New Banco Central de Venezuela Website: Trust at Your Own Risk

The BCV revamped and refreshed the look and feel of its online platform, but opacity, secrecy and misconduct in madurismo’s economic policies haven’t changed one bit. You have been warned.

Venezuela’s Central Bank (BCV) has released a brand-new website design, the first change in the institution’s only communications platform since March 2002. Gone are the days when economists and students could visit the page to find the remaining shards of economic data still made available by the government.

Right after typing the URL a sign pops up, warning you that the connection to BCV is compromised. Accessing the website of our country’s Central Bank looks just as dangerous as using Kazaa for downloading music:

Once you agree to forfeit all safety and still go in, you stumble upon a new interface that looks and feels like a chavista funcionario talking about the Venezuelan economy, right down to the trademark smugness and criminal negligence in trying (and failing) to conduct economic policy.

Although the BCV has not issued a statement of its monetary policy in almost five years…

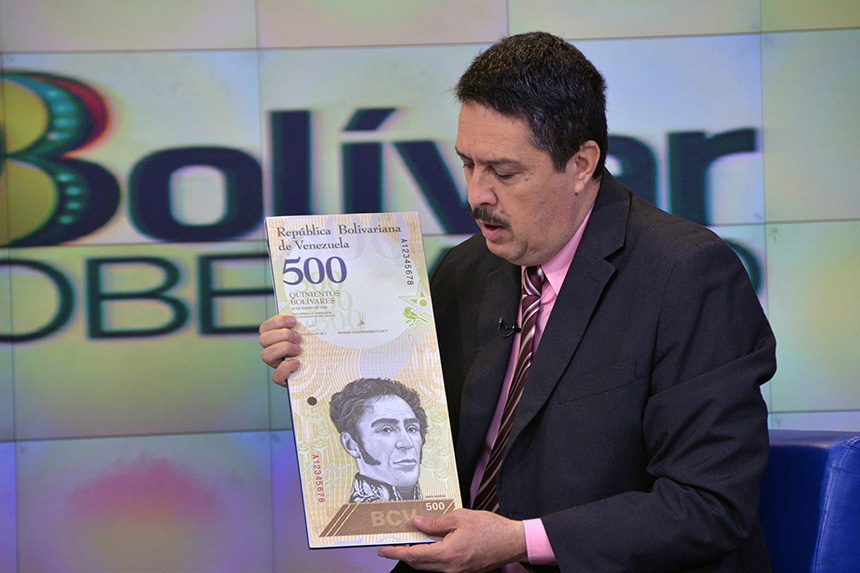

…It has been busy peddling the Presidente Obrero’s clumsy arrow-shots of surrealist “economic policy”: the Bolívar Soberano, DICOM, and the Petro.

Press releases, social media updates, promo materials, all filled with the typical rants about ‘economic warfare’, ‘financial blockade’, ‘defense of the Bolivar’… Perhaps the most jarring absurdity here is that the regime is presenting opposing concepts such as an ‘asset-based cryptocurrency’, a monopolized foreign currency grants system and a brand-new fiat bolivar with three zeros shaved off, as panaceas for an economic mess they can’t explain with anything but their stale ñángara narrative.

All theatrics, no data

Predictably, the new website ignores the country’s most pressing issues. There’s zero incremental data here, which means no new updates on GDP, inflation, balance of payments, consolidated external debt balance indicators, etc. And most importantly, no updates of social or human-development measures on the effects of the ongoing hyperinflation-meets-humanitarian-crisis.

Save for weekly-updated monetary aggregates and figures such as International Reserves, which are still updated daily but not discriminated by asset, the bulk of the Venezuelan economy remains in the dark.

The website doesn’t offer much help in the foreign-exchange front either. According to several sources, including localbitcoins.net, the black-market dollar is fetching close to VEF 350,000 at the time of writing, much higher than the VEF 235,000 mark published by DolarToday and several times higher than the VEF 49,900 fix of the latest DICOM “auction”.

And talking about DICOM auctions, it appears that the recent US sanctions haven’t let the auctions to settle in the accounts of beneficiaries, so the only official mechanism to acquire foreign currency is basically out of service right now.

However, if you take a closer look past the nonsensical shenanigans…

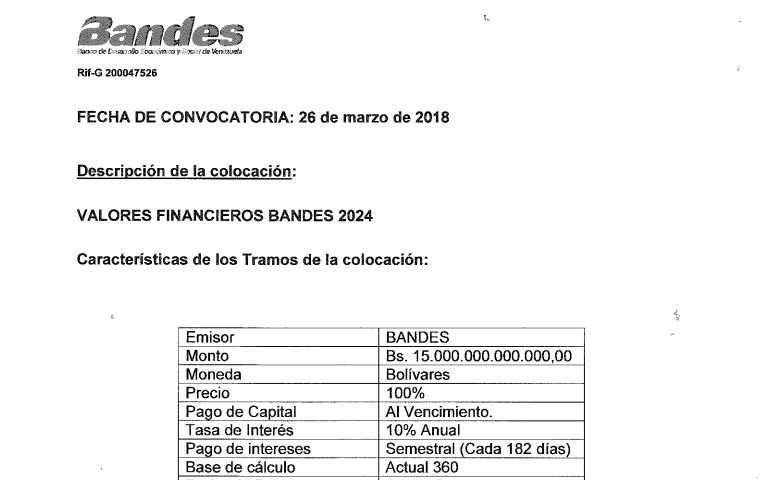

… You can see that the printing presses are still red-hot and the money market, flushing with bolivars, is being force-fed by means of state-owned BANDES issuing 15 Trillion Bolivars in bonds at a 10% nominal interest rate…

The new website ain’t fooling nobody, on the contrary, it’s doing a superb job at exposing the economic clique of late madurismo as the propaganda-spouting, stew-cooking, criminally incompetent con artists they are.

Aunque el mono se vista de seda, mono se queda.

Caracas Chronicles is 100% reader-supported.

We’ve been able to hang on for 22 years in one of the craziest media landscapes in the world. We’ve seen different media outlets in Venezuela (and abroad) closing shop, something we’re looking to avoid at all costs. Your collaboration goes a long way in helping us weather the storm.

Donate