Cash Crisis in Guayana Pica y se Extiende (Part II)

Facts and figures that might help you understand why it’s so hard to find cash in our country and Part II of the guayaneses’ odyssey and their many tactics to find cash.

Photo: Runrunes

Remember the Animalitos lottery? Remember the cash crisis in Guayana?

If not, let’s just say rules have changed around here.

Long gone are the days of betting any way you wanted in lottery. Just how markets adapt, lottery has become a convenience more than a distraction: you’re paid in cash only if you bet in cash. If you pay with a card, your earnings will come in transfers. People bet their cash hoping to skip the whole day-long ordeal of lines at the banks. Actually, my “cash guy” sells animalitos too and that’s how he gets it. All of those animalitos stands that spawned around the city have turned into reliable post-modern ATMs.

Now, why do we have a black market of banknotes and why is it this big?

As I said last week, bills are scarce. Everyone knows that this government has printed bolivars like nobody’s business to cover public expenses, but most of that money is created electronically, and only a small part is actually physical.

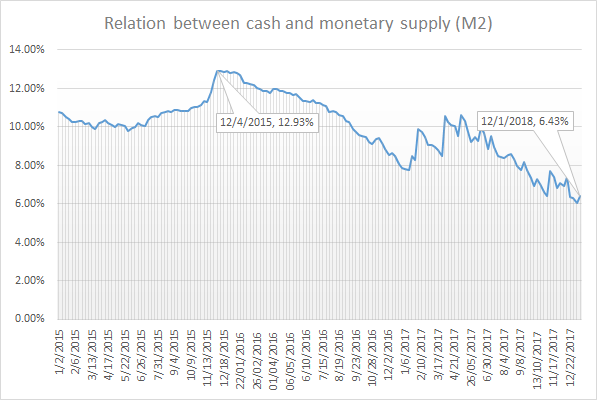

The proportion of banknotes against the money supply in circulation looks like this:

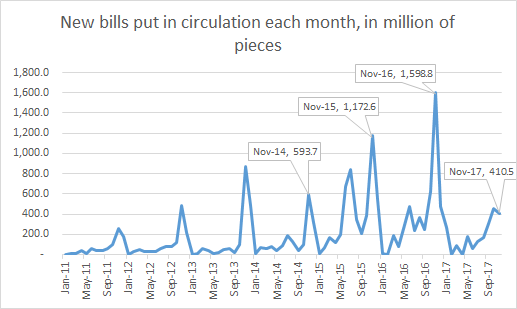

The money printer can’t keep up with the rate the government needs. In the following graphic you can see the production of new bills. Every September there are peaks in production, but this year fell extremely short. Looks like someone’s having printing issues:

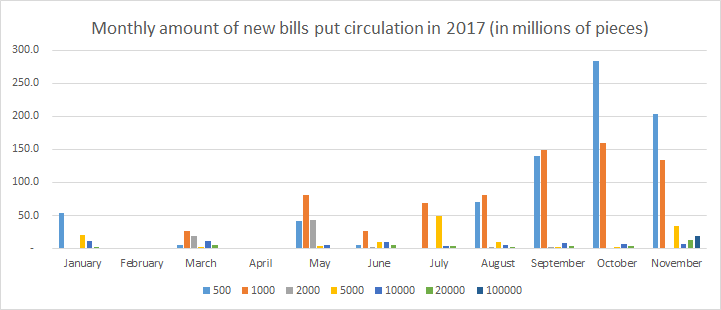

Economist Henkel García argues that it’s not just the bills, but the denominations themselves. We would have enough cash if the BCV just printed the right ones.

Even after delaying a long overdue new coin family, in 2017, the BCV was fixated in printing the lower denomination bills. Print the bigger ones already! They cost the same!

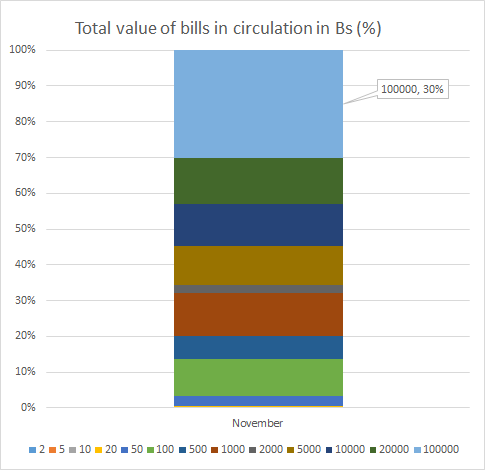

In November, 4% of all money printed was that new and shiny Bs. 100,000 banknote Maduro is so proud of. It doesn’t sound like much, and indeed the 18.4 million bills just meant 0.1% of all bills in circulation. The problem is that the bill is so disproportionately big, that it turned into 30% of all the money out there. Dude: 30% of the value of all of our bills is stored in 0.1% of them.

And it wasn’t practical; stores still refuse to accept it because nobody can give you change for 100,000 bolívares!

Today we have a bunch of really big bills, a lot of the (useless) small ones, and nothing in the middle. Not that it matters much: hyperinflation caught up, and our biggest bill is worth less than half a dollar.

Knowing that they could alleviate the cash crisis without expending an extra dime makes you wonder why they’re going out of their way to make our lives miserable. Is it sheer incompetence or is there some corruption scheme involving printing low bills?

After a riot in San Félix that apparently started when store owners refused to accept Bs. 50 bills, Caroni’s mayor, Tito Oviedo, issued a decree ordering everybody and their mothers to accept all bills. However, in the small shop near my house, where my parents have to buy their drinking water, there’s a sign reading “we can’t accept Bs. 50 bills because they’re incompatible with our system.”

So far, nothing has changed. Life in Ciudad Guayana is all about finding cash now — and I bet we’re not the only ones in this Patria Grande.

Caracas Chronicles is 100% reader-supported.

We’ve been able to hang on for 22 years in one of the craziest media landscapes in the world. We’ve seen different media outlets in Venezuela (and abroad) closing shop, something we’re looking to avoid at all costs. Your collaboration goes a long way in helping us weather the storm.

Donate