The Parallel’s Parallel Turned Upside Down and We Can Only Look at It Go

Strange things are happening in Venezuela’s parallel foreign exchange market. We delve into the dark depths of bolivar-dollar unregulated trading to understand what’s going on.

Photo: Fandom

Something broke in the parallel market during spring 2018, something that never happened before. The most trustworthy reference on the dark pool of unregulated bolivar-dollar currency trading, website DolarToday, a staple of late chavismo, started to act weird.

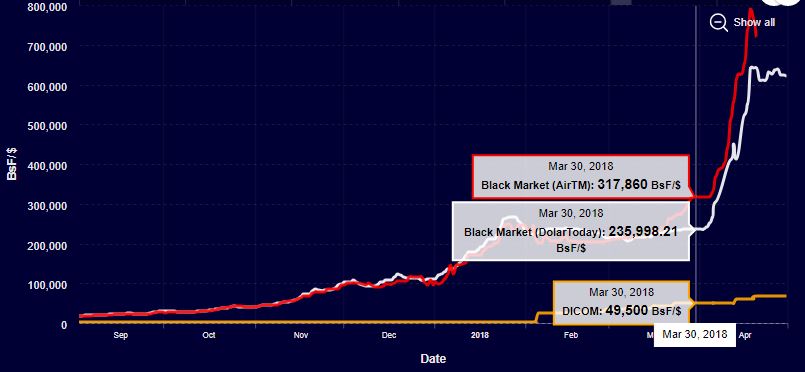

The first sign was obvious in hindsight. Prices of local goods and services rose at 50% or more per month, but the VEF/USD rate displayed in DolarToday (DT) was stuck in a narrow range between 200-240 thousand bolivars since last December, and well into the first quarter of 2018. The divergence between DT and alternative measuring tools of the black currency market (such as AirTM, popular for money transfers between Latin American countries) started to swell in March, hitting a never-before-seen spread of over 25% between the lower DT and the higher, more “truthful” market rates.

Source: https://www.venezuelaecon.com/

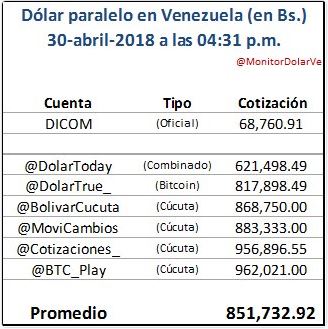

Just as the spread was getting out of hand, both parallel rates exploded higher in a messy bout of bolivars’ panic-selling. Finding out the real price of greenbacks became a herculean task, as the ever-growing supply of local currency overwhelmed the fragile black market ecosystem. DT was obviously lagging the price action, to the point that open auctions for dollars and alternatives of varying degrees of transparency and “tradability”, all of them pointing at way higher and faster-growing levels, started to pop up. At one point, aggregators of VEF/USD pricing sources were keeping track of up to six different quotes:

Source: @MonitorDolarVE on Twitter

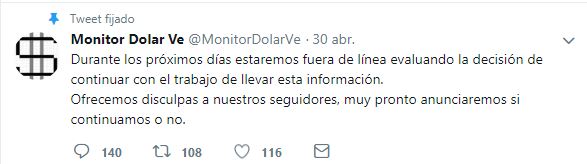

Oh… Scratch that. The website is going down:

Source: @MonitorDolarVE on Twitter

With or without Twitter accounts trying to shed light on the mess, the fact is that it’s still horrible down there. The portal to the Parallel Upside Down was opened, never to be closed again.

DolarToday: Our #TropicalMierda Libor

What’s going on with DT has many striking (and sad) similarities with the story behind the Libor interest rate, the global benchmark for trillions of dollars’ worth of loans and derivatives. They both share the same methodology (a survey of dealers involved in their respective market submit their daily indicative bid prices), crucial weaknesses (the quoted rate does not represent actual transactions, which makes both of them easy targets of price manipulation), and ultimately the same fate (extinction).

There has been a massive probe at the way Libor works after a rate-setting conspiracy triggered a campaign against the illegal rates’ fixing by major investment banks. As of this year, if all goes smoothly, Libor will be dropped off in favor of a superior, more transparent alternative, called Secured Overnight Financing Rate (SOFR). DT and its demise, however, are as TropicalMierda as it gets, so the similarities end right about there.

We still don’t know who’s really behind the scenes (I’ll concede that the Home Depot clerk thing is a cool story, though), and we’ll probably never know for sure. The idea of a deep, honest audit of the VEF/USD black market is absurd. Long ago the biggest elephant in the Venezuelan room, there’s ample evidence of hard currency leakage coming from oil exports that ends in the parallel market (after all, crude sales represent upwards of 95% of the nation’s hard currency earnings), by work of well-connected intermediaries. Who would dare go against the interests of the mafia?

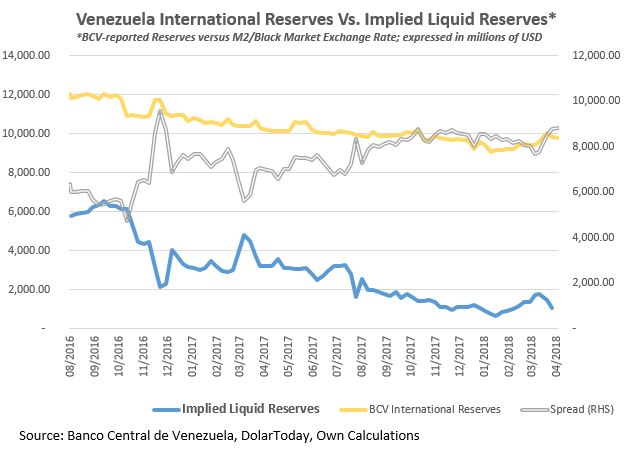

The sudden lack of a reliable market benchmark leaves no doubt that there’s major trouble beneath the surface. The Central Bank just gave up altogether in trying to conduct monetary policy (but hey, new website!), money growth and inflation continue to accelerate amid collapsing domestic output and, if we take cues from the black market, it appears the country’s liquid reserves position is precarious, as the entirety of bolivars in circulation can now be bought with less than USD 1Bn. The data suggests the spread between the “official” reserves figure and the “market-implied” figure continues to grow, and points to more pain in the black market in weeks to come.

With new players, the rules change

There’s a lot going on beyond the dynamics of hyperinflation and price differentials that, granted, have reduced substantially, since the DT rate woke up from its months’ long slumber to propel upwards in line with the rest of the market. Alongside the end of DT, a new class of foreign-exchange players has come to the spotlight, and the government is aware of it.

The ascent of AirTM has came on the back of the cryptocurrency revolution and the mass emigration of Venezuelans throughout the world. The site’s appeal is hard to resist for local citizens: it enables them to store savings in either US dollars or bitcoins, and to send/receive money from both in and out of the country. Couple that with competitive bid prices (from the point of view of Venezuelans abroad sending remittances in VEF to their families) and what appears to be a smooth execution of payments — though based on phony “anecdotes” published by AirTM itself. It almost sounds too good to be true.

Prosecutor General Tarek William Saab announced that AirTM, plus two other exchange houses (Radiocambio and Intercash), were dismantled by the government in the context of “Operation Paper Hands”, claiming they were taking part of a regional conspiracy to decimate the bolivar’s value. A Facebook Live session with AirTM CEO, @RubenGSP scheduled for May 2 made it clear that the situation doesn’t bode well for the company’s prospects in Venezuela.

Source: @theairtm on Twitter

The other popular black market reference that appears to escape Operation Paper Hands is LocalBitcoins, a site offering the chance to buy or sell cryptocurrencies (no petros allowed) versus bolivars from listed vendors a la Mercadolibre. Just like AirTM, the site serves not only as a DT replacement for VEF/USD quotes, but also as a “tradeable” market upon which one could actually exchange currency at free-floating rates. And since you get to choose among multiple counterparties and settlement terms, this is the closest thing to a free market for domestic currency exchange in Venezuela in nearly a decade. Let’s see how long it lasts.

The VEF/USD upside down black market has taken over the entire economy. The government keeps fueling the fires of hyperinflation while trying to bring down all conduits for free-market dealings of foreign currency, trying to force Venezuelans to ignore the growing influence of the dollar in domestic economy. Individuals are going at growing lengths to find new ways of connecting between the real world and the upside down through obscure trading venues, in a nationwide act of rebellion purely driven by self-interest —nobody is so pendejo as to validate “official” rates. As days go by and alternatives are taken down one by one, the pursuit becomes more and more exciting… and more dangerous, for those still willing to go the upside down way, with no guarantees of coming back.

Caracas Chronicles is 100% reader-supported.

We’ve been able to hang on for 22 years in one of the craziest media landscapes in the world. We’ve seen different media outlets in Venezuela (and abroad) closing shop, something we’re looking to avoid at all costs. Your collaboration goes a long way in helping us weather the storm.

Donate