Picking through the Crazy in PDVSA’s Financial Statement

PDVSA’s financial statements for 2016 are in, and it’s all sorts of fun — if you’re into suffering and crying.

Is it possible that a company with $48 billion in revenues can’t keep the elevators running at its corporate HQs and can’t afford enough paper and printer-ink cartridges for their offices?

If you’re PDVSA, it is!

Venezuela’s battered-and-bruised public oil company published its 2016 consolidated financial statements late at night last Friday. The data was supposed to be published by the end of July, but PDVSA requested, and was granted, an extension until August 11th. It ended up being posted with less than 90 minutes on the clock to the deadline, like some partied out undergrad staggering to deposit a paper in a professor’s mailbox minutes before it’s due.

They had no choice. Any further delay may have triggered a default under the terms of PDVSA bonds, which require that the company releases its financials each year before June 30th, with a 30-day grace period.

As for the substance, everybody knew it would be ugly — the average price of Venezuela’s oil was barely over $35/barrel — but we didn’t imagine it this ugly.

The biggest tell is right at the front of the doc.: the signed report at the beginning. Normally, this section is always a precise couple of pages, but in this case, we get eight pages full of KPMG’s minutely-crafted warnings, caveats and explanations. This is very far from normal, and points to the delicate negotiations that must have gone into getting Mauro Velázquez, of Rodríguez, Velázquez y Asociados (the lead auditor for this statement, and KPMG’s local partner) to sign off on this thing.

Everybody knew it would be ugly… but we didn’t imagine it this ugly.

The eight pages of caveats are like a dystopian poem written in bureaucratese. You can tell the whole story of PDVSA through those caveats, if you’re able to read them forensically. Taken as a whole, they underscore just how difficult it’s become to characterize PDVSA as a going concern, which is fancy accounting slang for a company with no imminent risk of bankruptcy.

The warnings relate to the key issues that are drowning the company: the drop in oil prices and output, the numerous corruption scandals and the multitude of ‘related-party transactions’ undertaken between PDVSA and the Venezuelan government. These issues paint a picture of internal disorder so pervasive that it puts into question whether PDVSA is keeping the government afloat or vice versa. Or even worse, whether both entities are dragging one another into a shared abyss.

Let’s start with a Golden Oldie: the staggering gasoline subsidy, which — if these Financials are to be believed — cost the central government $5.72 billion last year. But wait, how did they arrive at that number? In fact, PDVSA requested a Bs.3.8 trillion unilateral transfer to the Oil Ministry, which was subsequently approved by the country’s vice president, according to Note #29 of the statements. Where did all those freshly minted bolivars go? To the dollar black market, it seems.

Revenue was down 33.5% from $72.2 billion in 2015 to $48 billion in 2016. Net income was down a staggering 88.2% from $7.3 billion to $0.83 billion. Oil output dropped 10% to 2.57 million barrels per day, from 2.9 million in 2015.

The financials confirm several parts of the explosive Rosneft story published by Reuters on Friday, which said the Russian company had prepaid PDVSA $1.49 billion for future oil shipments in 2016, with a collateral on 49.9% of Citgo’s shares. Also, on April 2017, Rosneft again paid PDVSA $1.02 billion in advance for future oil shipments. These schemes, devised in desperation to make ends meet, could severely compromise future cash flows for the company.

It puts into question whether PDVSA is keeping the government afloat or vice versa.

Why Rosneft continues to play ball is hard to fathom. Consider Note #24, which sets out all liabilities PDVSA has incurred with Rosneft. It includes two big prepayments which came in 2014 ($2 billion each, first in May, then again in November). PDVSA missed its grace period for servicing its obligations over those deals in 2016, which forced it to start delivering unspecified quantities of crude oil and “other products” to Rosneft’s subsidiaries, further reducing its share of cash-generating exports.

As of December 31, 2016, PDVSA had exchanged $1.37 billion of its outstanding commercial debt for promissory notes issued with a 6.5% interest rate, and a 3-year maturity. PDVSA’s plans to correr la arruga, by turning overdue debt into unmatured debt, have become business as usual for the company.

On the corruption scandals, the financials repeat the almost comical language pioneered in 2015, briefly mentioning the Roberto Rincón case, then setting out vague internal procedures to avoid and investigate corruption practices, stating that “PDVSA does not tolerate corruption” – which is true, because what they do is encourage it.

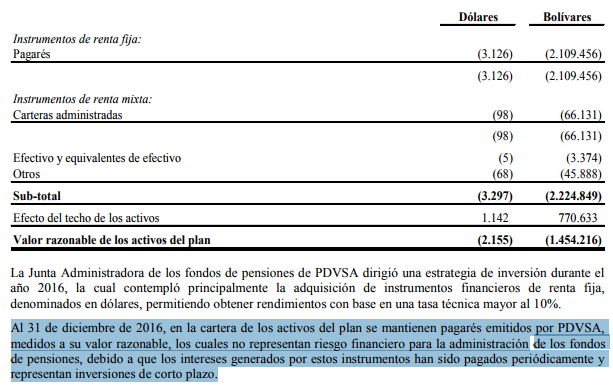

One of the most infuriating themes shown in the statements is the systematic plundering of PDVSA’s pension fund, detailed in Note # 22. The defined-benefit plan is nominally run independently from the board of directors of the company, but in reality has been used for several years now to support the payment of bonds, enriching the Bachaqueros of Wall Street at the expense of the present and future retirees from the oil industry.

The mechanics are rather simple: the pension fund is instructed to buy next-in-line PDVSA bonds and keep them to maturity, thus buying a significant share of the float every year. In the days around the payment date, PDVSA arranges with the fund to “swap” the holdings of bonds for an IOU that might as well be scribbled on a napkin, but for the purposes of the statements is a ‘short-term debt investment that does not represent any financial risk whatsoever for the pension fund’. Little by little, the vast majority of the pension fund’s assets have been subject to the scheme, leaving it holding little less than USD 100mm in assets and over $3 billion in so-called Pagarés. [Corrected: this paragraph originally misstated the currency of the $3 billion figure.]

Shameless…

Another caveat is the fact that the statement was prepared using two different exchange rates: the DIPRO exchange rate of 10 bolivars per USD and the Dicom exchange rate as of December 31, 2016 of 674.81 bolivars per USD. As you can imagine, the arbitrary use of such wildly different exchange rates may overestimate assets and downplay liabilities making the reported data unreliable at best. It’d take a team of talented forensic accountants an eternity to disentangle the effects of the exchange rate shenanigans.

There is just so much that’s just plain wrong with the statements. For example, they completely screwed up Note #21(b) related to last year’s swap of PDVSA 2017 for 2020 bonds, clearly misstating one of the bonds that was subject to the operation. Going through all of them is an exercise in learned depression that we cannot recommend. We will leave at here and wonder what do buyside investors think of these figures.

Not surprisingly, PDVSA is becoming toxic to international investors. Last month it tried and failed to put together an investor call. And that was before the firm’s Finance Director was sanctioned by OFAC, rendering anything he signs radioactive to all counterparts. For years, we’ve known the PDVSA roja rojita was a train-wreck in the making. Now it’s made.

Caracas Chronicles is 100% reader-supported.

We’ve been able to hang on for 22 years in one of the craziest media landscapes in the world. We’ve seen different media outlets in Venezuela (and abroad) closing shop, something we’re looking to avoid at all costs. Your collaboration goes a long way in helping us weather the storm.

Donate