Cryptocurrency Nation

With all the cash issues that Venezuela is going through, some have dared to experiment. Meet the guys from Portal Grill and their huge dreams about digital coin.

Original art by Mario Dávila

There’s a restaurant in Puerto Ordaz, Bolívar state, called Portal Grill, a fancy place not aimed at an impoverished middle class, but at a higher, scarcer class. What makes it different, though, is that it’s the only business in Venezuela accepting cryptocurrencies as a form of payment.

Certainly intrigued, I visited the place to see if I could buy lunch in digital coin and talk a bit with Jonathan Santamaría, Portal Grill’s operation manager.

“See that part in the back?” he points to rows of chairs facing a TV. “We are using that section for meetings. We explain to business owners the process and advantages of Onixcoin, so they adopt our currency.”

Turns out, their plan is huge. Venezuela has the highest inflation rate in the world today, and a major cash crisis. The government is maintaining public expenses by creating lots of bolivars that never become physical banknotes, making cash for day-to-day operations really hard to come by. People use debit and credit cards to the point where networks collapse. Every operation is a potential nightmare.

Cash has become so valuable that businesses are offering discounts if you pay in cash. Lines at the bank can take hours, and people can only withdraw Bs.15,000 a day (less than fifty cents) from ATMs. The cherry on top? Point of sale terminals are scarce too.

At first I thought Portal Grill was just trying to offer another payment option to make our lives easier, but that’s a small part of it all. Joining up with Onixcoin, they’re set to replace the dying bolivar and turn Venezuela into a cryptocurrency nation.

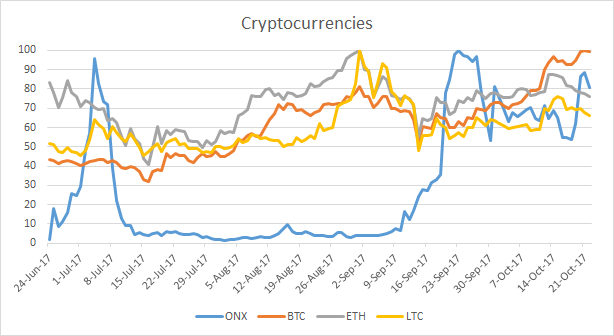

It’s not a hard sell; there are no good reasons to save in bolivars, but with the foreign currency exchange control it’s not easy to get rid of them. That’s why many businesses and individuals try to shield themselves from the crippling inflation by buying bitcoins, and although the bitcoin is extremely volatile, it’s a better choice than the ever-depreciating bolivar. Onixcoin, they say, will allow them to save money without the crazy fluctuation of bitcoins.

“Three kids came in the other day and bought their lunch with bitcoins” a waiter told me. “The older must have been 15, and they impressed everyone with how familiar they were with the process. They ate, asked for the QR code, scanned, paid and left. $18 in total, which is a lot of money for Venezuelan standards.”

He’s even getting tips on cryptocurrency.

“What is this worth?” he shows me a wad of bolivars that barely fit in his pocket. “Those kids had $18 with them and weren’t carrying anything.”

How easy it is to use, however, might be their biggest pitfall: I got there with Onixcoins on my cellphone, but I had to create an account in LocalBitcoins, find a seller that accepted my bolivars, buy the bitcoins, sign up to Novaexchange, transfer my bitcoins from this page to buy onixcoins, download the Onixcoin app from their webpage, install it manually and then transfer the onixcoins to the wallet on my cellphone. All the instructions were in English.

Most people in Venezuela don’t even have a smartphone, and I wonder if the rest is likely to put up with the process.

That’s why the first goal here is to popularize the method. Jonathan tells me that if they manage to expand well, they could partner up with businesses across the city to function as ATMs, where people could change onixcoins for bolivars, even helping companies bypass the exchange controls, as it can be convertible into any currency through the exchange webpages.

They ate, asked for the QR code, scanned, paid and left. $18 in total, which is a lot of money for Venezuelan standards.

Probably the weirdest part is that the government seems to be ok with the experiment — even though there’s no official word about cryptocurrencies in general. A lot of mixed signals, though, with chavismo praising the digital coin as an alternative to the American dollar, while cracking down on bitcoin miners.

I ask Jonathan if they aren’t afraid of the government shutting them down, and if all of this is even legal.

“As long as you declare taxes in bolivars, it’s not a problem.”

“The thing here is” he continues, “that we’re using a decentralized currency precisely to protect our transactions. Regardless of what the government does (to the economy), they cannot touch money that’s not subjected to Venezuela’s Central Bank.”

When it’s time to pay, I go to the cashier. The check is issued in bolivars, and Portal Grill’s software calculates the amount of onixcoins based on current market prices. The cashier then shows me the QR code on a smartphone and I scan it with the app. On my cellphone, I check the amount, write my password and hit send. The phone service in Venezuela is unreliable, so the process stalls for a few minutes before showing up on their screen. Jonathan says they are working on printing the QR code in the invoice, so “it’ll look cooler.”

For me, it’s cool already.

Caracas Chronicles is 100% reader-supported.

We’ve been able to hang on for 22 years in one of the craziest media landscapes in the world. We’ve seen different media outlets in Venezuela (and abroad) closing shop, something we’re looking to avoid at all costs. Your collaboration goes a long way in helping us weather the storm.

Donate