The Financial Industry: No Longer an Exception

Until relatively recently Venezuela's financial sector floated above the maelstrom of economic dislocation all around. But the economic crisis now engulfing Venezuela is now so big, it’s no longer possible to escape unscathed. Here's why you should care.

Until relatively recently Venezuela’s financial sector floated above the maelstrom of economic dislocation all around. But the economic crisis now engulfing Venezuela is now so big, it’s no longer possible to escape unscathed. Why should you care? Because if, say, the non-alcoholic beverages sector tanks, well, that’s bad for the non-alcoholic beverages sector. But if the financial sector tanks, we’re all on the hook.

For several years, the sector had been one of the brightest spots in the GDP figures. The streak got going in the fourth quarter of 2010 — from then, banking and finance saw 18 straight quarters of growth, including 14 straight at double-digit rates. While the country sank into recession in 2014, the financial sector rode a wave of expanding money supply and increased its lending to continue posting growth for five more quarters. Five!

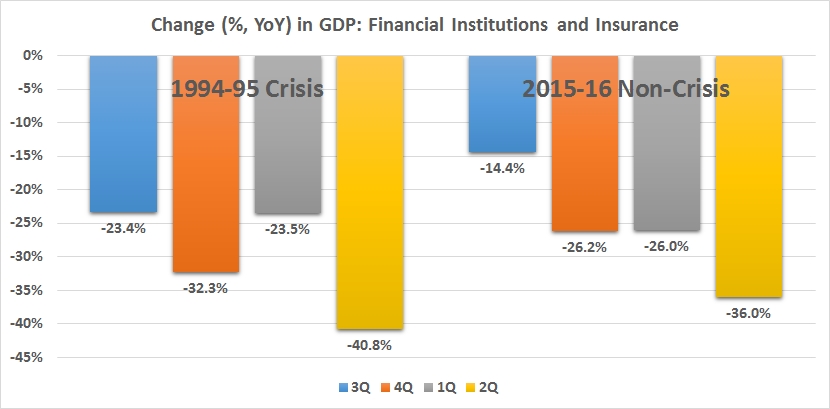

To put these numbers into perspective, the 36% contraction would be the second largest in modern Venezuelan history for the financial sector.

Things turned south in the second quarter of 2015, and the sector began shrinking at an increasingly rapid pace in the last three quarters of last year: by 10.3%, 14.4% and a chilling 26.2%, respectively.

The government hasn’t released GDP figures for 2016, yet. To fill that void, Ecoanalitica’s Carlos Álvarez estimated on how the financial sector fared during the first half of the year. His estimates were included in a note to the firm’s clients in August. Álvarez estimates that the sector shrank by around 26% in the first quarter of 2016, and by 36%, year-on-year in the second.

To put these numbers into perspective, the 36% contraction would be the second largest in modern Venezuelan history for the financial sector, only surpassed by the 40.8% contraction posted in the second quarter of 1995. The fact that we are close to the 1995 number is worrisome: back then, the financial sector was still reeling from the devastating banking crisis that began in early 1994.

If we plug Ecoanalitica’s estimates for the first and second quarter of 2016, we see that during the last twelve months the GDP of the financial sector could be shrinking remarkably like the worst period of the 1994-95 crisis:

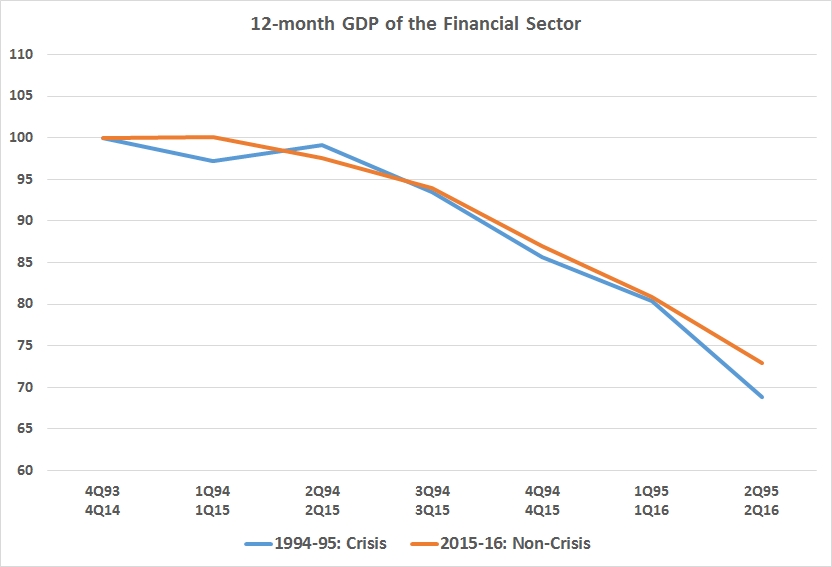

We can also look at it another way, constructing an index for the 12-month GDP of the financial sector of each period. The blue line in the graph below is for the banking crisis, and starts with the twelve months of 1993, normalized to 100. The orange line for 2015-16 starts with the twelve months of 2014, normalized to 100. In both cases, for each quarter we use the GDP of the preceding twelve months.

We can also look at it another way, constructing an index for the 12-month GDP of the financial sector of each period. The blue line in the graph below is for the banking crisis, and starts with the twelve months of 1993, normalized to 100. The orange line for 2015-16 starts with the twelve months of 2014, normalized to 100. In both cases, for each quarter we use the GDP of the preceding twelve months.

Again, we include Ecoanalitica’s estimates for the first two quarters of 2016.

During the 18 months between the start of the banking crisis in early 1994 and the second half of 1995, the financial sector’s GDP shrank by 30.6%. In the last 18 months after July 2015, it could have contracted by around 25.3%.

During the 18 months between the start of the banking crisis in early 1994 and the second half of 1995, the financial sector’s GDP shrank by 30.6%. In the last 18 months after July 2015, it could have contracted by around 25.3%.

The similarities should not be taken as a sign that we are necessarily heading into a financial crisis.

The similarities should not be taken as a sign that we are necessarily heading into a financial crisis.

Regulations and economic conditions now and then are very different, and banks in 1994 were under a different kind of stress than banks today. Plus, there’s still time to right the ship.

It’s nonetheless alarming that the financial sector is posting results we have only seen before in our country during the height of a crisis that wreaked havoc in that sector and in economy as a whole. Between 1994 and 1995, 59 Venezuelan financial institutions closed and 16 were nationalized, out of a total of 168. Around 54% of bank deposits were held in these institutions.

The End of the Liquidity Party…or just a pause?

There are several factors bringing down the financial sector today. It had been enjoying such a good streak thanks in no small part to the expansion of the money supply in recent years, as the government turned up the printing presses to eleven to finance its deficit. Flush with deposits, banks could loan more money and the credit portfolio kept growing at steady pace in real terms, fueling the growth of the sector.

But as we’ve written before, under Perez Abad’s direction, the government tried to restrict liquidity in order to bring down the black market exchange rate and try to put a lid on hyperinflation. The rate of money growth, which had been on an upward trajectory, leveled at around 100% YoY in 2016. With inflation running much higher than that, the real value of the bolivars going around has decreased drastically.

One place you can see the effect of this policy in the size of the credit portfolio of banks. In real terms, the amount of credit extended by banks has plummeted, even if nominal lending still grows. The point is that if before they were loaning enough to build ten buildings, now they can only loan for five.

The Central Bank’s refusal to acknowledge that inflation exists by yielding to common sense and issuing higher-denomination bills is costing the banks a lot of money.

This is just the newest predicament for banks. For several years they have been operating under what economists term “financial repression”, which stands for government regulations that hinder the functioning of banks and the flow of funds.

One of the many examples of financial repression in Venezuela is the ceiling on interest rates far, far below the rate of inflation. Put Bs.100 in a CD at a Venezuelan bank and at the end of the year you’ll have Bs.125, but at the end of the year, what you used to be able to buy for Bs.100 you’ll need Bs.500 (or 6, or 700, depending on whose estimate you believe).

That’s financial repression: it’s a tax on lenders and an incredible manguangua for borrowers. In particular, for the country’s overwhelmingly dominant borrower: the government.

Thanks to these ceilings, real interest rates are negative, which is great for borrowers (and the government), but imposes limits on how a bank can handle a crisis. On top of that, regulations are not enforced equally to all banks, with public banks enjoying more leeway than private ones.

To make matters worse, the government and the Central Bank’s refusal to acknowledge that inflation exists by yielding to common sense and issuing higher-denomination bills is costing the banks a lot of money. Since people now need tens of the highest denomination bills to pay for everyday stuff, they are going to the ATM a lot more frequently. The same Ecoanalitica note mentioned above reports that between 50% and 70% of the expenses of the bank’s branch offices is spent on replenishing the cash in the ATM. Let that sink in for a minute.

It’s been a great year for the armored transportation companies.

Even a mild financial crisis is no picnic, but in the apocalyptic Venezuelan economy any crisis could have serious and wide-reaching consequences.

One of the first issues that come to mind is the loss of savings if banks are allowed to go bankrupt. Luckily –or unluckily, depending on how you look at it– no one saves in bolivars any more.

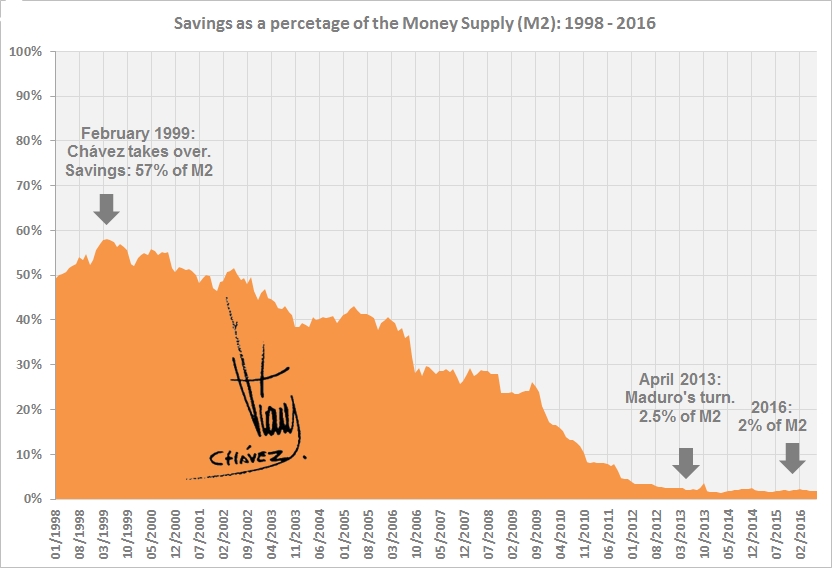

Whatever savings people had, they have moved them to tangible assets or foreign currency, or invested them in real assets like apartments or cosmetic surgeries, long ago. Chavismo made certain of that. When Chávez arrived in 1999, savings accounted for 57% of the money supply. He passed the baton to Maduro at roughly 2.5%, and it’s currently hovering around 2%.

Financial crisis are associated with deep contractions in output, from which it can take years to recover.

Even if the banks are rescued on the event of a crisis and no one loses their deposits, the cost of the rescue could be staggering. The bailouts dished out by the government and the Central Bank in 1994 amounted to 13% of the country’s GDP.

Financial crisis are associated with deep contractions in output, from which it can take years to recover. From its peak in 1993, Venezuela’s GDP dropped by 6.9% at the nadir. They are also associated with employment losses, downturns in the real estate market, increases in government debt, diminished tax revenues, and higher budget deficits.

And that’s in economies that are otherwise healthy. Imagine the effect on an economy already in the gutter, like ours.

Since our government is out of money, any bailouts would undoubtedly come straight from the printing presses, pouring gasoline on the already raging inflationary fire. That’s the same place from where most of the 1994-95 bailouts came, and that goes a long way in explaining the high inflation of the those and the following years.

We would all pay for the bailouts via the inflation tax.

There might be some good news for the banks in the near future. Perez Abad is gone, and it looks like also gone is his policy of restricting liquidity, with the monetary financing of PDVSA picking up steam in the past weeks. Bad for us, good for the banks.

One of the most pressing issues are the low ceilings in the interest rates, and Maduro might have obliquely alluded to a change in policy when he talked about new incentives to savings last month. Allowing banks to charge and pay higher interest is an absolute necessity for them to weather the storm before and during any future adjustment plan, or the lifting of exchange controls.

These timid measures might be enough to take banks back from the brink, without actually taking aim at the root of the problem.

Caracas Chronicles is 100% reader-supported.

We’ve been able to hang on for 22 years in one of the craziest media landscapes in the world. We’ve seen different media outlets in Venezuela (and abroad) closing shop, something we’re looking to avoid at all costs. Your collaboration goes a long way in helping us weather the storm.

Donate