the one bit of its expenses that did increase last year: social contributions.

PDVSA says it spent the equivalent to $9.2 billion in social programs during 2015 ($8.2 billion in direct contributions made in bolivars and $974 million in hard currency contributions to FONDEN), such as Gran Misión Vivienda Venezuela, PDVAL, PD-MERCAL, and others, compared to $5.2 billion in 2014. That’s what those elections in December cost, I guess.

PDVSA has been directly financing the bulk of misiones for five years now (what is this “unidad del tesoro” sorcery you speak of?!) For instance, if you check 2011’s and 2012’s balance sheets, you find PDVSA social contributions netting the equivalent to $52.9 billion between both years. That’s Bolivia’s and Hondura’s combined nominal GDP.

Chinese Whispers

You may also wonder what happened with China and all those thousands of oil barrels sent to compensate Chinese financing.

PDVSA sent 579,000 b/d to China: that’s more barrels than those we sent in 2014 (472,000 b/d), but of course those barrels weren’t worth as much as they did in 2014 – $14.4 billion in 2014 vs $8.4 billion in 2015.

With China getting more and PDVSA producing less, the ax had to fall somewhere. Here, we get to see the government’s real priorities.

Who bore the brunt? Latin America and the Caribbean. The volumes sent under energy cooperation agreements tumbled from 255,000 b/d in 2014 to 185,000 b/d in 2015. Hell, Raul Castro already said so.

There was also a cut in local consumption, which went from 647,000 b/d in 2014 to 580,000 b/d 2015. That’s one hell of a recession. In a glimmer of good news “unrecovered net costs and expenses” (newspeak for “the damn gasoline subsidy”) dropped to $7.7 billion in 2015, from $16.1 billion the year before.

Just compare that “unrecovered” amount for 2015, to the $7.3 billion reported as profit the same year. It’s a rabbit hole, and February’s subsidy cut is not likely to cover it.

There’s a lot more to see, but the tour has to end somewhere. Perhaps here:

El Voldemort de Bariven

“Pdvsa does not tolerate corruption”. That is what it says in note 32, which refers ever so obliquely to the story about an accusation against some representatives from certain contractors regarding certain law violations about corruption and money laundering that happened from 2009 to 2014, and the fact that some former workers from an international subsidiary were indicted and plead guilty in Texas. It’s worth citing the thing, because it’s just kind of funny.

En diciembre de 2015, la fiscalía para el Distrito Sur de Texas, División de Houston, en Estados Unidos de América, presentó una acusación en contra de representantes de ciertas empresas contratistas y proveedores de PDVSA, por ciertas violaciones de leyes anticorrupción y contra el lavado de dinero, entre otros cargos, en relación con contratos de procura internacional de bienes y servicios conexos celebrados con una filial de PDVSA, durante el período comprendido entre los años 2009 y 2014. Adicionalmente, ciertos extrabajadores de una filial extranjera de PDVSA fueron acusados por los mismos hechos. Todos los acusados se declararon culpables en diferentes oportunidades procesales, entre finales de 2015 y junio de 2016.

PDVSA no tolera actos de corrupción y continuará investigando y actuando con el propósito de determinar responsabilidades sobre los hechos identificados.

La investigación está en curso y hasta ahora ha permitido identificar asuntos de interés tales como: Confirmar que la Compañía ha sido víctima de fraude en su proceso de procura internacional de bienes y servicios conexos.

The superstitious unwillingness to use actual names is kind of hilarious. Grow up, dudes. His name is Roberto Rincón and he’s guilty as sin. He said so himself!

Not in EEFFlandia, though. The company insists it was a “victim of fraud”. But fear not, they are investigating and building up new controls. Whew, we can sleep easy at night now.

Caracas Chronicles is 100% reader-supported.

We’ve been able to hang on for 22 years in one of the craziest media landscapes in the world. We’ve seen different media outlets in Venezuela (and abroad) closing shop, something we’re looking to avoid at all costs. Your collaboration goes a long way in helping us weather the storm.

Donate