Venezuelan Banks Stare into the Abyss

Hyperinflation is like a tsunami destroying everything in its wake. The banking system could be next, and it's not even in the top-3 bad things to happen to the economy this week.

Photo: Massachusetts Bankruptcy Center

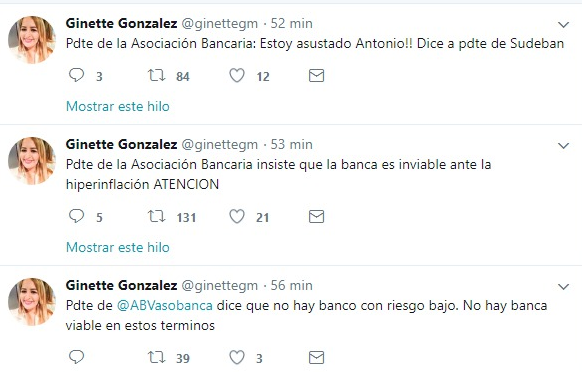

Prominent journalist Ginette González dropped a bombshell in her Twitter account earlier this afternoon. Covering a meeting between the Banking Association (ASOBANCA) and its regulator, the Banking Superintendency (SUDEBAN), she reports dire warnings made by the president of ASOBANCA, veteran banker Arístides Maza Tirado.

Maza told the Banking Superintendent, Lieutenant Colonel Antonio Morales, that there are no banks in the country currently at low risk, that the banking sector was not viable under the hyperinflation and that he (Maza) was scared.

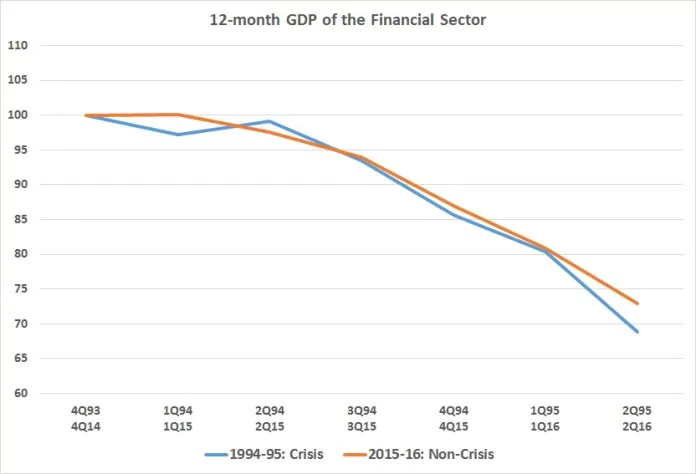

None of this is unexpected. In late 2016, we reviewed Econanalítica’s estimates on the financial sector’s risk exposure. In short, the sector was shrinking at a pace eerily similar to the 1994-95 financial crisis. This is how it looked back then:

We don’t have more up-to-date estimates, because the government stopped releasing these figures years ago, but we have indirect ways of gauging how the banks are doing.

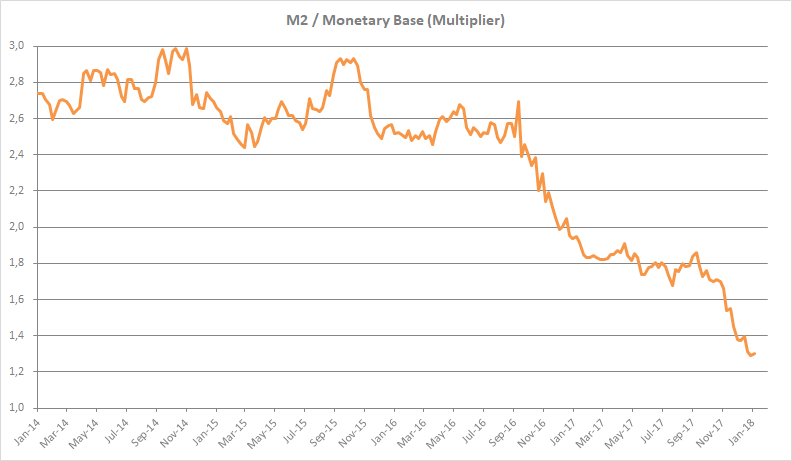

Contrary to what communists say, banks serve a purpose. They “multiply” the money in the economy; let’s say the Central Bank prints 100 bolivars, which end up as the salary of María, who takes them to her back. Out of this 100, the bank lends 50 to Juan. So María has 100 in her account, and Juan has 50, which means there’s 150 bolivars in the economy. The 100 Bs. have been multiplied by 1,5.

We can estimate, then, how much banks are multiplying money in the economy. In Venezuela, the multiplier during 2014 and most of 2016 was between 2,4 and 3. Around July 2016, it started to drop almost non-stop, and it’s now 1,3.

As the Venezuelan economy shrinks, the banks are shrinking too. They can’t loan money as fast as the government prints it, their profits are drying up, and they loan capacity can’t keep up with prices. To finance a major a project today, you’d need five or more banks to band together and make the loan.

What’s frightening is that, amid hyperinflation, the banking system’s collapse isn’t even that big a story. It’s like a house fire in the middle of a nuclear attack: it would be very serious in normal circumstances, but in this context, well…

Whether this turns into a major bank crisis will depend on how the government handles it. Unlike past banking crisis in Venezuela, no savings are at risk, because no one saves in Bs. anymore. However, banking crises are paid by printing money. The cost of rescuing banks during the crisis of 1994-95 was 13% of GDP. Cash is already being printed like crazy, having to print more to rescue banks would add more fuel to the hyperinflation fire.

Venezuela is in no condition to withstand more shocks. And this one would be major indeed.

Caracas Chronicles is 100% reader-supported.

We’ve been able to hang on for 22 years in one of the craziest media landscapes in the world. We’ve seen different media outlets in Venezuela (and abroad) closing shop, something we’re looking to avoid at all costs. Your collaboration goes a long way in helping us weather the storm.

Donate