Venny Bull Blend: The VENZ 2027 coupon drama and what comes next

A seemingly endless flow of terrible headlines suggesting Miraflores is as close to bankruptcy as ever capped off a payment delay on the VENZ 2027 coupon. And the Venny Bulls laugh through it all on a blend of optimism and cynicism.

For Venny bond Bulls who still have confidence in the Republic’s willingness and capacity to service its growing pile of external debts, this past week was the ultimate test of their convictions.

For several years now, they’ve shrugged off the incalculable social costs of prioritizing debt payments over the people’s most basic needs, and the fact that the ‘kiting strategy’ of getting indebted at ever higher interest rates to pay for previous credits is the very definition of unsustainable. For the last couple of months, they also had to disregard the growing threat of full-blown financial sanctions by the US government that would all but shut down the Venny Bond market.

Faced with all this, Venny Bulls are always eager to point out that “Venezuela always pays in the end”, which means they get to make bank at the expense of the skeptics, not to mention Venezuelans’ stomachs. And it happened again.

However now, there’s a twist:

‘Willing’ and ‘able’ might not be good enough anymore…

On September 15th, coupon payments on VENZ 27s came due. The Republic showed no signs of wiring the payment. We didn’t get the now-traditional cheesy tweet post about how ‘la república cancela sus compromisos‘ from the National Office for Public Credit (ONCP) either. Market sources told me nobody had seen the coupons yet and most people are bracing for the one-month grace period in the contracts to be used for this one.

“Apparently the payment delay has everything to do with the more strict conditions on which correspondent accounts of VZ government entities are being handled,” I’m told by a local trader. It makes sense. At around $180 million, the amount owed is trivial in terms of the current stock of reserves. On the surface, this is not a capacity-to-pay issue; nor is it a willingness to pay issue (see Mr. Lobo of Carmelitas Street reinforcing this view).

They’ve shrugged off the incalculable social costs of prioritizing debt payments over the people’s most basic needs.

However, keep in mind that this is the first debt maturity since the late August announcement that imposed sanctions on Venny bond trading and clearing by US counterparties. Compliance checks are running on all cylinders now, as Wall Street banks are unwilling to risk stepping out of bounds and risking hefty fines, not to mention their brokerage licenses. These delays are showing that, beyond capacity and willingness, the actual viability of debt payments represents another layer of risk bondholders face.

Which made the third week of September… curious, to say the least. Conversations on the Street were going something along the lines of:

“So, nobody has seen the coupon on their accounts right?”

“Nope!”

“Alright, have a good weekend folks.”

When it rains in VennyLand, it pours skeletons

Monday 18th came and, still, no signs of the coupon hitting the accounts. “It’s fine, they got 30 days to sort out their mess. Vamo a calmarno…,” another fellow trader cheekily points out. What did come on Monday was a flow of increasingly dire news about the credit.

First we found out Venezuela is asking for an extension on a USD 800 MM gold-backed loan with Citi that is due in October, openly saying they don’t have the cash to amortize the loan and they don’t want to get their collateral executed.

You thought the $3.6 billion worth of bonds that PDVSA and the Republic have to pay in Oct. / Nov. was an already tricky proposition. Now, enter a claim right on the same schedule, flying under the radar and showing up at the worst possible moment.

And this is by no means the only skeleton in the closet, mind you. There are a couple other ones that are scaring the bulls out there:

A $300 million Repo contract signed with Fintech Advisory earlier this year, whose terms remain shrouded in secrecy, could imaginably come due before the year’s end. However, we might speculate that Fintech has already started to do a ‘margin call’ and executing their collateral; seeing that the stock of Venny Bonds backing the repo have plunged to near all-time lows in recent weeks. They’re not in the business of speculating on the credit; their whole deal is to lend cash to a desperate government on absurd terms and with a massive amount of collateral, free to be liquidated at their discretion.

Venezuela is asking for an extension on a USD 800 MM gold-backed loan with Citi that is due in October, openly saying they don’t have the cash to amortize the loan.

There are plenty more skeletons where that came from: there are several more gold swap deals, with Deutsche Bank and Chinese state-owned banks of unknown amounts and tenors. All we know is that such deals were negotiated starting early 2016, that the government has liquidated or put up as collateral over 130 tonnes of gold since 2015, and that it took a strongly-worded letter by National Assembly chairman Julio Borges to try and stop the flow of fresh money to Maduro in exchange for mortgaging the country’s gold reserves. What we do not know is when the current loans are due.

Most worrisome of all ‘shadow’ debts are the ones acquired by state oil company PDVSA. There are promissory notes owed by PDV to critical oil service companies; depending on the source, the amount owed ranges between $2 billion and upwards of $4.7 billion – and many of these instruments begin to amortize next October. What a coincidence.

Pair this up with the over $6 billion in ‘prepaid oil shipment’ debts owed to Russian oil giant Rosneft, and the remaining balance on the over $63 billion owed to China in the FCCV oil-for-cash deal, and the numbers fail to add up very quickly…

(NOTE: It’s not that we haven’t done our homework and weren’t aware of those off-balance-sheet liabilities on time; it’s just that they are so completely walled-off from the public sphere that it’s actually impossible to keep up with them, and much less so to get a sense of the precise terms of each one of these obligations. Therefore, this list is by no means exhaustive.)

By the way, one would think that the most recent round of US sanctions explicitly forbid any kind of near-term credit easing, such as term extensions on current loans, right? And yet, the Venny Bulls have developed a near-mystical faith in the government’s capacity to make the payments somehow. The chatter keeps coming.

Dude, I’m not worried at all about the coupon being late or about all these off-balance-sheet loans. Remember PDVSA 35s last November? China Fund grace period extension? This is all just business as usual! ¡Sopórtala! Besides, short-end bonds are on fire. They will manage to muddle through, I’m sure.

This isn’t a normal amount of optimism, nor of cynicism. It’s a special blend. Venny Bull Blend.

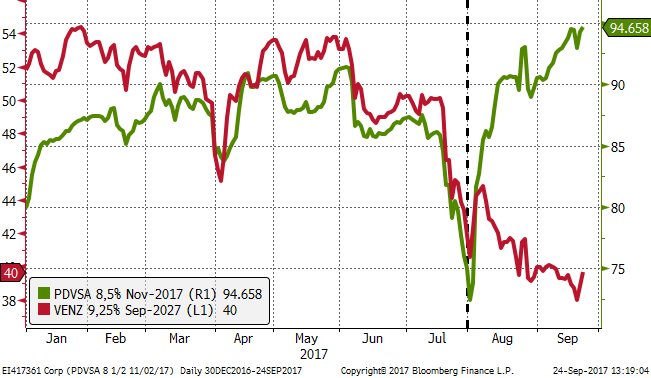

After the climax of panic selling on July 31st, two separate stories in Venny debt: ‘Short-end’ bonds are rallying to all-time highs, while ‘Long-end’ bonds drift to all-time lows. Venezuela will pay at all costs, or at least that’s what the market is still betting on.

Source: Bloomberg Professional Service

Sanctions fallout, Pt. II

“Dudes, no coupon yet, right?”

“Man, it’s 11pm on a tuesday, do you really think the funcionarios at the Public Credit office are gonna work now? Chill out bro, tomorrow is another day…”

“Oh, no, I’m chill, it’s my boss that wants to throw himself out of the window, LOL.”

It’s now September 20th and close to a week has passed since the V27 coupon is due with no signs of it getting paid. The ONCP is nowhere to be seen. Bulls are getting more scared as time passes.

“Aprieta y gana, chamo”. “Hang on and win, pal”.

Traders were pretty scared at this point to notice the devastating implications of a piece that flew under the radar earlier in the week. Turns out that PetroChina Americas, the US entity of a major state-owned Chinese oil company and a key intermediary in the China-Venezuela Oil Fund throughout the years, reviewed the current oil-for-cash deals and recommended that no new loans were extended to PDVSA after the imposition of US financial sanctions to the sector. Rollovers on existing debt would also be off-bounds. While this doesn’t mean that Venezuela has no way to receive credit relief from China, it suggests that any financing operation involving the US financial sector, including dollar-denominated deals, is off-bounds.

Now the desperation of the Maduro administration to ‘free themselves from the tyranny of the Dollar’ makes complete sense. Not even their Chinese allies dare go against the sanctions. And speaking about sanctions… The game isn’t over. Trump is willing to keep on tightening the screws if Maduro doesn’t change course on his authoritarian conduct. New and harsher penalties may come any day now.

The tweet that finally came

September 21st, day 6 of the grace period. Traders are bracing for the worst and long-end, ‘low-dollar-value’ bonds once again trade below the psychological 30 cents-on-the-dollar level.

“Check what ONCP just tweeted! (payment confirmation of irrelevant VEF-denominated public debts). What a bunch of fucking trolls.”

The trading day went by with the same uncertainty. Bloomberg posted a first-word quick piece, telling that calls to the ONCP about the payment were unanswered. Doom reigned supreme.

“Dude, did they make the transfer?”

“No man, why?”

“Bonds are getting lifted as we speak. What’s going on??”

5 minutes after bond prices rebounded, finally, the much-awaited, real tweet came by – “Venezuela fulfills its obligations”. The ONCP once again cited ‘operational setbacks’ to justify the delays. At the time of writing, not all investors have received the payment, but payment agent BNY Mellon confirmed that the coupons were ‘being processed’.

We don’t know if last month’s court indictment that gave Crystallex the right to seize monies held by Venezuela in BNY Mellon have anything to do with these setbacks, or if they in any way might complicate things down the road.

Either way, Venny Bulls will live to fight another day…

“Who’s up for a night out? Drinks on me!! Venezuela cumple, carajo!”

Caracas Chronicles is 100% reader-supported.

We’ve been able to hang on for 22 years in one of the craziest media landscapes in the world. We’ve seen different media outlets in Venezuela (and abroad) closing shop, something we’re looking to avoid at all costs. Your collaboration goes a long way in helping us weather the storm.

Donate