Panic on the Streets of Vennyland

Investors in Venezuelan debt were already nervous over the upcoming April 12th maturity. The TSJ power grab sent them into panic-selling mode and set the stage for a weekend of uncertainty.

The weeks in the run-up to bond principal repayments are always volatile in the Venezuelan bond market. For an issuer under such a big question mark, these big amortizations are the center of attention for dedicated investors. Uncertainty over capacity to pay and intrigues over actual willingness to honor debts feed an unstoppable rumor mill and generate a sizeable pick-up in trading activity ahead of the big dates.

Now that the political impasse was turned up to eleven with the unprecedented Supreme Tribunal decision to take over the functions of the National Assembly, a whole raft of new unknowns entered into an already pretty crowded stage.

In the last couple of weeks, market watchers have been increasingly focused on the repayment of PDVSA bonds due in April 12th (to the tune of USD 2,057mm plus interest) and have gotten nervous due to the recent fall in oil prices and several worrisome signs of the company’s operational difficulties.

The payment itself was a good reason to be nervous on Wednesday. But panic set in on Friday among the Venny community. Now that the political impasse was turned up to eleven with the unprecedented Supreme Tribunal decision to take over the functions of the National Assembly, a whole raft of new unknowns entered into an already pretty crowded stage.

What is the Maduro administration looking for with this reckless play?

Does this have to do with the Government’s apparent difficulties in sourcing external financing, given the National Assembly’s determination to inform any potential source of financing that any new agreement signed without its consent is illegal?

Is the balance of powers within the government shifting towards a group with a different view regarding external debt?

Will the external backlash force Maduro & Co. to backtrack on the AN invalidation?

Why are they doing this right before such a sensible moment for the country’s external finances?

You know what happens when events are inflamed to a point where the whole situación país gets out of control? Blood runs on the Street. Bond trading was already pretty heavy throughout the past few days, but nothing like Friday’s session. What a crazy day! Quick recap of just the first few hours, as told by my day’s chat log:

08:15 am. Traders greet each other with a ‘good morning’.. Bonds were already down over -1pt. Venny is front page news for the WSJ and FT over the TSJ power grab. Analysts sent reaction pieces discussing implications for the Govt in terms of internal and/or external backlash. Some callous analysts are dismissing the noise and calling to ‘buy the dip’.

09:00 am. The avalanche of selling continues. Bonds are now -2pts. Nobody seems willing to bid paper and the broker-dealers are updating their indicative levels lower and lower. Se prendió esta mierda.

09:30 am. Climax of panic-selling. Some bonds trade as low as -4.5pts on the day. Everybody’s worried and scrambling to get out of the risk. Shoot first, ask questions later.

10:00 am. Some demand finally seen in the market and bonds start to firm up. PDVSA ‘low-dollar value’ bonds, which traded as low as a 33-handle, start to get bid up.

11:00 am. The market is starting to change its tone. Reports of street protests in Caracas and the surprising denouncement of a rupture in the constitutional thread by Luisa Ortega Díaz seem to be changing market sentiment somewhat. Bonds start to inch higher and volumes pick up.

01:00pm After several hectic hours of trading flows being to stabilize. It seems as everybody has already squared their positions ahead of the weekend. An uncanny sense of calmness returns to the market, although bonds are set to close session -2 to -3pts lower on the day, sometimes not off the lows..

God only knows what would’ve happened if that story had hit during trading hours.

Mind you, that was just the first few hours, but it gives you a sense of the kind of day we had. People were nervous.

The rest of the afternoon was similarly mad. But it was a Friday, so most Wall St shops were closed by 3pm.

At 6:12 p.m., this explosive Reuters’ report quoting unnamed government sources saying PDVSA is negotiating financial help from Rosneft to pay the April maturities came out. God only knows what would’ve happened if that story had hit during trading hours.

I thought I’d have a bit of time to digest that report make sense of what happened. But this is Venezuela: things don’t stop.

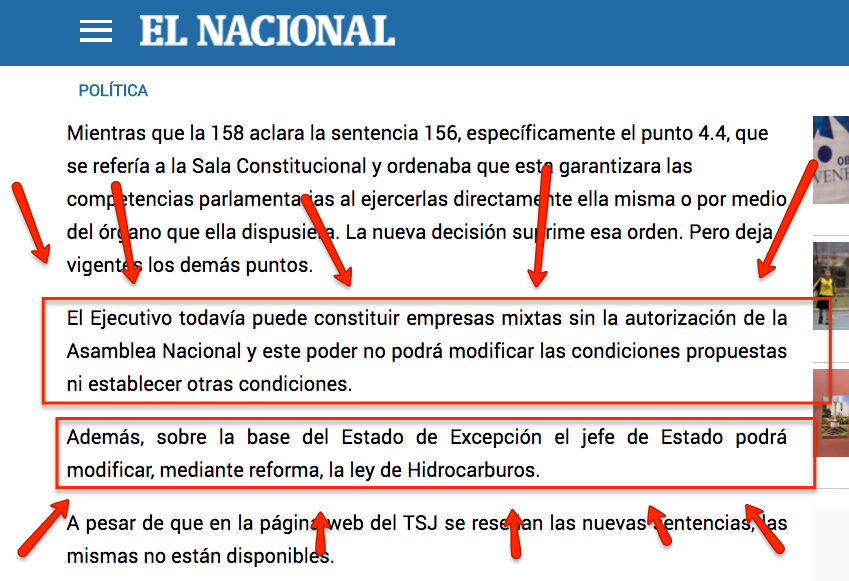

Late Friday night, the never-before-heard-of Defense Council of the Nation met to try to solve the “impasse” between the Prosecutor General and the Tribunal. At the meeting, which neither the Prosecutor General nor the head of the National Assembly attended, Maduro urged the Supreme court to review Decisions 155 (related to the opposition’s request for applying the OAS’s Democratic Charter, which the TSJ sought to retaliate by stripping MPs from their parliamentary immunity) and 156 (which they used to give the president the authority to sign agreements in the context of the Hydrocarbons Law without parliamentary approval, and themselves the power to act as a National Assembly ‘de mentirita’.) .

And, this morning —surprise!— the Tribunal withdrew the most incendiary aspects of Article 156 granting itself all of the Assembly’s powers but kept the provisions allowing the president to unilaterally alter the Hydrocarbons Law even though he has no enabling powers to do so.

Caracas Chronicles is 100% reader-supported.

We’ve been able to hang on for 22 years in one of the craziest media landscapes in the world. We’ve seen different media outlets in Venezuela (and abroad) closing shop, something we’re looking to avoid at all costs. Your collaboration goes a long way in helping us weather the storm.

Donate