Chronicle of a Currency Crisis Foretold

The value of the bolivar is collapsing at a frightening speed amidst a hard-currency crunch and disastrous FX shenanigans. Tipo: normal.

Art by José León @lion_mix

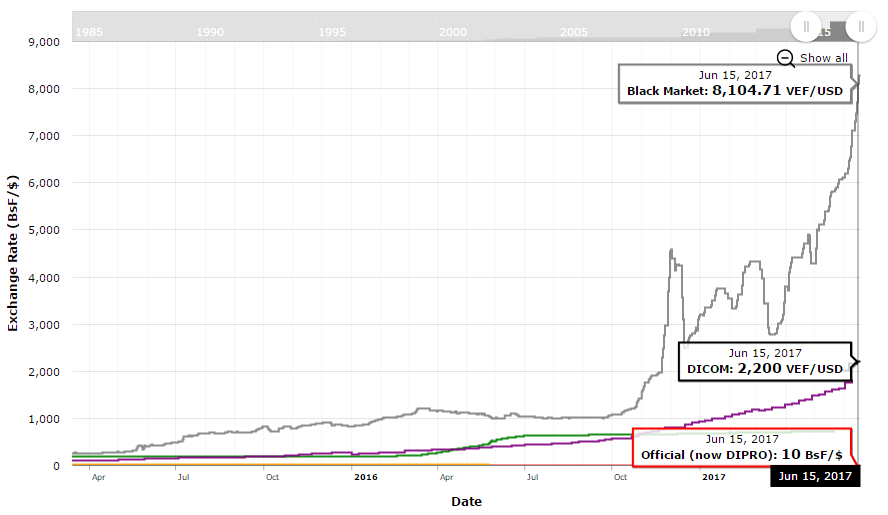

Brought to you by the letters W, T and F… (Source: https://www.venezuelaecon.com/)

As the nation finds itself staring into the abyss of Constituyente-geddon, uncertainty over the future is as intense as ever. In this context, the bolivar is screaming of major chaos coming ahead. The price of a US dollar has spiked violently in the past days and closed last week above the Bs. 8,000 mark for the first time, according to the Home Depot clerk who has the country by the bucks. Prices are ripping higher by several hundred bolos every day, pushing to infinity and beyond, or the Bs. 10,000 mark. Whatever comes first.

What a beautiful time for a currency crisis!

Omens of doom

None of the messed up stuff happening to our poor bolivar should have taken us by surprise. The signs of the impending collapse were there all along. We’ve been keeping tabs on them for a while.

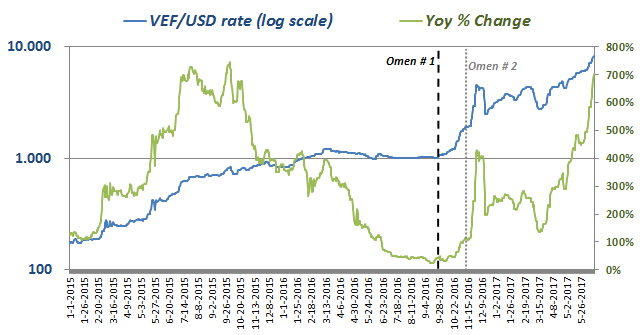

Back in September of 2016, we covered Omen # 1: Maduro & Co. decided to switch the monetary policy regime into full-blown money bazooka mode. Coupled with the ugly trajectory of the government’s fiscal balance at the time and no signs of change in the political front, our verdict was crystal clear: the bolivar’s gonna get pummeled.

None of the messed up stuff happening to our poor bolivar should have taken us by surprise. The signs of the impending collapse were there all along.

A couple of weeks later, as liquidity flooded the country’s money markets and the black market rate took off to never look back, we wrote about Omen # 2: the reason behind the monetary about-face was a hole in the public budget that the government sought to cover with a boost of cheap credit. In essence, the banking sector liquidity freed up by the Central Bank was forcefully directed towards mega-sized bonds issued by Bandes and Fondo Simón Bolívar (two colossal entities with the power to spend literally trillions of bolivars with zero accountability). Huge red flag; huge. We reiterated our somber view on the local currency and braced for the worst.

Some I-told-you-so’s bring you no joy. The price of the dollar in bolivars has jumped eightfold in the past year and nothing suggests that the trend is going to reverse soon. Looking at the historical chart, we can see that the dollar was pinned down at the 1,000 bolivar mark for several months in the midst of a dramatic decline in the rate of depreciation. All it took was a change of mind in the monetary policy regime to break the de-facto currency peg and set the foreign exchange demons loose.

Prices (in log-scale) and Year-over-year rates of change in the VEF/USD parallel market rate. Source: Dolartoday.com, own calculations.

Having said that, we are not alone in our view. Save for the occasional Twitter troll, there’s more or less a consensus on the ins-and-outs of the foreign exchange mess. UCV Professor Leonardo Vera recently published an amazing paper synthesizing this consensus view in the context of the latest years of chavista/madurista economic (mis)management. In summary, we tested positive for all the currency crisis warning signs a long while ago:

- Real appreciation of the currency, which destroyed the competitiveness of the non-oil local industry? CHECK

- Stubbornly keeping a fixed exchange rate with persistently-high inflation? CHECK

- Shock in the country’s terms of trade (in our case, a crash in oil prices)? CHECK

- Massive buildup in external debt? CHECK

- Equally-massive drawdown in liquid FX reserves? CHECK

- Increase in money supply relative to bank reserves? Self-inflicted CHECK

- Boom in domestic credit? CHECK

- Self-fulfilling cycle of inflation-depreciation? Well, duh. That’s what we’re living now.

Omen # 3: DICOM’s epic failure

Perhaps the most troublesome sign of the crash is that an old trick in the government’s book didn’t work at all this time. After several missed deadlines, the new DICOM was unveiled in late May. Just like the defunct Simadi and Sicad 2 systems, the mechanism was sold as the nemesis of the black market; unlike these two duds, though, there wasn’t even the slightest hint of a bounce in the value of the bolivar after starting up.

Local economists are pointing at the obvious: there’s not enough supply of dollars in the Central Bank’s coffers – not even at a dramatically weaker level of around 2,200 USD/VEF – and there will never be enough supply in the system for as long as the government insists on ignoring an inconvenient fact: holding Bolivars for anything other than consumption of local goods and services makes absolutely zero economic sense.

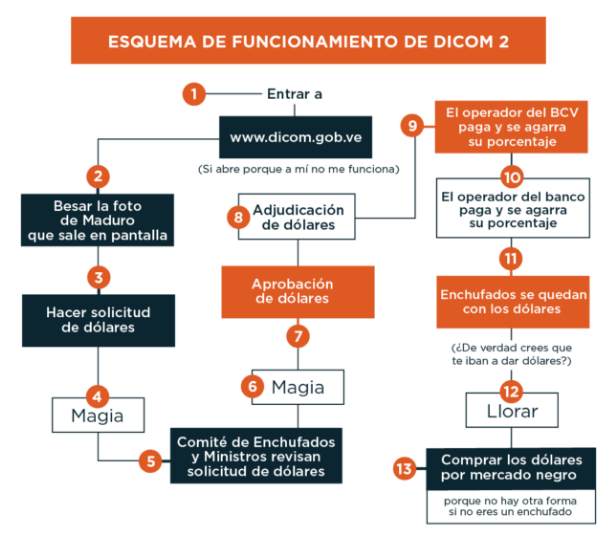

Of course, a cynic could also argue that the DICOM is flawed by design. The system shares three key elements with every single foreign exchange experiment of the Maduro era: inane bureaucracy to get into the game, a below-market clearing price of dollars, and ultimate discretion by the government on the allocation of dollars among participants. It’s the perfect cocktail for massive rent extraction through influence peddling and currency arbitrage, with zero intention whatsoever of bringing order to the foreign exchange market or benefitting the local industry.

You know things are messed up when satirical news outlet El Chigüire Bipolar has the most accurate flowchart of the new Dicom system to date…

“Did you think they were really gonna give you greenbacks?” Source: elchiguirebipolar.com

Bottom line, as long as there are multiple exchange rates, the situation will not improve.

Simple as that. Not even the Sala Constitucional can overturn the Law of One Price.

Caracas Chronicles is 100% reader-supported.

We’ve been able to hang on for 22 years in one of the craziest media landscapes in the world. We’ve seen different media outlets in Venezuela (and abroad) closing shop, something we’re looking to avoid at all costs. Your collaboration goes a long way in helping us weather the storm.

Donate