The Bachaquero of Wall Street Makes One Last Killing

Since last year, short-end Venny bonds have been possibly the one asset class worldwide that can more than double the worth of your portfolio in a year — aside from cocaine. That can't last, obvs, but man has the ride been sweet.

Venny bondholders are jolly after state-owned PDVSA pulled off a relatively smooth maturity of its USD 2.1 bond due in April 12th. Sure, there was a last-minute selloff and an emergency repo to save the day, but then you wouldn’t be investing in assets like these if you didn’t have a stomach for theatrics. Every single trader has his own war stories with those infamous 17 olds; I remember seeing them trading below forty cents on the dollar, back in February of 2016.

It’s the end of an era. The Bachaquero of Wall Street has pulled off his last, biggest trade yet.

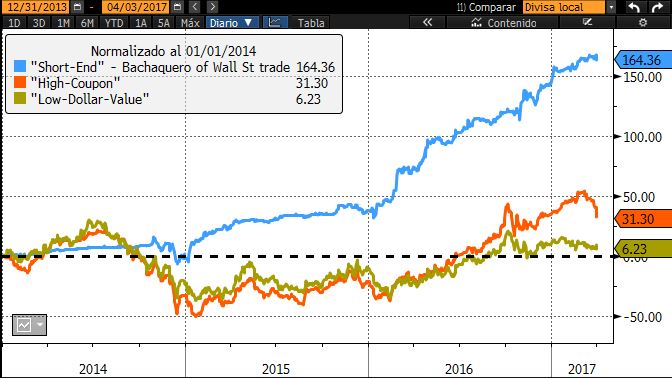

For the past three years, coinciding with the calamitous fall in oil prices that has turned the Venezuelan economy from a hotbed of macro disequilibria into full-blown economic disaster, there has been a strategy in the Venny bond market that has paid off massively with what seems like minimum risk. We first covered it back in October of 2015, dubbing it the ‘Bachaquero of Wall Street’ trade.

It really is the financial world’s answer to bachaquerismo: the whole game is to put yourself first-in-line to collect from the Venezuelan government. The point here is to combine a rock solid faith that the Maduro administration has the willingness and/or ability to pay the next bond that comes due with a commitment to indefference towards the huge mess the Venezuelan economy has gotten into.

Some investors have made impossible returns on the back of this trade — as much as 114% annualized returns (they doubled their money and then some more!) in the past twelve months. Of course, timing is everything: buy too late and most value will be gone by the time you’re able to find some bachaqueated bonds.

Price return chart of the PDVSA bonds due in 2017 (blue = 17 “olds”, which matured last week; orange = amortizing 17 “news”, due in November 2nd). The starting point is ‘The Quincena From Hell’, a two-week period of market distress where Venny bonds hit all-time lows. Add in an extra 12-15% from accrued interest for the total return figure. Source: Bloomberg Professional Service.

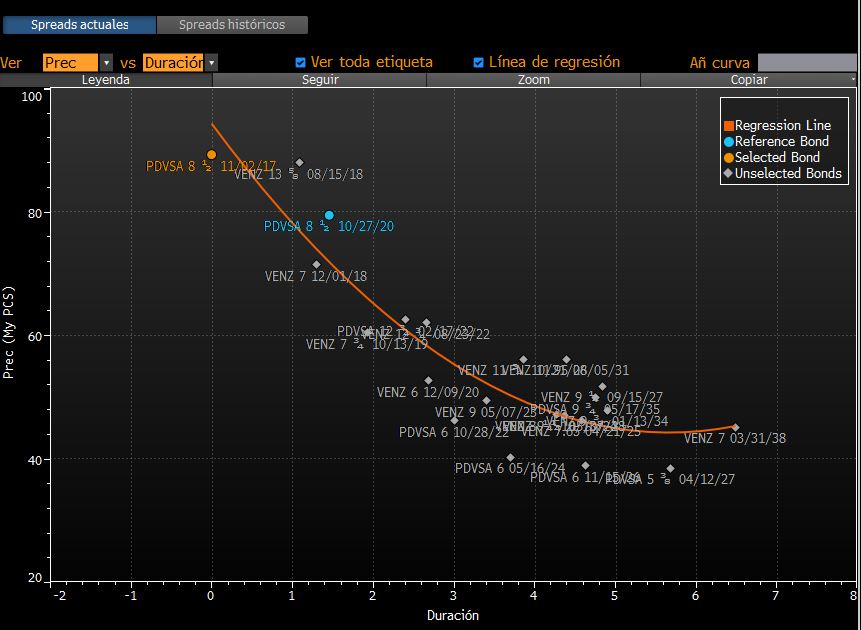

Recently, the bond market has figured out the way to price Maduro & Co’s ‘como vaya viniendo vamos viendo’ approach. VENZ/PDVSA bonds closest to maturity (deemed most likely to be paid) trade at systematically higher prices than the rest of the curve. The reason is straightforward: as investors are chasing and hoarding (ie. keeping to maturity) a relatively small fraction of the external debt outstanding, the rest of the pile of bonds (or loans, promissory notes, repos… you name it) lingers at bargain-basement prices, with nasty price swings to boot.

Market momentum keeps pushing up the prices in the short end of the curve at the expense of medium- and long-term bonds in a self-reinforcing pattern. The relationship also reflects the unorthodox (or, well, perfectly mad) policy mix that includes creative financing mechanisms with secondary (‘one-off’) sources of liquidity, such as depletion of external assets and import cuts. Together, the policy ensures that this year’s debt repayment capacity remains intact — and ain’t nobody have time to worry about the economic and humanitarian costs.

Figure 2: Price-duration ‘curve’ of Venezuela and PDVSA bonds. Highlighted: PDVSA 8,50% of 2017 (‘the next-in-line’ bonds), and PDVSA 8,50% 2020 (‘the Citgo-backed’ bonds).

Source: Bloomberg Professional Service.

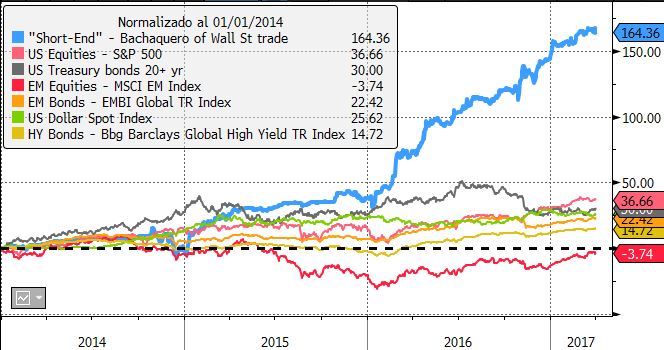

Over the past three years, the ‘Bachaquero of Wall Street’ trade has been a consistent winner, delivering a massive outperformance, both versus the rest of any other bond in the Venezuelan curve….

…not to mention against most (if not all) major asset classes worldwide:

Figure 4: Three-year evolution of the ‘Bachaquero of Wall St’ trade, compared against the total returns of the major global asset classes. Notice how the outperformance begins in earnest after the beginning of 2016.

Source: Bloomberg Professional Service, own calculations.

But notice how the outperformance against the world begins in earnest after the beginning of 2016? That makes me uneasy — and give us our best hint yet that this is the end of an era.

At school, they teach you that markets are efficient, because rational investors push the prices of stocks and bonds towards ‘risk-neutral, arbitrage-free, informationally-efficient’ prices that reflect the sum total of what is known about an asset. But Vennyland seems to be a living, breathing refutation of the Efficient Markets Hypothesis.

For one thing, the market appears to have mispriced the risk of the Republic and/or PDVSA defaults for several years in row. Investors never dreamed the government would go as far as it has in terms of creative financing and underestimated its capacity to cut imports, too. However, this appears to be no longer the case: prices in the short end of the curve are close to the 90% level, no longer the attractive risk/reward proposition of years past.

The external debt policy of the Maduro administration (and the Bachaquero of Wall Street trade it has nurtured) is the central paradox of the Bolivarian Socialism.

So does this mean that the Bachaquero of Wall Street trade was literal ‘bachaqueo’? Just jostling for position in line for a windfall sure to run out soon? If this were to be the case (*shudder*) the arbitrage will eventually self-correct. Either market prices align, or the underlying macro imbalance generating the arbitrage breaks down.

So now that all good information has been priced into bond prices, what else might keep the party going? How about you take a cool 5 minutes and read our Editor-in-chief’s latest piece for WaPo to help you put into perspective the current situation taking place in the streets of Venezuela. I couldn’t have spelled out the situation any better.

The external debt policy of the Maduro administration (and the Bachaquero of Wall Street trade it has nurtured) is the central paradox of the Bolivarian Socialism. Like all paradoxes, this one will wind down when its underlying assumptions (of unbroken willingness to pay and just-enough debt-paying capacity) cease to hold. Market axioms will reassert themselves against the highly unpleasant backdrop of a market crash. The timing of it, though, is elusive. Just ask Siobhan Morden, she’ll tell you.

Caracas Chronicles is 100% reader-supported.

We’ve been able to hang on for 22 years in one of the craziest media landscapes in the world. We’ve seen different media outlets in Venezuela (and abroad) closing shop, something we’re looking to avoid at all costs. Your collaboration goes a long way in helping us weather the storm.

Donate